12/03/13 – Sales Tax Commission

3:49 p.m.

Here again, back in the very warm room 313. This time we get to hear state revenue analyst Paul Dion’s take on what different approaches to economic modeling tell us about the policy of eliminating the sales tax.

4:09 p.m.

Another traffic-inspired late start. I hear Dion has a 40 slide presentation.

4:10 p.m.

Dion’s offering a summary of his intended presentation and the history of the legislation. He’s starting with a review of the RI Center for Freedom & Prosperity’s Zero.Zero report. [I think of URI economic professor Len Lardaro’s suggestion that the state needs more due diligence for its proposed policies. Inspiring that sort of thorough look was a central motivation for the Zero.Zero report.]

4:16 p.m.

Describing how models run economic adjustments until an equilibrium is reached, Dion uses the shampoo example of “lather, rinse, repeat.” How could he not have a visual on that slide?

4:18 p.m.

“There are hundreds [of equations] underlying these models.”

Moving on to the REMI PI+ model that the state uses (in the Office of Revenue Analysis since 2009). REMI is “a little bit more complicated,” but the two models are “pretty much the same.”

The PI+ model has more sectors, though, so it is “a little bit more fine.” [Having sat in on the meeting where we compared the two models, I can say that the fine details are not the major concern in comparing them.]

4:22 p.m.

Now, Dion is laying out some of the differences between the models’ assumptions, such as “economy’s capacity and potential.” He says STAMP assumes the state is currently in equilibrium, meaning (for example) that anybody who can be employed is. REMI allows for underemployment. [I’d note that that’s more complicated than it sounds. I don’t think Dion’s suggestion that STAMP assumes that anybody who “wants to be” employed is employed is accurate. It’s more like “anybody who can be.”]

STAMP also assumes that the adjustment begins to happen immediately, while REMI phases it in. [Based on our meeting, that’s not entirely accurate, either, nor is it really as big a deal as Dion’s emphasis with his voice made it seem. STAMP assumes a major effect within a year… which is theoretical and could go, say, six months shorter or longer… not 25,000 jobs the next day. The upshot is that STAMP’s year 1 shows the result fading a little bit over five years, as the advances in the economy that would have happened anyway erode the effect of the new policy, while REMI year 1 shows a slightly understated result, growing up to the max… such as the difference between 95 of something, to begin with, growing to 100 after five years.]

REMI assumes that government spending is “more localized” and differs “in substance,” such as providing services “of last resort” (e.g., Medicaid).

Dion says these differences aren’t hugely important for our purposes, here.

4:33 p.m.

He’s now describing how the state budget breaks down from expenditure to expenditure in the model. Lots of detail; it’s good that they did the work, but (1) I’m not sure this is what makes the critical difference between the models or (2) that any commission member will leave conversant on the methodology.

Rep. Patricia Morgan asks how much school aid the state sends out. Dion says it’s around $900 million, including pension payments.

In response to further questioning, Dion says they didn’t model any increases in local taxes (or similar things)… but they did model layoffs of local workers. Not sure how they make those assumptions.

Dion says that dynamic revenue (i.e., increases in other tax collections from economic growth) only comes in year two, for REMI. That’s different from what I understood from our meeting. It’s also not very realistic, inasmuch as people start paying taxes on their income the first hour that they start to earn it.

4:42 p.m.

Dion says they assume growth in the economy and employment even if we do nothing. Frankly, that’s not really the experience that the state has had over the past five years. (Although, I should note, STAMP makes similar assumptions.)

Rep. Morgan asks what growth the model has predicted in past years. Dion doesn’t have a specific answer. Morgan asks how accurate the model’s been in the past. “Has this model predicted no growth?” Dion doesn’t have that number. “I can go back, and hopefully we can check that,” he says.

[Why would he have to go back to the folks at REMI for that answer? Odd.]

Rep. Jan Malik says he’s seen the state’s tax revenue go up, but he’s wondering when we’ll see the economy grow.

Dion says “tax is a residual” of economic activity… of course [I’d interject] the 2010 income tax revenue ended up increasing taxes without being a “residual” of economic growth.

He also says we “have an obsession” with the unemployment rate. For example, he says that you see an increase of the unemployment rate when an economy is recovering because the labor force is going up… but Rhode Island is experiencing the opposite of that effect.

4:48 p.m.

Morgan is pressing on job creation.

Dion says we will not recover all of our lost employment because of “demographic changes” and people having left the state.

4:49 p.m.

Dion says some young folks go elsewhere for work, at first, and then come back. [But if that’s a regular effect, it should wash out over time, no? Sounds like a long way to avoid allowing the emphasis to shift to the people of Rhode Island rather than the budget of the state government.]

4:53 p.m.

Malik emphasizes that RI is always the last one out of a recession. “The numbers always look bleak for the people of Rhode Island.”

4:56 p.m.

Sen Walter Felag clarifies from Dion that the House analysis office purchased the REMI model in 1998. On a further question, Dion states that this model is not used for the semi-annual revenue estimates.

Felag asks how often the model is used… for example, with some of Governor Chafee’s tax proposals. Dion says they’ve used it to model the America’s Cup event in Newport. They’ve made “internal runs” of tax proposals through the model “on occasion,” mainly as a matter of internal interest.

5:00 p.m.

Dion says this particular model is more designed for economic development projects (e.g., building a new stadium); REMI has a different model for tax reform.

5:04 p.m.

On the different clients of the two models, it’s clear that REMI is preferred by governments while STAMP is mostly used by think tank-type organizations.

5:08 p.m.

Malik refers to the meeting in Boston and asks if he was correct in having left understanding that REMI shows that government spending does more for economic growth than private sector spending.

