Explaining the Economics of Bold Policy Changes

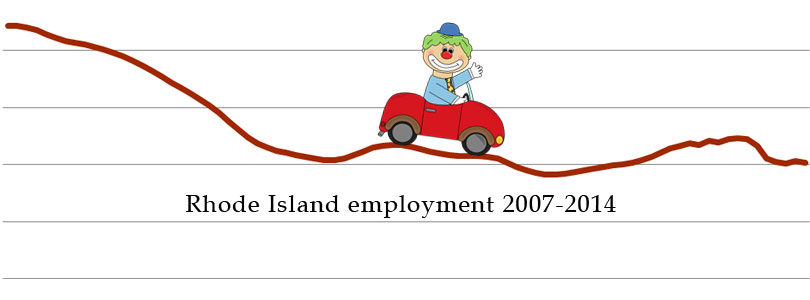

Over on RIFuture, Tom Sgouros has offered up pretty much the sort of economic analysis one would expect from a former clown (or a Rhode Island insider).

Only about one-third of his 839 words could fairly be called “analysis” of the RI Center for Freedom & Prosperity’s sales tax proposals, at all. Other than that, he makes a cute play on the name of the group; he makes cartoonish assumptions about our thinking and motivation; and his image of the economy is the analytical equivalent of a big hollow red nose that honks when he squeezes it.

Tedious as it is, though, I’ll consider Sgouros’s vision of the “real world”:

They claim, for example, that their model predicts $79 million in new sales tax revenue. This is a 20% boost in sales. Do you believe that lowering the cost of a $100 item from $107 to $103 will produce a 20% increase in sales of that item?

That’s not a real-world kind of question. It’s like an oversimplified example contrived for a fifth-grade math test.

In the real world, there’s a difference between discounting a single item by 4% and discounting everything sold within a state’s borders by that percentage. You probably wouldn’t go out of your way to a store that’s going to save you a few cents on paper plates. But you might make a habit of going to a store where everything’s a dollar, or one where you know the odds are that you’ll pay less for any given item.

However, that’s mainly a tug of war for readers’ impressions of how they personally might react to a policy change. The major gap in Sgouros’s “real world” comes with this:

The [Center’s] report goes on to imagine that the resulting 20% increase in retail sales in Rhode Island will be responsible for $208 million in income tax revenue. Backing this out, that means they imagine the 20% increase in sales will be responsible for around $4 billion in income for the state. … They are only (only!) projecting an increase in taxable retail sales of $2.5 billion, so the other money presumably comes from the tax cut fairy.

Sgouros insists that the Center is trying to appeal to the gullible, but I’d suggest that readers should be suspicious of an “analyst” who’s satisfied to write off so much of his opposition’s case as magic.

Let me digress for a moment, because this is an important point: The Center has put forward the results of an economic model. Some heavy hitters from the Suffolk University economics department have their reputations invested in the ability of this model to work. There’s been extensive debate about the accuracy of this model in Rhode Island, specifically in comparison with a competing one, with the conclusion that they operate pretty much the same way, with different assumptions.

And this guy — Sgouros — wants you to let him get away with simply assuming that we’re making things up. It seems to me that he’s the one who relies on readers’ gullibility. Referring to a “tax cut fairy” is a parlor trick to distract readers from the fact that he doesn’t know what he’s talking about.

It’s critical that Rhode Islanders begin to see through Sgouros’s sort of argument, because it’s the main strategy of an incompetent political class that is strangling this state for its own selfish personal benefit. We saw it in the recent state of the state speech, when Governor Lincoln Chafee — under whom the state has lost economic ground relative to other states — tried to blame grassroots activists who have next to no power here (Tea Party) and a U.S. president who hasn’t been in office for five years (Bush).

So what actual mechanisms take the place of Sgouros’s fantasy magic? First, not all of the economic gain from a sales tax reduction comes directly from the increase in consumer sales. If Tom does his own shopping, he may have noticed that there tend to be two parties to a sale: There’s a seller, and there’s a buyer. More sales mean the seller makes more money, but a lower sales price means the buyer has more money to spend, on retail and on other things.

Second, people will invest time and money in order to increase their income, growing the economy in the process. Tax and regulatory reform are mainly about changing the environment in which people conduct their business and allowing them — not the government — to do the work of pushing the boundaries of the economy outward.

Retail business owners will expand to increase volume and venture into new products. Other businesses that save on the sales-tax expenses of their business purchases (such as energy, trucks, and tools) will find it more plausible to invest in their own lines of work. Individuals whose dollars are now going farther will reinvest increased disposable income in their careers, families, and property.

Another thing Sgouros glosses over, if he realizes it at all, is that new retail sales in Rhode Island don’t have to be on items that otherwise would not have been purchased. The percentage of their sales taxes that Rhode Islanders pay outside the state will vary by area, but a walk through a Seekonk parking will make it easy to imagine its being high — say, 20% or more in out-of-state purchases.

Obviously, there are other reasons that people might shop outside of Rhode Island, whether convenience or the location of the store to which they need to go, but if there’s a blanket savings on sales tax, it isn’t laughable to think that people will generally change their shopping behavior. Rhode Island liquor stores’ experience when Massachusetts temporarily leveled their taxation playing field proved that keeping Rhode Islanders local makes a huge difference.

Then add to that the probability that nearby and pass-through shoppers will shift their own spending ratios in favor of Rhode Island. It doesn’t have to be a total change of habit, just another weight on the scale, tipping total volume within the state’s taxable borders to a 20% increase.

This brings us to another bad argument against the tax cut. The Center is simply not claiming that the state’s revenue loss or the economy’s gains will be “immediate,” as Sgouros alleges. Taxes come in throughout the year, and a one-year projection includes 12 months of smaller changes.

Making the same erroneous “immediate loss” claim during the latest sales-tax-elimination commission hearing, Rhode Island Public Expenditures Council (RIPEC) director John Simmons repeatedly insisted that there would have to be a “construction” phase before stores could accommodate greater volume. He seemed to think he was disproving the possibility of immediate job gains, but he didn’t seem to realize that construction jobs do, in fact, count as jobs.

Even more: Those jobs wouldn’t be paid for by immediate sales, but by investment to capture increased sales in future years. That means the sales tax change brings money that is currently inactive or is invested elsewhere into Rhode Island’s active economy.

The Center isn’t claiming that reducing the state sales tax will generate some billions of dollars in sales that otherwise wouldn’t happen and some billions more in magical economic boost. We’re claiming that, if the state government takes the risk of leaving about $500 million in the economy (for the 3% tax scenario), people will change their behavior in economically productive ways…

- to increase the share of their current spending within Rhode Island

- to capture increased demand

- to leverage a competitive advantage

- to maximize the value of money saved

Altogether, these activities will grow the state’s economy by around 10%, which will make up for a large portion of the state’s foregone sales tax revenue. And none of this takes into account less quantifiable effects, like the change in Rhode Island’s image, among residents and across the country, were it to take a bold step to improve the lives of every resident.

Imagine how differently you’d see Rhode Island if it weren’t a hopeless state where top-down restrictions on people come down heavy and much-hyped reforms are generally minor (if not phony), but rather were a place where it’s possible for the people to get the government to do something dramatic that helps them for a change.

Is the economic modeling tool that the Center uses too optimistic? Maybe. Is the model that the state uses too pessimistic? Absolutely (I’d say). That’s why the Center put out an obvious-to-us proposal for dealing with the uncertainty.

Obvious or not, though, the folks for whom government spending is like air or existential purpose seem more interested in speaking in broad strokes about economic principles that they aren’t inclined to understand.