Taxing the Rich in Testimony and Looking Forward

Given that it was my first time testifying in my capacity as research director for the RI Center for Freedom & Prosperity, I didn’t think it appropriate also to be there in a media capacity liveblogging. Consequently, I’d note one thing that doesn’t come through in Kathy Gregg’s Providence Journal article on the hearing: The audience was of the regular-business-of-the-legislature variety, as compared with the standing-room only hearing on these bills last year, during Occupy season.

That does come through, though, in the Capitol TV video, online here. (Try this link if that one doesn’t work.)

I’m on the first panel after the bill sponsors, and my written testimony, which I didn’t follow very closely in person, is available as a PDF on the Center’s site. But some interesting points are worth expanding upon, here.

Enter the Mysterious Rich

While the subsequent panel was answering the legislators’ questions, the mystery of around 2,000 new wealthy taxpayers appearing on the 2011 tax rolls came up. By that year, the state had completely reversed its attempt at capital gains tax reform and essentially frozen the flat-tax phase-down before it had reached its targeted rate. If tax policy affects behavior as free-marketers suggest, why would that happen?

The Rhode Island Public Expenditure Council’s John Simmons, to whom the question was addressed, said RIPEC intends to look into that, but as of the hearing, he could only note that the economy had been improving. Looking at the data, I’m pretty sure that’s not the answer.

Comparing the tax data available from the Internal Revenue Service (IRS) and from the state Division of Taxation shows that they don’t match. Measured by federal tax returns, the number of Rhode Island taxpayers with adjusted gross income (AGI) over $200,000 increased from 13,389 in 2010 to 14,333 in 2011, or about 7%.

That’s closer to a plausible range for economic growth, if we also consider that the top tax brackets uniquely reflect income inflation. As income numbers go up in current dollars (because they’re worth less in real dollars), it’s relatively easy for somebody in the $75,000 to $100,000 bracket to move upward out of it, compared with somebody in the $200,000 to $500,000 bracket.

In Rhode Island, however, the number of residents with state tax returns over $200,000 AGI increased from 11,643 to 13,570, or 16.6%. That indicates that something uniquely related to the state’s tax structure might be in play. Either the various income tax changes in Rhode Island over the past few years designed the system to move people into the top tax bracket or behavior changed in a way that Rhode Island captured more than the IRS.

Policy Does Affect Behavior, Especially at the High End

Trying to come up with an explanation for what those differences might be is, as Simmons suggested at the hearing, a tricky business. But the exercise does illustrate that policy can change behavior. That’s especially true for the people for whom larger dollar amounts are in play.

In 2002, the General Assembly passed, and Governor Donald Carcieri signed into law, an elimination of the state’s tax on income from capital gains. The first year in which taxpayers would realize savings from that policy was 2007, and the tax would phase down from there. But during the 2007 legislative session, the government froze the rate where it was, and in 2009, it eliminated special treatment and made capital gains taxable at the regular income rate, several times higher, as of 2010.

Looking at the number of tax returns in the $200,000 bracket with capital gains, the 8,722 in 2006 jumped to 11,023 in 2007 (26.4%) and then plummeted to 4,168 in 2008, 2,025 in 2009, and (obviously) zero in 2010. That’s a dramatic change of behavior, with a total economic effect probably over $1 billion. And while it’s likely that some of the people in that count were reacting to the recession, it’s not inconceivable that some of the effect went the other way — with the incentive to cash in on productive investments helping to ensure that Rhode Island’s recession was even deeper than it otherwise would have been.

As for the upswing of wealthy taxpayers in 2011, part of it might have been a ripple effect. Investors who could cash in during 2007/2008 did so, creating a lull that finally eased in 2011. Conspicuously, the 13,570 “rich” tax returns that year is just a few dozen away from the number in 2007. (Of course, even with the much lower capital gains rate in 2007, the total tax liability of this bracket was $25 million higher then than in 2011.)

In a similar vein, sources in the Department of Revenue tell me that, after conversation with some CPAs, they attribute the increase in high-end income taxpayers to shareholders in pass-through companies (like S-Corps) who had used up all of their offsets from business losses in the recession by 2011. That would have made the AGIs on their personal income tax returns significantly higher, moving them into the upper brackets.

So, What Will Tax Policies Do?

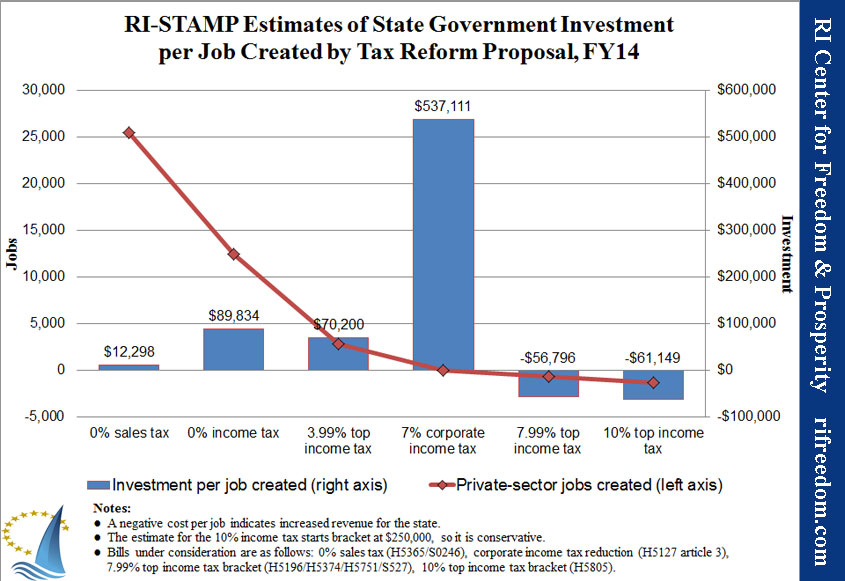

This all leaves unanswered the question of what the various tax policies currently under review would actually do in the future. To answer that question, I ran them through the RI Center for Freedom & Prosperity’s tax policy modeling tool, RI-STAMP. As part of my testimony, I presented the following chart of the results:

Our expectation is that the tax-the-rich proposal submitted by Representative Larry Valencia (D, Exeter, Hopkinton, Richmond) would kill one job for every $61,149 more that the state takes in through taxation. By contrast, for an investment of $12,298 per job, eliminating the sales tax would allow the economy to create 25,426.

At next Wednesday’s hearing for Warren Democrat Jan Malik’s sales tax bill (1:00 p.m. in House Finance), I’ll be on another panel that will offer some explanation of how the sales tax projection will come to be and how the state government can track and adjust as the policy takes effect. That’s quite a different approach than trying to unravel the mystery of taxpayers’ appearance and disappearance after policy changes five years ago.