Zero.Zero Sales Tax: Objections and Who’s Objecting

As it happens, somebody forwarded to me the following Wall Street Journal political diary entry by Allysia Finley on the same day that the Providence Journal’s Philip Marcello reported that the Republicans in the Rhode Island House are considering championing the RI Center for Freedom & Prosperity’s proposal to eliminate the state’s sales tax:

According to new Census data, New York, Illinois, New Jersey, Connecticut and Rhode Island led the country last year in out-migration (measured as a share of their population). Not incidentally, the Tax Foundation ranks New York, New Jersey and Rhode Island among the five worst business tax climates.

Connecticut, which raised income, sales and corporate taxes last year to the tune of $1.5 billion, is not far behind.

That line about Connecticut struck a chord with me, as I’ve been wonder what might be behind the state’s employment free fall. The only other explanation that I’ve heard came from my counterparts in that state, who suggested that its job market had previously been inflated by stimulus spending.

What’s striking, though, is that in an environment in which the health of Rhode Island’s economy is a matter of dire concern, not a single one of the objecting quotations that Marcello provides in opposition to the tax-cutting plan goes much beyond distress at the threat to the budget of the state government.

Speaker of the House Gordon Fox (D, Providence) worries that such an investment in the state’s economy would come at too high a price to the government that ostensibly works for it. Kate Brewster, of the left-wing Economic Progress Institute (formerly the Poverty Institute), calls it “simply reckless” even to think about letting the Rhode Island keep a couple of years’ worth of state budget increases.

It’s not surprising that such folks from the list of establishment players would hold the public sector as inviolable above the economic health of the long-suffering Rhode Island people. However, those who’ve taken the private-sector’s side over the years might be surprised to see Gary Sasse among the objectors, because they’ve generally considered him to be on their side:

“The sales tax generates over one-third of all state general revenues, and budget deficits are forecast to grow to over $400 million by [fiscal year] 2018,” he said Wednesday. “Given these projections, it is fiscally unrealistic to suggest that the state revenue base be cut by almost a billion dollars.”

Of course, as Patrick Laverty emphasizes in a post on Anchor Rising on the subject, the actual effect on the “revenue base” would be much smaller, because of the many ways the government takes money out of the economy and the overall bigger pie that a healthy economy would represent. Also of course, a major contributor to the projected deficits is the fact that the state’s economy is not projected to expand significantly.

But the more immediately relevant point might be found in the op-ed by Sasse appearing in the commentary section of the same paper. Among the studies and summits that government typically uses to kick the can of difficult action down the road, Sasse suggests:

… the private sector should encourage the creation of an independent university-based economic-research collaborative. This new collaborative should be tasked with the responsibility of providing the governor and General Assembly with real-time economic data and analysis needed to make informed decisions pertaining to economic opportunities for all Rhode Island citizens. The research collaborative could, collect and aggregate critical economic data, create a dashboard indicators to measure trends, develop performance metrics, conduct cost-benefit analyses for major state investments and benchmark performance to other states.

Gary fleshed this idea out a bit at a table at which I happened to be sitting at the RI Foundation’s Make It Happen RI summit, and the nuts and bolts involve an annual million dollars or so of start-up money from the state government to help him, in his capacity with Bryant University, get this effort rolling. When I questioned the university’s president, Ronald Machtley (also at the table), about how decisions might be made in this “independent collaborative,” he made it clear that the people paying the bills have controlling influence.

It isn’t surprising that somebody whose economic development plan requires skimming a million dollars of new money off of the government’s budget would be wary of proposals forcing the state to figure out how to shave many times that amount with the least pain.

At the end of the day, the key economic decision that Rhode Islanders must make is one of emphasis and priority. Progressives in and out of government want the operations and priorities that they force through government to remain untouched. Technocrats want to be able to issue studies and then to tell Rhode Islanders what sorts of industries they should pursue, how they should educate themselves for those industries, and how much “public investment” they should make in it all.

The Center for Freedom & Prosperity’s approach is a bit simpler: let people keep their money, stop reducing their incentive to exchange it, and let people remain free to make their own decisions about what they should do with their lives.

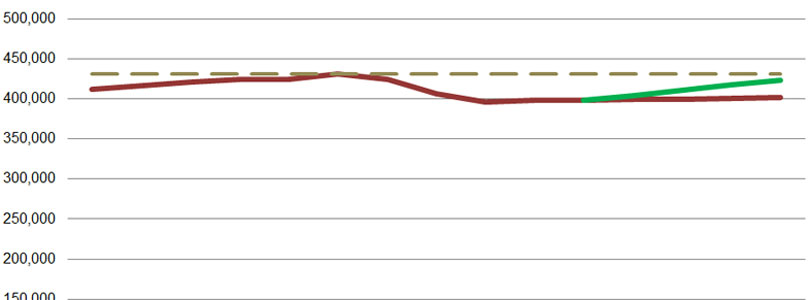

The featured image to this post comes from an Ocean State Current post on the jobs that Zero.Zero would help create.