Sasse’s Great Illustration of Rhode Island’s Perspective Problem

I’m in the midst of an interesting Twitter exchange with Rhode Island budget titan Gary Sasse. For readability, I’ll copy it below:

Sasse: Amazing nobody is proposing reform of the property tax which is the driver of RI’s sorry tax competitiveness.

Katz: Maybe ’cause property tax is and should remain a local issue.

Sasse: Property taxes are not just a local issue because State mandates result in higher property taxes.

Katz: So mayors & town councils should refuse mandates.

Sasse: Only the General Assembly can amend mandates cities and towns can’t flaunt a law.

Katz: If they started to, the issue would become clear. Reality is cities/towns love mandates. Excuse + money.

Sasse: What $? Between 2008 and 2012 direct non- school aid declined from $242 to $66 million, a decrease of 73%.

Katz: the point is local governments love things that force the budget upwards.

Putting aside differences about how the politics should roll out, we’ve reached a testable question: Would more state aid stop the climb in property taxes? Not really.

A November 2011 report from the RI House Fiscal Staff shows that the last decade (give or take) saw the beginning and end of a surge in state aid to cities and towns as part of the automobile excise tax phaseout. On either end of this wave, the report gives total aid of $39.5 million for 1995 and $60.3 million for 2011. So, taking out the effects of the tax-reform subsidy still shows a compound annual growth rate (CAGR) in state aid of 2.68%, which was higher than inflation during that period.

But in between, did the cities and towns take the opportunity of a massive influx of hundreds of millions of dollars in additional state aid to reduce the burden on local taxpayers? No.

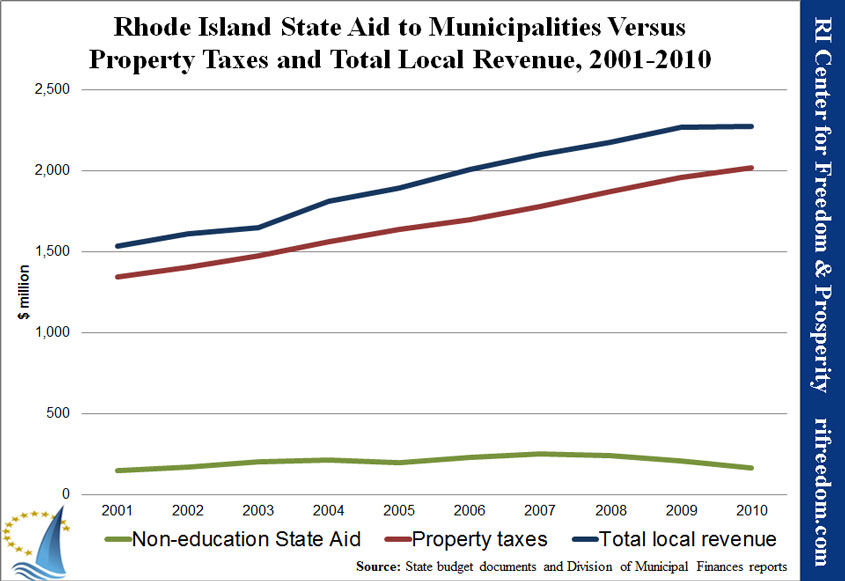

Based on state budget documents and Division of Municipal Finance reports, from 2001 to its peak in 2008, state aid increased 60%. Over the same time period, property taxes increased 39%, and total revenue from local sources increased 42%. Governor Chafee’s administration hasn’t seemed keen on keeping the municipal reports current, so here’s a chart of all of the available data.

If the local property tax burden is the problem, focusing on getting more money from an ever-strapped state government, which imposes a high tax burden of its own, is not the answer.

That doesn’t mean property taxes are not a problem. The interactive chart-making tool at KeyPolicyData.com shows Rhode Island to be fourth highest in the nation for property tax burden, as a percentage of personal income.

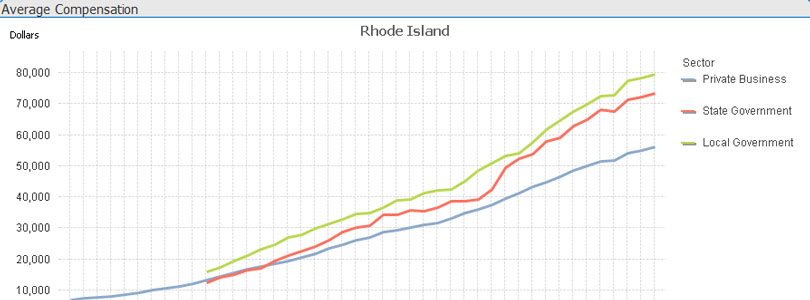

If we’re looking for a reason, unfunded mandates from the state probably don’t top the list. KeyPolicyData also has a tool for graphing the growth in total compensation for state, local, and private-business employees.

For the nation as a whole, state and local government employees have been better paid than their private sector neighbors since the 1980s, with a big jump in the gap just after the turn of the millennium, with state government now on top and private businesses on the bottom.

Massachusetts roughly follows that trend, while Connecticut’s local government has stuck with the private sector. In Rhode Island, however, local government employees were already better compensated at the start of the data, in 1979; local government employees have remained on top of the pile; and the gap between government and private sector is huge, with local government 42% higher.

It doesn’t take much subtlety of analysis to spot the parallel trends of property taxes and local government employee compensation. Returning to that 2001-2008 range, municipal revenue from local sources increased 42%, as explained above, and average local government employee compensation went up 36%.

None of this means that the state government can’t help Rhode Island out of its mess. Two types of policy changes at the state level could make a world of difference:

- Policies that encourage economic growth and personal productivity (like eliminating the sales tax)

- Policies that give Rhode Islanders — the people whom our governments only exist to serve — more leverage and self empowerment versus government interests (like school choice)

Wringing our hands over state aid and how we’re going to balance government budgets is a distraction from what ought to be our central mission.