The Difference the Tax Cut Makes, Corporate versus Sales

Mike Stenhouse and I have said it in passing, but with various politicians and groups proposing their own tax cut solutions, it bears repeating: The reason the RI Center for Freedom & Prosperity chose the sales tax as our target (prompting arguments from some of our national friends) is that it simply has the greatest effect in Rhode Island.

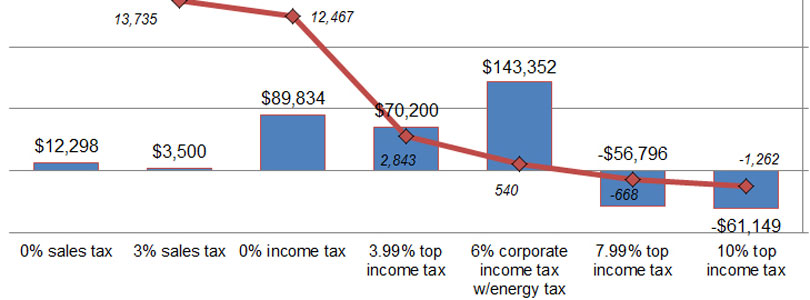

The following chart, for example, shows the results of our RI-STAMP model for several tax changes that have been on the table in the recent past. The red line shows the number of new private sector jobs that the reform would spark, while the blue columns show the amount that the reform would cost state government in revenue per job. (Multiply the two numbers for the total cost of the proposal.)

In the broad view, all taxes ultimately come to the same thing: Leaving money in the economy. The questions are who gets to decide where it goes and what decisions they’re likely to make.

One favorite of politicians and many on the right, in Rhode Island, including the “fiscal conservative” aspect of our otherwise progressive governor, is cutting the corporate tax. The implicit assumption is that — because their economic productivity is what defines them as a group — they will make more economically productive decisions if the effects of a tax cut enter the economy through them.

It depends how one is measuring the economy, of course, but it’s important to remember that businesses aren’t in business for the purpose of growing the economy, but to make a profit. There’s nothing wrong with that attitude, but it’s not clearly different from leaving consumers more money with which to choose products and services to buy.

Yes, it will attract businesses if they get to keep more of their profits, but it will also attract businesses if a more active marketplace gives them more profits to keep. The question that must be answered is which option will be more economically productive in Rhode Island’s unique circumstances.

Using last year’s RI-STAMP model (because we’re still tweaking this year’s), I find that cutting the corporate tax in half (i.e., to a 4.5% rate) would put at risk $118.76 million in state revenue, of which the state would ultimately forgo $110.01 million (after dynamic effects), while creating 199 private sector jobs. If you put the same amount of revenue at risk on the sales tax (i.e., reduce the rate to around 6%), the state ultimately forgoes just $23.45 million while creating 1,805 jobs.*

Looking at the details, however, brings out some interesting contrasts. The corporate income tax, for instance, increases total investments within the state by $191 million, which contrasts with $53 million under the sales tax cut. Meanwhile, per capita disposable income grows $13.85 per year under the corporate tax cut, but it falls $50.00 under the sales tax cut.

The reason for these results appears to be that the sales tax cut actually grows the population, while the corporate tax cut does not. Indeed, the sales tax cut increases disposable income more than the corporate income tax cut in every income group except the $10,000-25,000 group and the $150,000+ group, while the corporate income tax cut actually reduces disposable income for every person under $50,000 per year.

What it looks like, in other words, is the sales tax cut creates more jobs and draws in more people wanting to work and to lower their cost of living at the middle-to-low end, which changes the averages, but it benefits almost everybody making under $150,000 per year, while the corporate income tax cut mainly benefits those over $150,000. Meanwhile, the corporate income tax generates investments, but (I’m inferring) a lot of that increased activity moves the benefits (i.e., the money) to people and parties out of state.

The corporate income tax cut makes Rhode Island a better place to do business, if you’ve already got business to do, but it doesn’t do as much to make Rhode Island a better place to live. The latter should be the focus of public policy debates.

* Obviously, if we look at the sales tax that would actually cost as much as halving the corporate income tax, after dynamic effects, then the state government could go much farther. If we’re willing to actually forgo around $110 million, we could cut the sales tax rate to somewhere around 2.5% and create around 15,000 jobs.