Despite DE Status, RI Will at Least Receive $500 Minimum Tax from 38 Studios

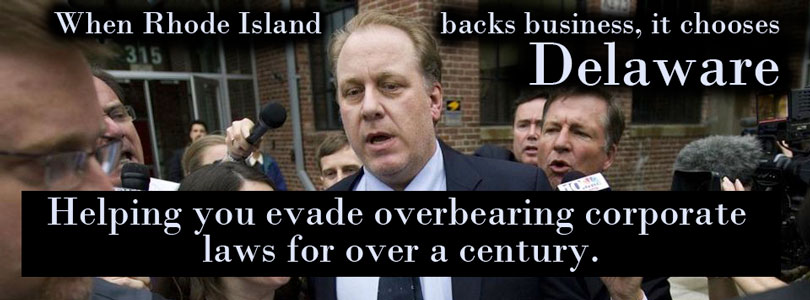

It now appears that the point may be moot, with 38 Studios having laid off all of its employees yesterday afternoon, but WPRI’s Ted Nesi has reported that Curt Schilling’s video game company — operating under a $75 million loan guarantee from the state of Rhode Island — may not be eligible for in-state film-industry tax credits because it is not technically a Rhode Island company.

The company, according to Nesi, is registered as an out-of-state limited liability corporation (LLC) based in Delaware.

As the Web page for the Delaware Division of Corporations explains, many companies choose to incorporate in the state. In fact, the page claims that over half of “all U.S. publicly-traded companies and 63% of the Fortune 500” legally reside in Delaware, although most are physically located elsewhere.

A PDF marketing booklet titled “Why Corporations Choose Delaware” and available in English, Chinese, and Portuguese offers in-depth explanation of why that is.

The [Delaware General Corporation Law] statute itself is an enabling statute intended to permit corporations and their shareholders the maximum flexibility in ordering their affairs. As such, it does not purport to be a code of conduct. Indeed, it is written with a bias against regulation. When compared to some corporation laws where the drafters have attempted to regulate every nuance of corporate behavior or deal with every conceivable eventuality, the Delaware statute has a spare, almost open quality. Every effort is made to simplify drafting and to avoid complexity.

The text goes on to extol the degree to which the state’s small size allows corporate lawyers and legislators to work together. “The old maxim that one’s word is one’s bond works better in an environment where the people involved interact regularly.” The advantage to making Delaware the legal home of one’s company has mainly to do with protections for the owners and the company generally, in the face of a lawsuit. The business-friendly corporate statutes and consistent case law create a predictable environment.

In Rhode Island, another very small state, the 38 Studios deal in particular has helped to solidify the understanding that the state is a haven for inside deals pursued at taxpayer risk. Another well-known matter of corporate law in Rhode Island is the minimum $500 franchise/corporate tax imposed upon all business entities, even if they have no revenue.

The good news for Rhode Island is that 38 Studios is still subject to the state’s corporate tax system. So, even if it takes a loss, the company will be liable for at least $500 per year for as long as it is registered to do business here.