In Support of Reliance on Local Taxes

The Providence Journal editorial board is among those who believe that Rhode Island’s property tax is of especial concern:

In a state overly dependent on the property tax, many cities and towns — typically the larger ones — have shifted a disproportionate share of the burden onto businesses, thereby limiting the bill for homeowners. Politicians get away with this because there more voters who are homeowners than business owners. But this practice, of course, makes it harder to run a business in Rhode Island.

High property taxes are also one of the reasons Rhode Island’s construction industry has never returned to its pre-recession numbers, developers say. When the cost to build, or renovate, is too high for developers to make a profit, the work doesn’t get done. Meanwhile, some cities and towns — looking to limit student enrollment that drives up education costs and, consequently, property taxes — have made it more difficult to build new homes, notes Rhode Island Builders Association Executive Director John V. Marcantonio.

Plenty goes into businesses’ and builders’ decisions. Strict zoning and other regulations are certainly a problem, but I’d argue that property taxes are important mainly in the context of the total tax burden of the area. In Rhode Island, one could point to just about any tax as “the” problem, because they’re all bad.

Based on political theory as well as political experience, I’d argue that we ought to rely more on property taxes, relative to the other forms of taxation. For one thing, emphasizing local taxes inherently moves political power to the local level.

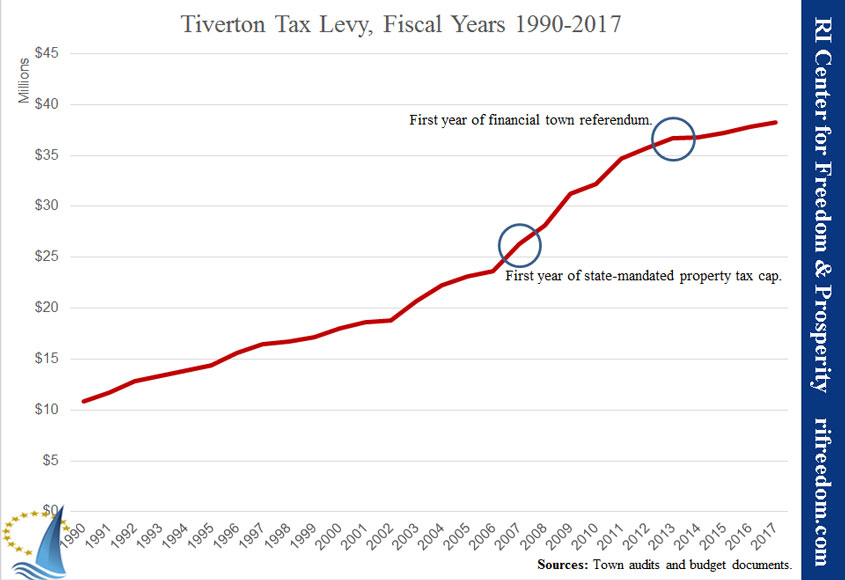

More important (albeit related), the property tax, being local, is easier to control if we want. Tiverton’s tax levy and the state’s levy cap make a great illustration of the point. After the passage of S3050 in 2006, the cap on the size of the increase of local tax levies phased down from 5.5% in 2007 to 4.0% in 2013. As you can see in the chart below, taxes shot up anyway.

Tiverton taxpayers used to have to fight just to keep government from breaking the cap each year, but then we changed the local budget process to a financial town referendum (FTR) for fiscal 2013 to reduce the advantage of entrenched special interests, and the results are obvious.

Yes, it takes work and some locals in each city and town willing to stand up to attacks that can be quite vicious and intended to make life in one’s community less pleasant, but local government is where it is actually possible to push back against the machine.