Umm… Who (and What Policies) Got Us into This Mess?

I’ve had the extreme good fortune to shift careers to one that allows me time to create and stare at charts. (Sadly, yes, that’s a literal description of some of my afternoons, as well as my feelings about those afternoons.) So it’s with an especially strong “What!?” that I watched this video, via Ann Althouse, via Glenn Reynolds:

To save time for those who don’t want to watch a political ad, the important point is that former President Bill Clinton argues for a second term for President Obama on the grounds that Republicans want to return to an era of deregulation — which, he claims, is “what got us into trouble in the first place.” This, he contrasts with the Obama’s plan, which “only works if there’s a strong middle class.” “That’s what happened when I was president.”

Let me first say that deregulation did play a role in our current predicament, but it wasn’t deregulation alone. It was deregulation with a de facto government backing when risky ventures went wrong.

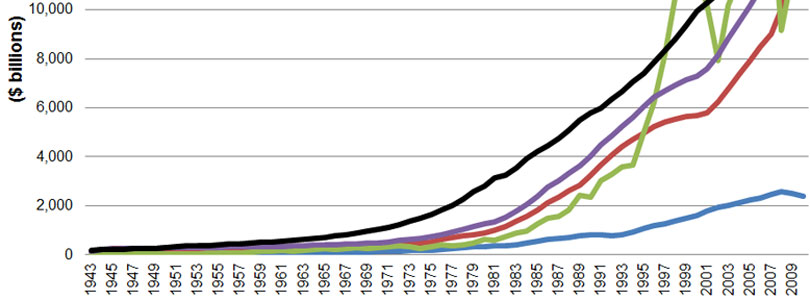

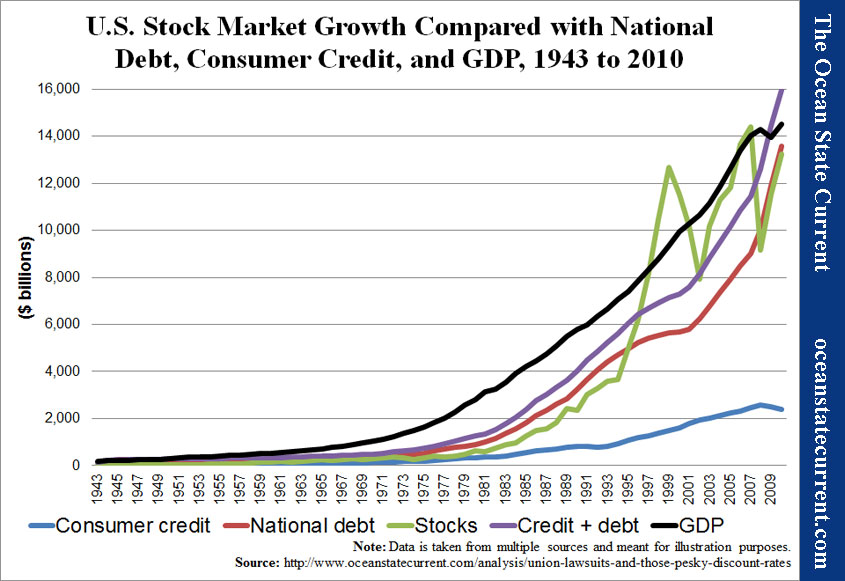

So, to the chart, which regular readers have seen before:

The important line to consider is the green, which is the total market capitalization of the stock market, starting with the Wilshire 5000 index for the scale and the S&P 500 for trends. (Hey, it’s a rough sketch to stare at.) I’d say that any reasonable person interested in “what got us into trouble in the first place” would target the period in 1994/1995 when the stock market became unhinged from government debt and GDP.

During that period, the Clinton administration introduced the “National Homeownership Strategy.” In terms of credit and the economy, what it did was to lower standards for home loans, which enabled the market to withdraw money from the (hypothetical) futures of poorer people who wanted to buy homes.

That’s a bit of a unique way of phrasing that particular transaction, so let me explain: When a family takes out a loan, it is promising money from its future wealth. In the present, that requires a lender to put the money down, but when the lender makes the leap into the derivatives markets, with securities, credit default swaps, and whatnot, a portion of the extra money from the future becomes a trade-able, spendable asset.

As it happens, the mid-’90s also marked an expansion of derivatives and the final lunge toward elimination of the wall between different branches of banking, with the Gramm-Leach-Bliley Act in 1999. That final passage came after years of market insiders’ declaring that the restrictions that the legislation explicitly removed were effectively eliminated already.

The point is that the real boost of the Clinton years came not from a steady “investment” in the economy… workers… infrastructure… education, but from (in essence) deregulation in mortgage lending and derivatives. Oversimplified, the pain of the Obama years has been the result of those families’ not having the promised money in their futures and the finance industry’s absorbing all of the present-day cash withdrawn from the future through government debt in order to make itself whole on its losses.

What’s needed, now, beyond the immediate cessation of government spending and borrowing, is a dramatic deregulation of all of the non-finance-industry activities by which individuals earn a living. Whether we’ll get the necessary steps from a Romney administration and fully Republican Congress, I have my doubts, but the side that raises deregulation as an evil boogeyman is (to say the least) even more doubtful of a proposition.