Government Employee Overtime About Equal to a 38 Studios Every Year

The State of Rhode Island spent $89.6 million on employee overtime in 2011, according to payroll data acquired by the RI Center for Freedom & Prosperity. In 2010, the total was $82.8 million. The free-market think tank will make the individual payroll data for fiscal years 2011 and 2010 available next week through an interactive transparency Web site.

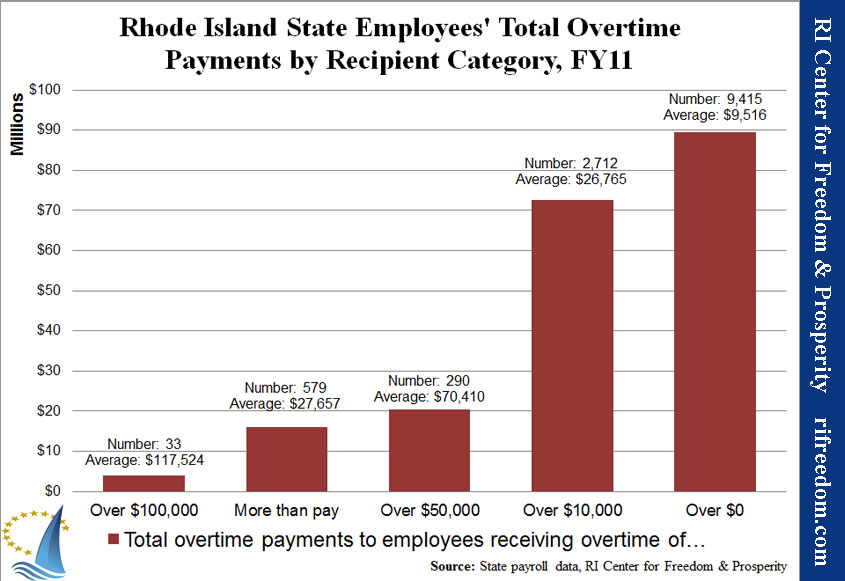

The average overtime payments of the 9,415 employees receiving at least some overtime in 2011 was $9,516, but removing those who claim relatively small amounts reveals some startling totals.

In 2010, the state paid $66.1 million in payments to the 2,643 employees who claimed more than $10,000 in overtime, for an average of $25,023. In 2011, the comparable 2,712 employees claimed an average of $26,765, for a total of $72.6 million. That’s fast approaching the equivalent of a 38 Studios loan guarantee every year.

Narrowing the range more, $20.4 million went to those claiming over $50,000, for an average of $70,440. And $3.9 million went to just the 33 claiming over $100,000 in overtime payments, averaging $117,524.

In total, 579 employees made more in overtime than they did in regular pay. Assuming all overtime hours at time and a half, 526 employees would have had to work at least an additional 50% of their ordinary hours (e.g., 60 hours on a 40 hour workweek) in order to achieve the overtime that they were paid. That’s every single week of the year, including vacation weeks and holidays.

Honing in on the top 33 overtime recipients, it appears that these massive amounts of money are not one-year spells of heavy workloads or understaffing, but have become regular features of state government workers’ income. The following table shows the gross pay, overtime, and regular pay (gross minus overtime) of each employee who took home more than $100,000 in overtime pay in 2011, as well as his or her department. (The table assumes that no two people with the same first and last names work in the same department and switched places with regard to who had more overtime.)

On Tuesday, an article by Suzanne Bates on the Ocean State Current looked into the twelve employees in the table from the Dept. of Behavioral Healthcare, Developmental Disabilities and Hospitals (BHDDH). Yesterday, we pointed out that overtime excesses aren’t merely a factor for highly skilled employees, driving laundry workers’ total pay over the $100,000 mark.

