Narragansett Well Positioned to Lower Commercial Taxes

According to its filed agenda, the town council of Narragansett will consider and vote on a proposed change in tax rates on Monday night. As described in Matthew Enright’s reporting for The Independent, commercial property owners in town pay 150% the rate charged to residential property owners.

The state Division of Municipal Finance puts the current rates at $9.94 for residential and $14.91 for commercial. The proposed ordinance would eliminate the different rates, lowering the commercial and raising the residential.

Obviously, such changes to the status quo create winners and losers, and opponents of the plan are saying, as does Town Council candidate and Democratic Town Committee Chairman Will Hames, that they “don’t think we should be paying Stop & Shop’s taxes.” The data available from Municipal Finance suggests:

- that it would be more accurate to say that business owners in the town are currently paying disproportionately for residents’ services,

- that this is hurting Narragansett’s commercial tax base,

- and that the town should lower its commercial rate without raising the residential rate, adjusting its budget accordingly.

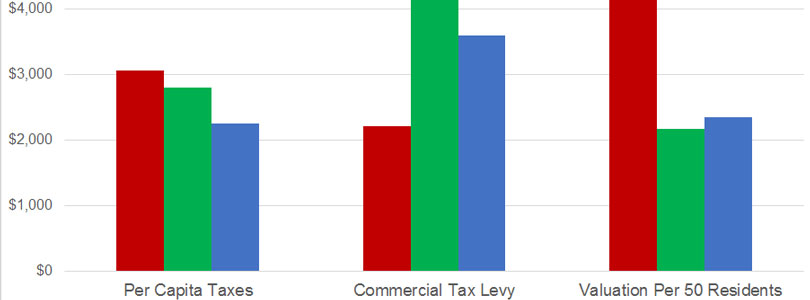

By the numbers, Narragansett’s residential tax rate is the 4th lowest in the state, while its commercial rate is the 6th lowest. These low rates, however, are mainly a reflection of the town’s high property values. Despite having around half the population of its neighbors, North and South Kingstown, Narragansett’s total residential property value is significantly higher than those of both towns — 47% and 16%, respectively. As the following chart shows, these differences result in Narragansett’s having a higher tax levy (i.e., total taxes collected) than either of its neighbors.

The chart also shows that, despite having relatively valuable property, Narragansett’s commercial property tax collections are much lower than those of its neighboring towns. This suggests that its actual commercial activity is also much lower.

In summary, Narragansett is raising a large amount of taxes per capita — 6th highest in the state — in part by soaking a small number of businesses with an inflated tax rate. Although some residents may like this state of affairs, one could suggest that, as a matter of principle, government shouldn’t be so heavy handed in preferring one use of property over another. Taking the town’s thumb off the scale would almost certainly encourage more business in town, reducing the hit to tax collections in the long term.

Given its high tax burden, Narragansett clearly has room to adjust its spending to compensate for lower commercial collections. But if residents would prefer to keep the high taxes and whatever services they purchase with them, they shouldn’t object to applying the tax burden more fairly.