The Governor’s 2015 Budget for Rhode Island in Historical Perspective

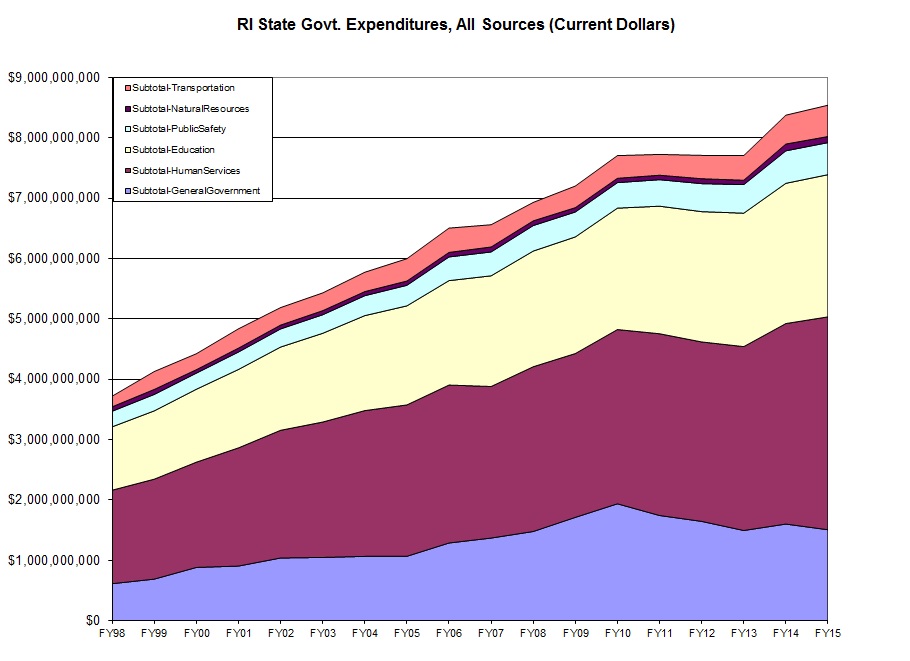

1. As always, actual dollar amounts spent, at the time they were spent (or will be spent for FY2014 and FY2015), known as “current dollars” in the parlance of economists, are presented first. All budget numbers were taken from the budget documents posted at the State of Rhode Island Budget Office website.

2. The next chart shows amounts spent from all sources, adjusted for inflation. The inflation adjustment is based on the Consumer Price Index series compiled by the Bureau of Labor Statistics and available from the RI Department of Labor and Training website (with an annual 2% inflation rate is assumed for the future). With the adjustment for inflation, the proposed total state budget for FY2015 is approximately the same size as the total state budget for FY2010 (the next-to-last budget during the Carcieri administration).

How did the state of Rhode Island arrive at that result? In current dollars, the state budget was flat, $7.7B in each year between FY2010 and FY2013; in inflation-adjusted terms, flat current-dollar amounts translate into a decline in spending. The budget increase between FY2013 and FY2014 (i.e. the fiscal year we’re in now), will bring total spending back to its FY2010 level, and the goal for the fiscal year after that (FY2015) appears to be a slight increase which would match a reasonable inflation rate.

3. The next chart shows inflation-adjusted spending from general revenues (basically state taxes). In this area, the proposed budget continues the trend of faster-than inflation growth that has been present throughout the Chafee administration; if proposed totals for FY2014 and FY2015 are ultimately outlaid, Rhode Island’s general revenue spending will have have grown by a total 8%, adjusted for inflation, over the course of four Chafee administration budgets (roughly 2% per budget).

The proposed budget for FY2015 keeps (inflation-adjusted) spending from general revenues well below the peak it hit in FY2008. While Governor Chafee used his state of the state address to take various digs at spending decisions made in the “recent past” or by “the previous administration”, in the absence of the budgeting decisions made during his predecessor’s second term, the options for Governor Chafee and the current legislature would have been 1) making hundreds of millions of dollars of cuts of their own in order to get to the current budget, 2) raising additional hundreds of millions of dollars via taxes to maintain general revenue spending in accordance with a FY2008 baseline, or 3) doing some combination of both to implement a program in between.

The bottom line is that it’s disingenuous for the current Governor to open his state of the state address by boasting of “no broad based tax increases”, while speaking only with disdain for the budgeting in the “recent past” that made a no-tax increase plan not containing major disruptions feasible.

4. Finally, the last chart shows Rhode Island state spending paid for with Federal funding. Are we now into a post-stimulus/post-temporary-expansion-of-DLT “new normal”?