Local Taxes, All About Perspective

On Tiverton Fact Check, I’ve taken a look at comparative taxes across the state. Because the local Tiverton Taxpayers Association has been successfully controlling tax increases for the past four years by informing people about our regionally high tax rate, proponents of higher taxes have taken to insisting that we really don’t pay that much. Why, our tax rate is in the middle of the Rhode Island pack, they say.

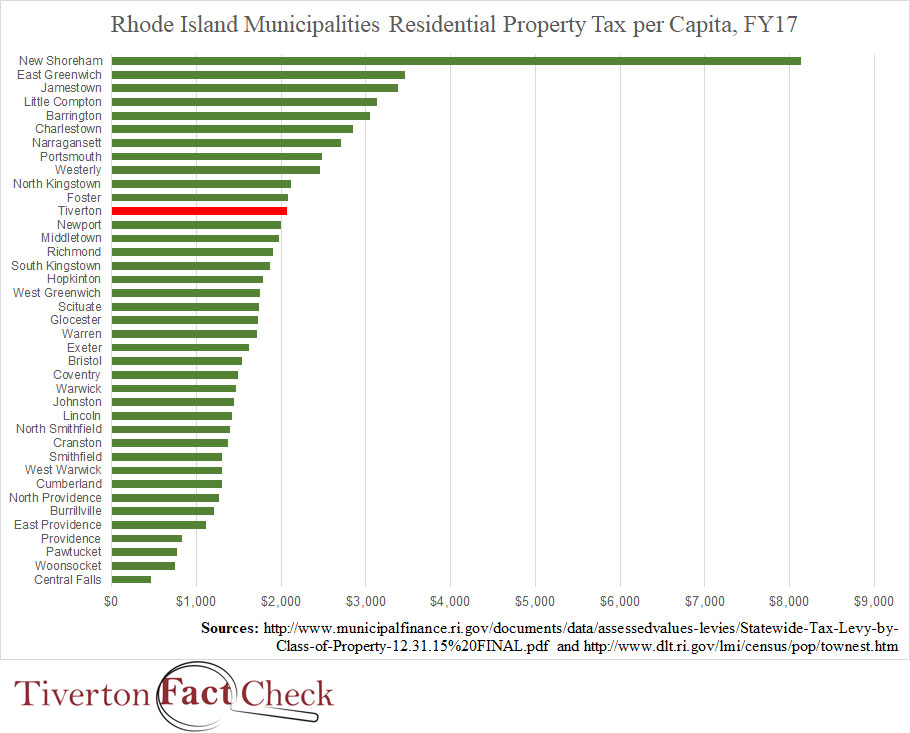

That may be true, but it has no context. This chart shows every Rhode Island municipality’s tax levy per capita, and as you can see, Tiverton is 12th highest.

Above Tiverton, for the most part, are notably wealthy towns and those that are relatively sparse in population. This is the chart that Tiverton should be in the middle of, and it would require a relatively low tax rate.

Even this, though, concedes too much. The main difference in perspective is that the taxpayer group takes the point of view of the family and how much it has to pay for an asset. Progressives and other high-tax constituencies take the approach of asking how much government can get away with taking from those families. In that regard, all of Rhode Island is way too high.