Dion says that’s “not how I understood that.” [I’ll tell you that the two representatives from REMI explicitly said that more government spending would grow the economy while eliminating the sales tax would shrink the economy by $368 million. That was clear and explicit. I asked the question in multiple different ways in order to make sure my impression was correct because I found it so outlandish.]

5:15 p.m.

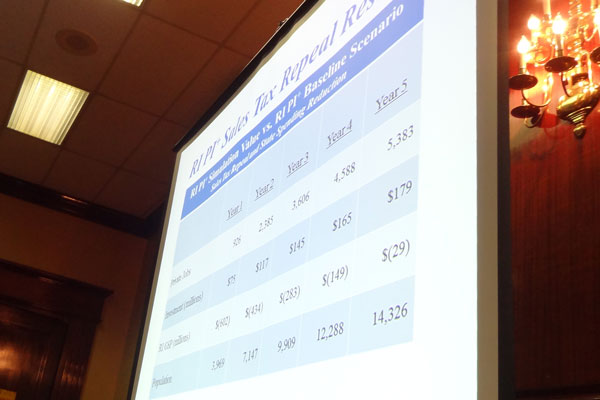

Dion’s showing the REMI results, which are much lower than STAMP’s. They appear to have made some adjustments to the numbers since Boston, because it only shows the economy shrinking by about $30 million after five years when the government lets people spend their own money, rather than taking it away and spending it better than regular people would.

5:21 p.m.

Dion’s mischaracterizing the Zero.Zero reports. It’s telling that, in preparing this ostensibly objective and thorough review, he never once asked the Center for clarification on what it has done even though he and I have had productive discussions in the past.

5:31 p.m.

In response to a question, Dion says the models are based on different philosophies. [No kidding. REMI assumes the government can spend money more efficiently to grow the economy than regular people would.]

Rep. Morgan says MA increased its cigarette tax, and in the three months since then, RI cigarette sales are up very significantly, 9%. “That’s enormous.”

5:41 p.m.

While the ongoing conversation covers whether people will actually comply with laws to pay use taxes on goods bought in other states, I want to note something: Dion mentioned that the year-older version of the Zero.Zero report shows the year-to-year numbers. He’d insinuated earlier that we were trying to pull something by not showing them in the latest report. That’s not because we were being more honest that year (as Dion seemed to imply), but because we ran the model phasing out the sales tax over five years in the earlier version.

If that’s what REMI does, it’s modeling something completely different than is being stated.

By the way, I want to emphasize: Dion’s model shows that the Rhode Island economy would shrink $602 million the first year of no sales tax. Sure.

5:56 p.m.

I’ve got to say that I’m simply not believing REMI’s assumption that state workers who might be laid off from government based on lower revenue would simply disappear from the state… for one thing, all those things that progressives say about tax rates apply. There are reasons to stay in the state other than exact maintenance of income.

For another thing, higher paid state workers also have a premium because they’re familiar with Rhode Island. (Paul Dion, for example, has special knowledge of accounting in Rhode Island, giving him incentive to set up a consultancy in Rhode Island and grow the economy, here, if he loses his government job.)

For a third thing, REMI doesn’t assume that any state workers will take the opportunity to do anything as active human beings to cut a new path in life. That is, the availability of overqualified people as slack in the labor force would not inspire new types of investment and other economic activity.

6:04 p.m.

Mike Stenhouse is up.

He says that the current approach of Rhode Island government to the economy is not working. The Center would suggest that REMI is more in keeping with Rhode Island’s current approach.

6:10 p.m.

Stenhouse says the REMI model shows that government spending is good for the economy. How, he asks, has that been working out for us? He says that government spending does indeed crowd out private spending, contrary to Dion’s suggestions.

[It occurs to me that one major difference between the models is that REMI appears to assume a sort of static vision of the economy. The government, for example, will pay for people’s expensive medical care, which arguably has a stronger economic effect than would the purchase of the same dollar amount of trinkets. But the model assumes people will only buy the trinkets if they have more money to spend.

[Indeed, it came to light at the Boston meeting that REMI assumes new investment from the private sector only to meet demand. That is, a business will invest only to grow to provide more of the same services that it currently provides based on increased purchases. The STAMP model assumes that people will invest pro-actively in order to maximize their income.]

Stenhouse says that the REMI representative in Boston said that doubling the sales tax to 14% would wind up being a net benefit to the economy. “Does anybody believe that can possibly be true?”

6:21 p.m.

Dion is responding very defensively (almost meanly) to Stenhouse’s suggestion that the folks who made STAMP model are PhD economists. I don’t think that Mike’s comment was a belittlement of Dion, but rather an affirmation of the qualifications of the folks who built it.

Dion is also saying that REMI’s representatives did not say that doubling the sales tax would be a net benefit to the economy at our meeting. That’s absolutely false. Again, I asked the question in multiple ways, and they did in fact say it. That’s when everybody from the Center and from the Beacon Hill Institute threw up their hands and said there’s no reconciliation of the models possible, then.

Dion’s also emphasizing that New Hampshire is “only 100 miles away” and saying most folks from Massachusetts wouldn’t change the direction for their tax-free shopping. He doesn’t seem to give any weight to the realities:

1) That Rhode Island has some natural advantages that might make it a more attractive place to shop while visiting.

2) That there happens to be a very large population center in the tri-state area of New York City that is roughly as close to Rhode Island as New Hampshire… in the other direction.

[One thing I would have written, here, had I not gone up to the witness table to clarify something had to do with Dion’s challenging STAMP’s projections of local revenue, given the tax cap legislation in Rhode Island. I’ll have a separate post on that, tomorrow.]