Retiree Liability and What You Owe

This headline, drawn directly from Tom Mooney’s Providence Journal article, is factually incorrect:

R.I. municipalities owe $5.1 billion in retirement, health benefits, report says

As a minor matter, the headline confuses “liability” and “unfunded liability.” According to the referenced report, other post employment benefits (OPEB; i.e., retiree healthcare) amount to a $3.1 billion liability, but it’s 1.4% funded, so the unfunded liability is $3.0 billion. Added to the $2.0 billion unfunded liability for local pensions, that’s $5.0 billion. What’s a hundred million dollars among friends?

As I said, that error is minor, but it points to a more substantial lack of understanding of the terms on which journalists are reporting, and at this point in the game, there’s really no excuse for them — and, more importantly, their editors — not to have figured it out.

In short, the total liability is not the total benefits that the municipality owes its employees and retirees; it’s the total amount of benefits adjusted for future contributions, investment returns, and inflation. In other words, it’s the amount of money that the municipality would have to have in the bank right now in order to pay out benefits in the future assuming contributions continue to be made and investments continue to pay off. (To make matters worse, the plans tend to assume unreasonably high returns on their investments, which makes the liability seem smaller.)

The unfunded liability, then, is the amount of money that is not in the bank right now to pay benefits. Every year that the money isn’t there (or investment returns or contributions don’t materialize as expected) the unfunded liability goes up.

For the sake of illustration, I’ll make up some numbers. To make things easy, let’s take the total municipal tax levy as what it was in 2012, $1.5 billion. We’ll assume that payroll is 80% of that ($1.2 billion). We’ll also assume that inflation will hold at 3%, the total employer and employee contributions for pensions and OPEB should be 15% of payroll, and investments will return 7% per year. Finally, we’ll treat the pensions as 50% funded and take just the unfunded portion of OPEB and lump everything together to make life easier.*

(Note that the goal is a back-of-the-envelope calculation of what municipalities owe, so I’ve picked the 7% investment return not because it’s likely to be realized, but because it’s an approximate average of what municipalities are relying on.)

That would mean that, per the report, we’re starting with a $7.0 billion liability, for which there is currently $2.0 billion collected. In the first year, municipalities would be adding $180 million in contributions, and investments would bring in $140 million.

Calculated out to thirty years, the unfunded liability amounts to around $36 billion. If we’re talking about the total liability, and we want to know what pension and health benefits municipalities actually owe to past, current, and future employees over those 30 years, the number is more like $70 billion.

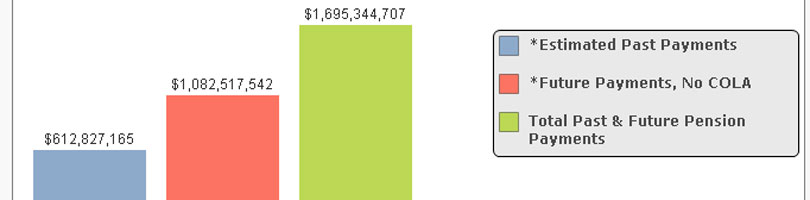

If that seems high, play around with the pension modules on RIOpenGov. As of 2012, the estimated future payments just for Cranston employees who had already retired by 2011 was $1.7 billion. Now factor in the 38 other cities and towns and future retirees and OPEB for the whole bunch. Now consider that the municipal liability is only a small portion of the total state and local government liability.

You can see why government officials don’t like to present that “what we owe” number too prominently. Just like care salesmen and realtors, they’d like people to focus on smaller bites of the total. For journalists to report that number without context, though, is like saying that somebody owes $30,000 on his $300,000 house because that’s what he has to come up with this year.

* Note that I’m obviously assuming every other adjustment in the real world cancels out. Obviously, there wouldn’t be investment returns on portions of the fund that have already been paid out in benefits, but then again, payroll may grow more than inflation (as I’ve assumed), and retirees will almost definitely continue to live longer. My purpose, here, isn’t to repeat the actuaries’ work, but to illustrate roughly what the numbers mean.