Winners, Losers, and Losing More

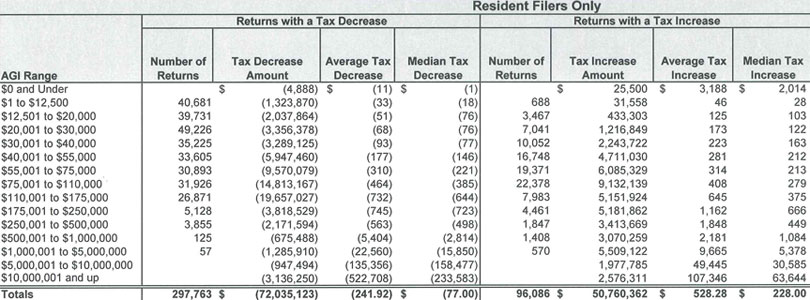

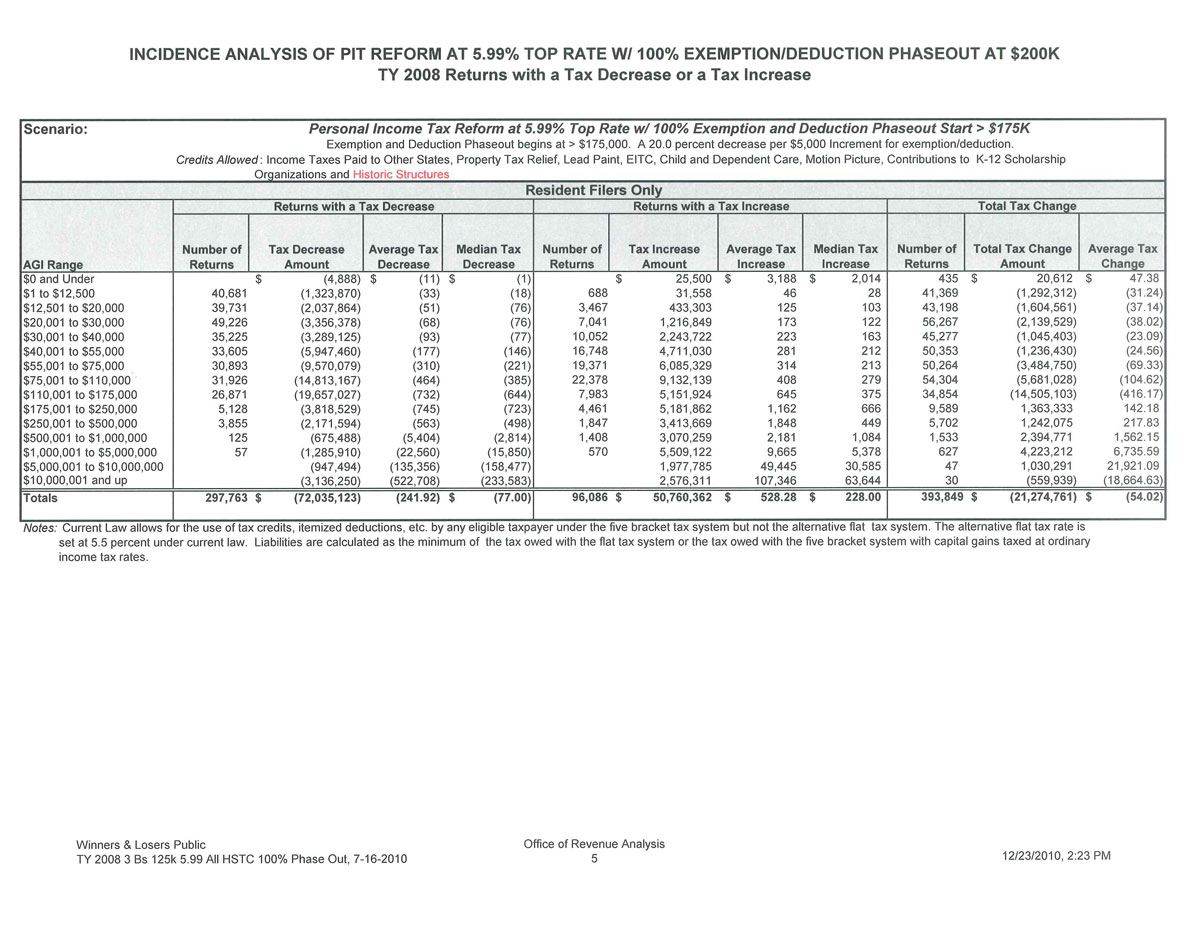

If it’s possible for the Current to stay in the tax-policy weeds for one more post, something discovered while researching the tax increase legislation merits closer inspection. The following table comes from the office of Revenue Analysis review of the 2010 income tax reform. Specifically, it shows how many taxpayers in a variety of income ranges would be paying more and how many would be saving (click the image to see it bigger):

What this shows most strikingly is that no income range was entirely full of winners or of losers in the reform. In the $55,001-$75,000 range, for example, just under 31,000 taxpayers would save an average of $310 on their income taxes, while a little over 19,000 would pay an extra $314. In the upper brackets, the distinction has mainly to do with whether those taxpayers utilized the flat tax system, in which they would be losers in this analysis. However, another significant factor was whether the taxpayers had high deductions or not. (The income brackets are adjusted gross income [AGI], so deductions haven’t been factored in, yet, meaning that the brackets are comparable on the winning and losing sides.)

What this shows most strikingly is that no income range was entirely full of winners or of losers in the reform. In the $55,001-$75,000 range, for example, just under 31,000 taxpayers would save an average of $310 on their income taxes, while a little over 19,000 would pay an extra $314. In the upper brackets, the distinction has mainly to do with whether those taxpayers utilized the flat tax system, in which they would be losers in this analysis. However, another significant factor was whether the taxpayers had high deductions or not. (The income brackets are adjusted gross income [AGI], so deductions haven’t been factored in, yet, meaning that the brackets are comparable on the winning and losing sides.)

In large part, then, the tax reform shifted wealth from people who are productive in economic and familial ways (e.g., high investment in businesses and families), people in need (e.g., high expenses on medical services), and especially people who are both to taxpayers who are none of those things. The tax reform represented almost a $51 million increase on those in losing categories, $15 million of that from households with income under $75,000. Any of the tax-the-rich proposals would raise taxes on such families in upper brackets yet again.

It’s important to note, in all this, that the analysis shown in this table compares the new tax system against what the old tax system would have been had the flat tax stayed in effect and actually dropped the expected half percentage point, to 5.5%. If we were to look at the taxes paid in 2010, when the flat tax was at 6.0% and compare it with taxes paid in 2011 under the new system, the effect of eliminating the flat tax would be greatly minimized. That is, on a year-over-year basis, the upper-income winners won more than the table indicates, and the losers didn’t lose as much.

One can look at that fact in a variety ways, but it wouldn’t be unreasonable to suggest that the tax reform raised taxes on a lot of productive people, and any of the bills to raise taxes again would represent two straight years of income tax increases in the midst of Rhode Island’s continuing effective recession.