RI Income Tax Withholding Shows No Evidence of Employment Boom (But a Bigger Tax Take)

For my monthly employment post in May, I took a look at income tax withholding, as reported by the state Office of Revenue Analysis. As the chart on that page shows, if Rhode Island really did experience an employment boom during the first five months of the year, it was having shockingly little effect on the amount of income taxes that the state was collecting.

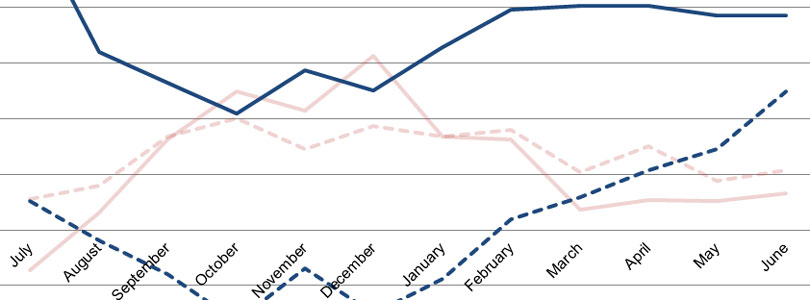

Every year, the Office of Revenue Analysis holds off on releasing the numbers for June to include them in an annual final report. That document is now out, for 2014, and it reinforces the conclusion that the employment boom was entirely a figment of statisticians’ imagination. Here’s the updated chart:

Two observations about the chart:

- Whether the disconnect is a statistical error in the employment numbers or something within the Rhode Island economy that’s replacing old jobs with new jobs that pay much less, or something else, these differing trends are not right. The pink lines show last year’s results, illustrating that the two data sets tend to track reasonably closely. If the disconnect is statistical, then the impression that the government numbers (during an election year) are creating is misleading. If the disconnect is real, then Rhode Island and its public policies are creating an unhealthy job market.

- Apart from the disconnect over the first half of calendar year 2014, note how much more tax withholdings have increased this fiscal year versus last fiscal year. Even when employment has decreased in a month, that only meant that the taxes withheld increased less than they had been. More research would be needed to determine whether there’s been a change in accounting rules or some other factor that would increase withholdings without its indicating an overall tax increase. Still, whatever the reason, increased withholdings means increased money not in the economy. When job growth is stagnant — or even decreasing, in some months — that’s not a good dynamic to be creating.

On the second point, I’d note, especially, that the General Assembly passed a variety of measures to squeeze Rhode Islanders for more taxes this year, such as the default charge for the use tax, which assumes Rhode Islanders have shopped out of state or on the Internet, unless they can prove otherwise. This is not the way to go about fostering a recovery.