A Voice of “No” on Debt

The RI Center for Freedom & Prosperity has released a statement against all three ballot questions for more debt:

Broadly, Rhode Island is relying too heavily on debt to cover its bills. The Mercatus Center at George Mason University puts Rhode Island’s long-term liabilities at 90% of the state’s assets, which is higher than the average state. Truth in Accounting’s State Data Lab gives Rhode Island a D for finances, with $8,288,881,000 in bonds and other liabilities, plus another $4,316,527,000 in pension and other retirement liabilities. A recent Rhode Island Public Expenditures Council (RIPEC) report finds Rhode Island already among the worst states when it comes to debt per capita and debt per income.

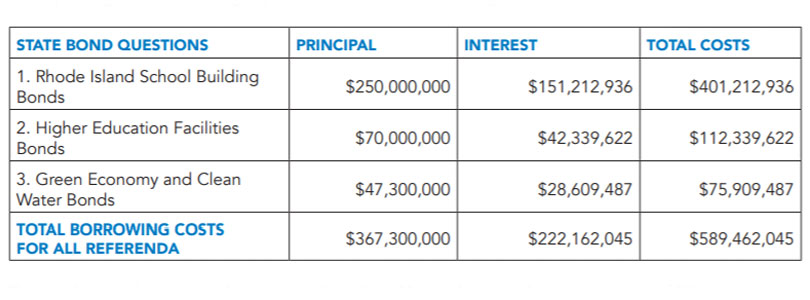

More debt is not the answer to the Ocean State’s problems; it is a major problem in itself. Adding $589,462,045 in principal and interest by passing the three ballot questions will make it worse.

The State of Rhode Island and its municipalities must be more prudent with the tax dollars they already collect — for example, prioritizing school-building maintenance over more frivolous projects.

[box type=”tick” style=”rounded”]Please consider a voluntary, tax-deductible subscription to keep the Current growing and free.[/box]

Every election brings this same issue. It’s just too easy for people to tally up the promised benefits and not consider the costs. Meanwhile, the special interests — from the construction unions to the environmentalist groups — have huge incentive to advocate for the debt. (Contrast that, by the way, with the dangers of advocating for a bigger piece of existing spending, which might go up against other special interests who want to keep what they’ve got.)

This is another area where the public needs more education on the issues and all too few people have any incentive to provide it.