“National Grid sells renewable energy at a profit; customers get credit.” FALSE

In his Sunday Providence Journal column, Alex Kuffner reported on legislation that would keep the ratchet going on Rhode Island’s renewable energy standard (RES). The bill in question is H5079, with Representatives Ruggiero, Handy, Hearn, Shekarchi, and Ackerman (all Democrats) as its first five sponsors.

Under current law, energy distributors (mainly National Grid) must increase the percentage of the energy that they receive from green, “renewable” sources each year until 2019. Having received a one-year suspension, last year, the percentage will reach its maximum at 14.5%. The new legislation would bump the requirement up 1.5 percentage points every year until 2035, at which point 38.5% of the energy that distributors provide would have to come from the sources that government prefers.

According to Kuffner:

Much of the opposition to renewable energy centers on its higher cost when compared with power generated from fossil fuels. Interestingly, as Jerry Elmer, an attorney with [Conservation Law Foundation’s] Providence office, pointed out in his testimony to the Corporations Committee, the recent hike in electric rates for National Grid customers in Rhode Island would have been slightly higher if not for renewable energy.

Grid will be able to re-sell at a profit the energy and tax credits it buys under longterm contracts from solar arrays in Rhode Island and other renewable projects in New England. The net effect is a credit of 32 cents on the typical monthly residential electric bill, according to documents filed with the [Public Utilities Commission (PUC)].

Let’s break down the basic statement and insinuation of those two paragraphs:

- The first paragraph implies that the “opposition to renewable energy” might be misguided, inasmuch as such energy actually helped to bring down electric rates during the latest review.

- The second paragraph explains that this is the case because National Grid “will be able to re-sell at a profit the energy and tax credits” from renewable suppliers, and that this lowers “electric rates” by providing a “net… credit” to ratepayers.

First we’ll clear up a few minor errors in Kuffner’s statement that we won’t count toward the ruling of whether his report is true:

- Although there may be some out there, “opposition to renewable energy” is actually pretty unusual. What Kuffner probably means is “opposition to government mandates for purchases of renewable energy.” Those are two very different things to oppose, and by conflating them, Kuffner engages in environmentalist spin.

- National Grid does not purchase “tax credits” related to renewable energy. Rather, the suppliers of such energy are required to give renewable energy credits (RECs), also called “renewable energy certificates,” to the distributor. In essence, each credit is a certification that the distributor purchased 1 megawatt hour (MWh) of renewable energy. The distributor can then turn in these credits to prove that it is fulfilling obligations such as Rhode Island’s RES. If the distributor is short of requirements, it can buy credits from other distributors (or other sources) that have extra.

- The line item marked as a credit that ratepayers will find on their bills for at least part of 2015 does not lower “electric rates.” Rather, it is a separate charge, considered a “tariff”; if it is negative, it reduces the overall bill. This is the “Renewable Energy Distribution Charge” in the “Delivery Services” section of the bill that ratepayers receive, and the distinction is important for the sake of clarity: Saying a credit lowers the rates reinforces the impression that renewables have lower rates than traditional energy.

Now on to the larger question of truth.

Will National Grid be able to sell the renewable energy that it purchases at a profit? No.

Via Twitter, I asked Kuffner for the documentary source for his claim, and he sent along PUC Docket 4535, posted in November. In the area for textual explanation, the docket uses a lot of technical terms of art, like “credit factor” and “market value.” However, page 6 of the docket presents the actual numbers for National Grid’s long-term renewable energy contracts.

In these tables, the total six-month cost for these contracts is shown as $19.2 million. The estimated market value — what it can charge consumers — for this energy, however, is only $14.2 million. Looking at just the energy, in other words, National Grid expects to pay a 35% premium (sold at a loss) for renewable energy.

Even with the huge increase in the cost of traditional energy that has been the cause of much official hand-wringing in RI, lately, renewables are still much more expensive. If the company or the government finds a way to bring down energy costs, the renewable gap will go up.

Will National Grid be able to sell the RECs that it receives from the suppliers at a profit? No.

As the docket shows, the total tariff/credit includes the market value of the RECs that National Grid receives from its suppliers. This makes sense, because even though the distributor doesn’t really pay extra for the credits, the law allows the company to sell them separately from the actual energy that it buys.

The docket estimates the value of these RECs at $6.6 million dollars. So, combined with the sale of the energy, that means the “total market value” of its renewable energy, bought at $19.2 million, is $21.4 million.

Unfortunately, National Grid will not be selling its RECs at all.

Remember the renewable energy standard that the General Assembly has imposed on energy distributors? Well, the RECs that National Grid collects are not high enough to cover its requirements. That means that it will actually have to go out and buy RECs from somewhere else. One reason the PUC waived last year’s increase in the standard might have been that nobody else had excess RECs to sell either, or at least not enough for National Grid to make up its deficit.

Here’s the kicker: National Grid is able to pass along the costs of all this REC activity to its energy users under another tariff. It’s the one that appears in the “Supply Services” section of the monthly bill and is labeled “Renewable Energy Charge.” Take a look at your latest bill, and you’ll see that this tariff is many times higher than the one that will be marked as a credit in the “Delivery Services” section.

You could almost say that National Grid is “selling” its RECs to you, the ratepayer to whom the company is supposedly giving a credit based on the sale of RECs… umm… to you. It is not only technically false to call this transaction a “net… credit” to the ratepayer, it’s highly misleading. Of course, just about everything about environmentalist policy is highly misleading.

If they are able to cut through the layers of talking points and terms of art among green industry advocates, reporters covering the legislation to hike the renewable energy standard should explain its probable effect on this whole bizarre arrangement.

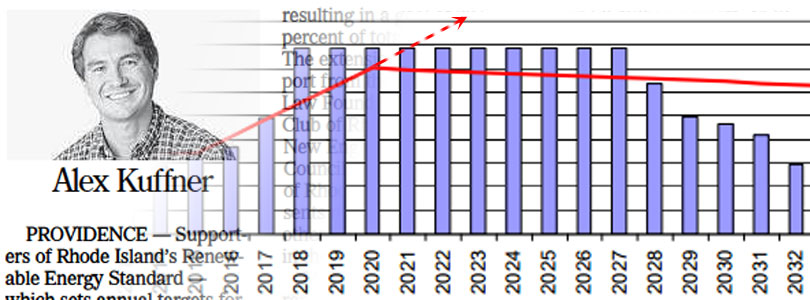

According to a chart on page 150 of another PUC docket, National Grid is projecting that the RECs that it receives through its long-term renewable energy contracts will finally surpass the RECs that it is required to collect in 2017. If H5079 were to pass, National Grid would have extra RECs to sell only for a few years; somewhere around 2021, the company will have to start looking to buy them from somebody else once again. (See the modified chart in the featured image of this post.)

The other option, of course, would be for National Grid to go out and buy even more renewable energy at a loss of 35% or more in order to satisfy the politicians whom Rhode Islanders inexplicably keep sending back to the State House.