Pretend Money and the Economic Recovery

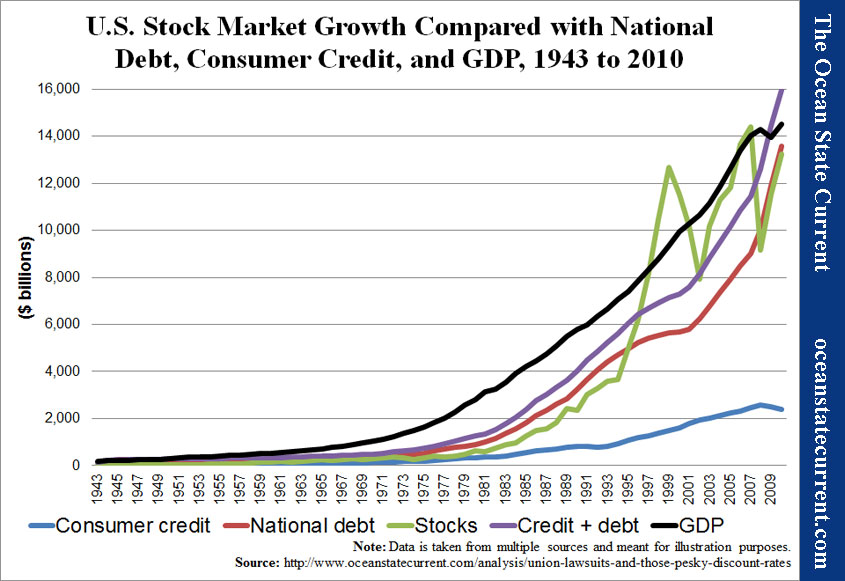

Although the data isn’t updated, the economic conversation currently in the air suggests that it might be a good time to revive Scary Economic Chart #1,275:

The green line is an estimate of the total capitalization of the U.S. stock market, and although it’s true of the first spike, the focus of this post is the green line’s second big spike, which (not to put too fine a point on it) isn’t real money. It’s pretend money. The financial imagination is diverse, so there are many figments, but the most prominent in the second spike was the debt that risky borrowers were never really going to be able to pay back.

The thing with imaginary money is that somebody is eventually left holding a half-empty briefcase. In this case, it wasn’t the folks who couldn’t pay their mortgages because, well, they couldn’t pay their mortgages. Instead, it was the banks and pension funds and other investors who had somewhere along the line produced something real (like cash to lend) or debts they couldn’t divest so easily (like pension promises).

So the United States issued bailouts, although liberal economists have a point when they say that the bailouts and stimulus weren’t enough to do what they were ostensibly meant to do. In part, that was because a full bailout would have been politically impossible, but in part, it was because (as pensions illustrate spectacularly) the empty space in the briefcase was not just its balance at the crash, but where its holders had expected it to be at any given time if the crash had never happened… and where they expected it to go in the future.

So what’s a debt-addicted society governed by a ruling elite to do?

Well, it changes the measure. It fills the briefcase up with newly printed dollars. None of those dollars are representative of anything that has actual economic value, so they don’t really indicate a growth of wealth. And once they’re in the briefcase, you can’t differentiate between the new and the old, so twice as much cash is representing the same amount of value, meaning that each dollar is worth half as much.

“Half” is just an illustration, in this post, but the underlying principle is where the debt, spending, and quantitative easing policies of the Obama Administration and the Federal Reserve have gotten us. As happens whenever one blows air into a closed, flexible space, it creates a bubble.

The stock market has rebounded during a time of stagnant GDP and stagnant or declining absolute human work. Meanwhile, policies designed to hold inflation low have kept the bubble in the stock market — that is, in the speculative economy of pretend wealth, where a promissory note is suddenly worth more because somebody is willing to add a fake dollar to a real one in order to buy it.

That can’t last. Eventually, people will need to withdraw actual value from the game. Eventually, the dealers will start to cut themselves some tangible assets with real value. And when they do, that’s when the inflation will seep out into the marketplace.

Thus, the folks who rode that green line down during the crash will simply spread their pain to the entire economy, leaving themselves relatively better off from the privatized gains and socialized losses. That may be the whispers heard between the lines of Nathaniel Popper’s New York Times article, “Behind the Rise in House Prices, Wall Street Buyers“:

Large investment firms have spent billions of dollars over the last year buying homes in some of the nation’s most depressed markets. The influx has been so great, and the resulting price gains so big, that ordinary buyers are feeling squeezed out. Some are already wondering if prices will slump anew if the big money stops flowing. …

While these investors have not touched many healthy real estate markets, they are among the biggest buyers in struggling areas of the country where housing prices have been increasing the fastest. Those gains, in turn, have been at the leading edge of rising home prices nationwide. …

Nationwide, 68 percent of the damaged homes sold in April went to investors, and only 19 percent to first-time home buyers, according to Campbell HousingPulse. That is helping to shore up prices and create confidence in the broader markets.

While real estate is arguably a risky investment where the objective is to make a profit, its buyers have actual things. Western civilization would essentially have to collapse before legal ownership of land and structures could be as worthless as speculative air can be. And as the bubble moves into actual things, it will cause inflation felt by that broad population for whom money is not just a bunch of numbers.

Of course, the “spreading the pain” future may be averted in a negative way, with another crash, which some are predicting in the near future with near certainty. In that circumstance, only a portion of the pain would have been spread.

The tragedy is that boom and crash cycle of financial speculation on economic dreams isn’t necessarily something to be feared, if investment is limited to status as tool by which to move resources quickly around the economy. But the problem that America now faces is that, gradually, the incentive to actually do anything to create new wealth is dissipating for a diverse set of reasons.

And as that happens, eventually, even a house will be worthless, although probably the office building next door will become worthless first.