In Rhode Island, the Government Is Taking Away Our JOI

The RI Center for Freedom & Prosperity today released its Jobs & Opportunity Index (JOI) report covering the month of June, and even with nine of the 13 underlying datapoints being updated, Rhode Island couldn’t budget out of 48th place. Indeed, if more states than two trailed the Ocean State, we probably would have sunk a bit.

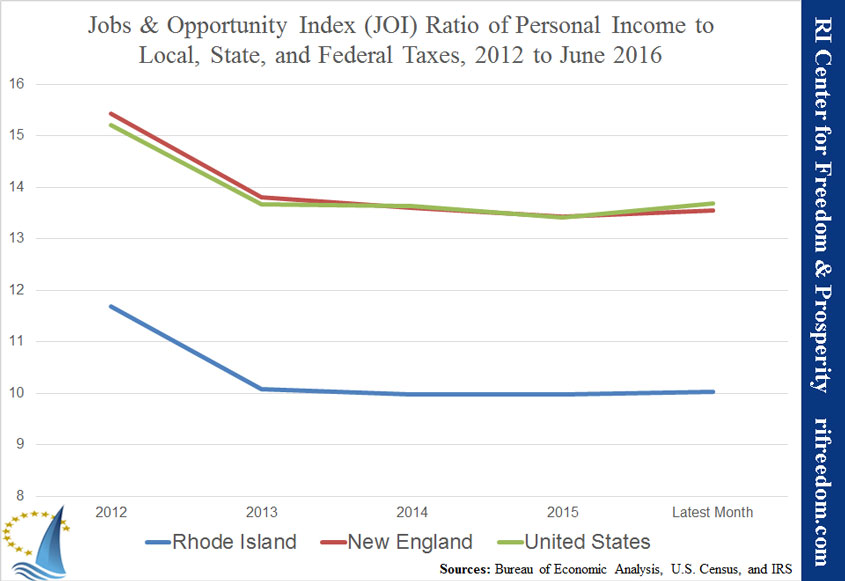

For this post, though, I’ll focus on a finding from within the calculations of the index. The following charts show the ratio of personal income to local, state, and federal taxes for Rhode Island, New England, and the United States, first from 2005 to the latest-available month and then zooming in with a starting point of 2012.

The first takeaway from these charts, of course, is how much more Rhode Island takes from its people in taxes. The Rhode Islanders’ income is around 10 times the total tax take. For our region and our nation, however, the average is more like 13.5 times. In the Ocean State, in other words, personal income is about 26% lower than it would be to support the same tax burden in the average state. From the other direction, the state simply taxes its people too much given their income.

The second takeaway is that Rhode Island moves to increase its tax take as quickly or more quickly than people increase their income. There’s no reason the government at any level must grow to reflect the income of the people. Government provides a limited set of services, and they aren’t entirely income dependent. Indeed, the wealthier a society is, the less it should need or want government to do.

After the income-to-tax ratio grew steadily from 2007/2008 to 2012, it dropped nationwide. In the first six months of this year, anyway, the United States and, even more, New England have seen an uptick, while Rhode Island remains mired at its 10x.

We hear a great deal about fixing Rhode Island’s economy by giving money to government that it can give away to favored private interests. The charts above illustrate one reason many of us believe that is exactly the wrong approach.