Low Revenue and Locking in the Union Advantage

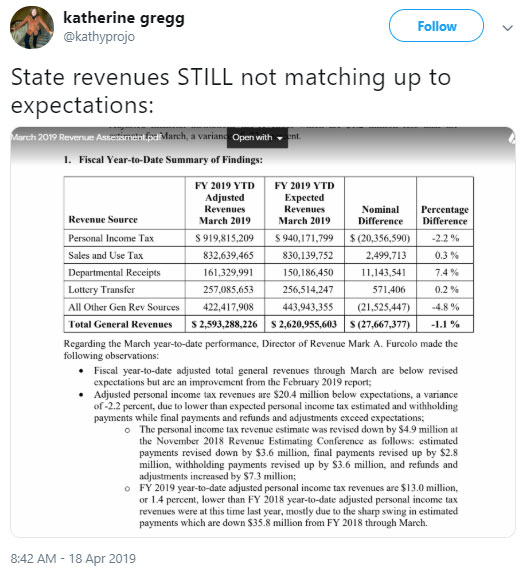

A week ago, Providence Journal reporter Katherine Gregg tweeted out that the state’s revenue was under performing by about 7%:

Note two things. First, if not for the application of sales taxes to new items, especially online, and an increase in the various fees and such that make up “departmental receipts,” the picture would be significantly worse. Second, about half of the shortfall is attributable to unexpectedly low income taxes.

[box type=”tick” style=”rounded”]Please consider a voluntary, tax-deductible subscription to keep the Current growing and free.[/box]

This is fully in keeping with the latest Jobs & Opportunity Index report from the RI Center for Freedom & Prosperity, which found that Rhode Island is uniquely lagging the country in residents’ personal income growth. In fact, we were the only state to lose personal income between the latest report from the Bureau of Economic Analysis and the originally reported numbers for the prior quarter.

Combine that fact with a downturn in employment in the Ocean State, and we’ve got a clear warning sign that we need to change direction. Unfortunately, our governor is busy pushing progressive social-welfare policy while the General Assembly is hurrying to grab the unions everything they can before the next downturn.

That last note kind of makes one wonder what the legislators know that the rest of us don’t. If they are expecting another recession in Rhode Island, that would be the time to lock in as much as they can for their friends in the labor unions.