A Dynamic of Property Tax Rates and Levies

Given my activities in Tiverton, I’ve had reason to devote thought to two related topics.

First is the importance of property tax rates. I’ve put in a budget that would reduce Tiverton’s tax levy (the total taxes coming from local property owners) by 2.9%, and those who prefer the town’s more-costly alternative are harping on a tax rate map that the Tiverton Taxpayers Association (TTA) updates each year around budget time. Their basic theme: Tax rates are meaningless.

Actually, one gets the sense that they believe that all comparisons are meaningless. The same reaction comes up when the comparisons are education results, labor contracts, and so on. If you want to shift the balance of power away from government and its established interests, every comparison is proclaimed impossible. This town has wealthier kids. That town has more commercial property. This other town doesn’t do EMT service through the fire department. Unless you can find two towns that are precisely the same in every respect, it seems, no comparison is ever valid. (Until the topic flips, and it’s time to argue that your teachers are underpaid or your taxes could be higher.)

The second topic of particular interest in town is the way property valuations shift the tax burden around town. This year, the way the market has been going, lower-end homes in Tiverton (particularly single-story ranches) have been increasing in value much more quickly than higher-end homes. So, while the overall rate is set to go down because the total value of property is up, those who own the less-expensive houses are seeing substantial increases in their tax bills.

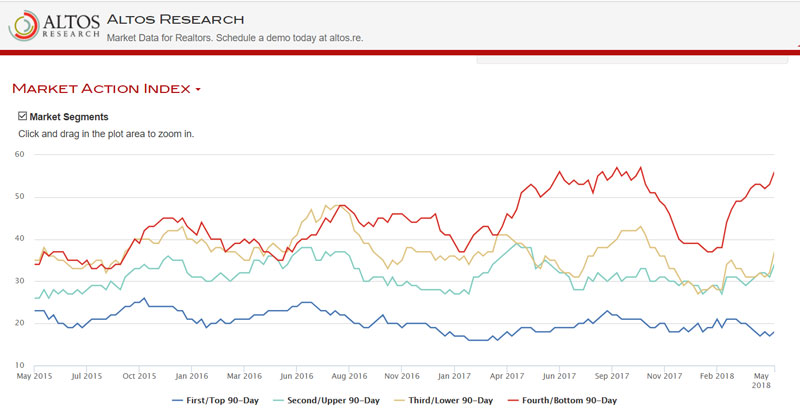

This experience is captured perfectly in a Tiverton-specific chart available through Altos Research. Anything over 30 on the index is considered a seller’s market, while anything below 30 is a buyer’s market. The blue line represents the most expensive 25% of houses, with a median asking price of $1.5 million. The red line represents the least expensive 25% of houses, with a median asking price of $244,900. The average expensive house has been on the market for 542 days, while the average inexpensive house has been snapped off the market after 37 days.

So, high-end houses are clearly a buyer’s market and going down, while the low-end houses are a seller’s market and have been rising. Meanwhile the middle 50% have been moving toward buyers, but are basically even. Basic economics would lead one to expect this to drive up prices in the low-end and drive down prices in the high end.

I’ve done some comparisons across Rhode Island, and while Tiverton’s neighbors, Little Compton and Portsmouth, are telling in that high-end houses are doing much better than in Tiverton, tax rates are clearly not the whole story. Still, they must be part of the story. The tax bill on that median expensive house in Tiverton would be $28,480 at the current $19.05/$1,000 rate. At Portsmouth’s $15.42 rate, the tax bill would be $5,427 lower. Throw those savings into a simple mortgage calculator at 3% on a 30-year term, and you’ll find that the seller in Tiverton would have to drop his or her price by $107,000 (7.2%) in order to offer a buyer the same monthly payment as on an identical house in Portsmouth.

If your impulse is to sneer about the “poor little rich people,” think again. When the tax assessor catches up with those falling prices, residents who own high-end properties will lose value on their house, but they will also pay less in taxes, because there is a uniform tax rate across the town. Meanwhile, the town government doesn’t set the rate and then hope it generates enough revenue; rather, the government decides what revenue it needs and then sets the rate to get that amount. When the poor little rich folks pay less of that bill, somebody has to take up the slack. In Tiverton, the market has been handing it to the working-class neighborhoods.

As I noted above, tax rates aren’t everything, but they do have an effect. Somebody in the market for a million-dollar house somewhere over here in the suburban East Bay will shop around and choose accordingly. That decision affects everybody in each town.

This is the fourth budget I’ve put in for Tiverton other than as a Budget Committee member, and if it wins, the combined budgets will have shaved $1.60 off the town’s tax rate. That will amount to direct savings of $400 per year for a family living in a $250,000 house. That’s real money, but it isn’t the whole story. As we control the tax rates, the home sales should even out somewhat across income brackets, which will shift some of the tax burden back toward the high end.