Rhode Island State Payroll Employees Making over $100,000 in Overtime in FY11 |

||||||

| 2011 | 2010 | |||||

| Name, Department | Gross Pay | Overtime Pay | Regular Pay | Gross Pay | Overtime Pay | Regular Pay |

| Stella Adeniyi, BHDDH | $269,858 | $172,398 | $97,460 | $248,876 | $156,674 | $92,202 |

| Sylvia Macagba, BHDDH | $263,052 | $158,462 | $104,590 | $282,280 | $180,112 | $102,168 |

| Abella Corpus, BHDDH | $246,938 | $142,060 | $104,878 | $294,867 | $192,086 | $102,781 |

| Gary Clark, Corrections | $206,641 | $140,822 | $65,819 | $145,574 | $94,239 | $51,335 |

| Sung Lee, BHDDH | $232,950 | $140,507 | $92,443 | $162,718 | $79,110 | $83,608 |

| Paul Fetter, Jr., Corrections | $204,595 | $132,398 | $72,197 | $144,479 | $89,701 | $54,778 |

| June Nwanna, BHDDH | $214,573 | $130,420 | $84,153 | $170,701 | $94,231 | $76,470 |

| Dale Fogarty, Corrections | $210,029 | $128,123 | $81,906 | $159,856 | $95,356 | $64,500 |

| Jack Vicino, Corrections | $201,156 | $124,315 | $76,841 | $135,990 | $70,883 | $65,107 |

| William Distasio, Corrections | $181,368 | $121,426 | $59,942 | $140,802 | $88,972 | $51,830 |

| Cynthia Smith, Corrections | $198,868 | $120,747 | $78,121 | $144,597 | $83,019 | $61,578 |

| William Curtin, Corrections | $175,256 | $120,395 | $54,861 | $64,066 | $34,559 | $29,507 |

| John Meehan, Corrections | $186,771 | $117,405 | $69,366 | $124,482 | $63,939 | $60,543 |

| Nelson Bolano, Corrections | $175,694 | $114,615 | $61,079 | $154,433 | $102,013 | $52,420 |

| Juliana O. Gunnaya, Corrections | $199,501 | $113,505 | $85,996 | $173,942 | $101,089 | $72,853 |

| Patrick Flynn, Corrections | $183,624 | $111,306 | $72,318 | $240,790 | $177,768 | $63,022 |

| Vincent Paiva, Corrections | $171,501 | $110,181 | $61,320 | $118,705 | $65,383 | $53,322 |

| Josephine St. John, BHDDH | $194,205 | $109,946 | $84,259 | $170,377 | $95,478 | $74,899 |

| Kevin Krupa, Corrections | $170,918 | $109,839 | $61,079 | $124,740 | $72,320 | $52,420 |

| Pedro Tactacan, BHDDH | $245,660 | $109,700 | $135,960 | $262,575 | $141,439 | $121,136 |

| Kerstin Uy, BHDDH | $171,555 | $108,280 | $63,275 | $49,368 | $23,617 | $25,751 |

| Michael Gorman, Corrections | $175,256 | $107,645 | $67,611 | $160,481 | $99,056 | $61,425 |

| Cecilia Falguera, BHDDH | $198,692 | $106,355 | $92,337 | $203,459 | $112,439 | $91,020 |

| Gavin Frament, Corrections | $167,912 | $105,835 | $62,077 | $132,199 | $78,599 | $53,600 |

| Angela LaCombe, BHDDH | $217,016 | $105,121 | $111,895 | $250,630 | $137,579 | $113,051 |

| Stephen Perry, Corrections | $161,447 | $104,014 | $57,433 | $129,289 | $78,674 | $50,615 |

| Errol Groff, Corrections | $162,613 | $102,787 | $59,826 | $128,220 | $75,800 | $52,420 |

| Robert Midwood, Corrections | $164,663 | $102,415 | $62,248 | $128,718 | $74,421 | $54,297 |

| Kyw Lee, Corrections | $164,582 | $102,107 | $62,475 | $132,715 | $77,936 | $54,779 |

| Thelma McGuirl, BHDDH | $192,960 | $102,017 | $90,943 | $173,454 | $86,163 | $87,291 |

| Louis Cesario, Corrections | $164,219 | $101,980 | $62,239 | $122,617 | $68,330 | $54,287 |

| Dale Campopiano, Corrections | $163,704 | $101,093 | $62,611 | $135,083 | $81,484 | $53,599 |

| Carl Langley, BHDDH | $201,076 | $100,080 | $100,996 | $179,452 | $80,841 | $98,611 |

| Notes: “BHDDH” = the Department of Behavioral Healthcare, Developmental Disabilities and Hospitals; “Corrections” = the Department of Corrections. | ||||||

Editing note: Added 2010 total to first paragraph at 3:55 p.m., 3/28/13.