A Decade of Moving Next Door

I’ve been following taxpayer migration data for years, but in a haphazard way. A new study that I’ve coauthored for the RI Center for Freedom & Prosperity finally gave me the opportunity to review all fifteen years of available data from the IRS.

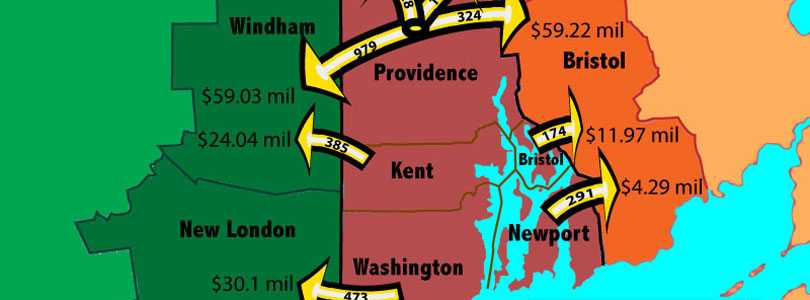

The picture — from the 2003 beginning of what can only be described as an exodus — is frightening. After accounting for the tens of thousands of Rhode Islanders who moved to other states and other taxpayers who moved in the opposite direction, Rhode Island lost 24,455 households, with $1.2 billion of annual income (not inflation adjusted). More conspicuously, a net 3,406 taxpayers moved right across the border, to abutting counties in Massachusetts and Connecticut, taking with them $254.5 million in annual adjusted gross income (AGI).

And when I say that they moved right across the border, I mean that literally, as this chart from the study shows. (Note that the chart is out-migration, not net.)

The bottom line is that a state in its 41st month of unemployment above 10% and (most likely) its tenth year of net taxpayer out-migration (including a net loss of income) cannot afford to hang its hope on incremental improvements and technocratic adjustments. This trend is eminently reversible, and once again, it comes down to a choice that Rhode Islanders have to make.