No Tax Increase in Tiverton, and the Mysterious Influence of Wall Street

Yesterday, I submitted a petition for a 0.0% property tax increase in Tiverton, and if I can get 50 signatures by next Tuesday, it will appear on the ballot at the town’s financial town referendum (FTR) on May 20. The only difference between my proposal and that submitted by the Budget Committee is that they want to put 56% more in the unassigned general fund balance than the town charter requires, and I want to put in just 14% extra.

There are curious things in the Budget Committee documents — it implies, for instance, that the charter requires 3.5% to be reserved, rather than 3% — but the key argument that people make for having a large surplus balance is that it will improve the town’s credit rating and lower the cost of debt. When one asks for detail, proponents of that argument say that the unassigned balance is “one of the things” the agencies look at when coming up with ratings.

I have no doubt that it is one such thing, just as one thing I consider while deciding whether to have a snack is whether I feel like taking down a plate so that I don’t get crumbs everywhere. I also consider how hungry I am, how long it has been or will be to an actual meal, how tight my pants are feeling that day, and any number of questions that all come prior to (and influence) whether I’m motivated to take the simple steps of getting down a plate and, later, putting it in the dish washer.

The point is: the unassigned balance is not some magic number that determines a town’s credit rating.

It’s just like taking out a line of credit or a loan. Yes, your savings account balance is often on the questionnaire, but the more important questions have to do with income, assets, and reliability. If a town sells bonds in the amount of $10 million, it’s of relatively little consequence whether it has an extra $600,000 lying around, right now. Financial experts realize that town officials could easily give that much away in the next union contract negotiation or (less likely) give residents a break on tax increases for a year.

The biggest factor for a municipality is whether it will be able to tax its population to pay off the debt.

The numbers for Rhode Island’s cities and towns support this argument. I made note of the available credit ratings from Moody’s and compared them with all of the available 2013 audits. Taking the unassigned funds as a percentage of major expenditures (municipal and school, for simplicity of comparison), it’s clear that there’s no direct correlation between unassigned funds and credit rating.

Yes, it’s true that towns with higher unassigned balances tend to have better ratings, on average, but it’s not decisive. Consider (from the 30 cities and towns for which all information was available):

- The four towns with AA1 ratings (the best) average 16.9% unassigned funds, but include Middletown, which is at 7.8%.

- The five towns with AA3 ratings actually have higher percentages than the twelve with AA2, including (in AA3) Hopkinton and Glocester, which have the third and fourth largest unassigned percentages of any city or town, in excess of 19%.

- Warwick’s unassigned percentage is lower than Tiverton’s and Warwick has AA3 rating, while Tiverton has A2.

- Smithfield has about the same percentage as Tiverton, and its rating is AA2.

It’s important to keep in mind that these are the numbers as of the end of the fiscal year, not necessarily what each city or town requires by law. It’s entirely possible that some of these municipalities regularly use the surpluses to offset the next year’s taxes, which is easier to do if population and/or wealth are growing.

Again, what’s important to credit rating agencies is the likelihood that a town will be able to pay back its debt with interest. Given that towns are able to impose taxes, sometimes with no legal choice, it shouldn’t matter much whether it remains in the accounts and property of the residents or in a slush fund for the local government. If a ratings agency looks at Tiverton and sees that its taxes doubled, last decade, while its average household income and employment went down, making a practice of over-taxing the population just to have money sitting around could actually be harmful.

The low-tax option has the added benefit that it puts the interests of the people first, rather than the mandarins on Wall Street.

Rather than trying to work the numbers game, a better approach would be for Tiverton — or any other city or town — to ensure that its residents and businesses have a positive outlook for the direction of their community and that taxes and regulations are not becoming a disincentive to moving in or expanding. After all, another way to make the dollar amount in an unassigned fund become a bigger percentage of the budget would be to cut the budget.

If Tiverton only spent as much per resident as Bristol does, its unassigned percentage would jump about three percentage points.

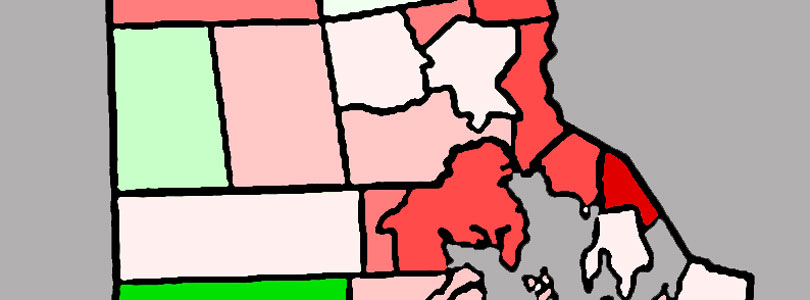

Note: The featured image for this post is not based on credit ratings, but was taken from this post related to population and employment.