Abraham Glazer: Various Ideas to Improve Rhode Island Government and Life

Abraham Glazer shares some collected notes on policies that might do Rhode Island some good.

Abraham Glazer shares some collected notes on policies that might do Rhode Island some good.

Somehow, it seems like the sorts of questions that John Hinderaker posed the other day don’t seem to be asked very often in the course of reporting on national political scandals. Yesterday, I summarized the two sides on the scene, and I think it’s important for people in Rhode Island to understand that there are live questions not answered by the standard Democrat-media talking points.

Here’s a marker of what many of us have no sense we don’t know:

Time was getting short for the insurance policy.

Four days later the same team was emailing about rushing to get approval for another FISA warrant for another Russia-related investigation code-named “Dragon.”

I confess that I can’t keep up with the ever-expanding FBI scandal, but do we know what “Dragon” is, and how it differs from “Crossfire Hurricane”? Whatever Dragon was, it apparently had to do with stopping the Trump campaign, as Strzok and Page were eager to get it off the ground.

Now, one can reasonably speculate about what direction all this will go, whether there is anything of substance here, and whether peculiar actions by government agents were justifiable, but one can’t reasonably dismiss these questions as a distraction. At the very least, there is plausible evidence of an actual, honest-to-goodness conspiracy within government to affect our political process and the resulting presidency.

Frankly, I have trouble trusting anybody who encourages us to look away from that. What do such people not want us to discover, or is their real fear that they’ll lose their ability to do such things in the future?

News of a former employee of the Rhode Island House Minority office who has filed a disability discrimination lawsuit claiming that Minority Leader (and gubernatorial candidate) Patricia Morgan discriminated against her raises a topic to which our society has perhaps not devoted sufficient debate:

Masciarelli says in her complaint that she suffers from depression, and she alleges Morgan told multiple people she needed to be fired before she was covered under the Americans with Disabilities Act.

Morgan says Masciarelli was fired due to her poor work ethic and she never knew of the woman’s disability. Morgan says she was cleared by the state Commission for Human Rights.

If emotional conditions are going to start carrying the same protections as physical conditions, we’re entering a legal thicket. When a disability is physical, one can more-easily differentiate between employment decisions that have directly to do with an ability to accomplish necessary tasks and discrimination. With emotional conditions, where does a “poor work ethic” end and a protected disability begin?

Indeed, the availability of such protections creates incentive for employees to seek diagnoses, and because psychology is more subjective than physicality, fraud would be more difficult to prove. Even without bringing fraud into the picture, though, doesn’t anything that creates incentive to have a mental health problem make it less likely that the person will overcome it?

How long, one wonders, until people begin to claim that the stresses of their jobs created the hazardous (i.e., stressful) condition circumstances that led to emotional disabilities?

The Rhode Island House Republicans’ Twitter account tweeted out a bit of deep insight from Mike O’Reilly of the Federal Communications Commission on C-SPAN:

“I was dealing with Rhode Island. They decided they were not going correct it, withstanding all the promises early in the year. They rename the program for the following year, thinking it’s going to fix the problem.” FCC Commissioner @mikeofcc

He’s talking about the 911 fee that the state government has come under scrutiny for misappropriating, but this is common in Rhode Island. After 38 Studios, the General Assembly changed the name of the Economic Development Corporation (EDC) to the Commerce Corporation and, voila, all is right with Rhode Island policy. In the season of education reform, Rhode Island shifted some names and org charts of state-level education boards around and all of a sudden children began a new educational voyage… I guess.

Once again the reminder: Elected officials will keep doing this stuff until it stops working for them.

During our weekly on-air conversations, John DePetro and I have long pondered the increasing significance of notary publics to political campaigns. A campaign with some extra money can deploy people to go out and get votes by bringing absentee ballots to them and signing off on their signatures.

Today, John noticed a statement from Secretary of State Nellie Gorbea touting the General Assembly’s passage of legislation implementing “a model” that only 11 other states have pursued “designed to standardize notarial requirements and procedures.” I’ll freely admit that my knowledge of the subject leaves me unable to assess how different the provisions of the new law are to current practice, but whether the following provisions will be new or are already in place, they are conspicuous in light of this increase in the prominence of political notaries:

In short, it’s very easy to see how notaries could haul in votes as if with fishing nets even without doing anything fraudulent, and be separated with several layers of ambiguity from actual fraud.

One last minute bill in the Rhode Island General Assembly, H8324, may or may not be going anywhere, but it’s worth a look as an educational exercise.

Very simply, it would require any “hosting platform” (e.g., AirBnB) that allows people to “offer any property for tourist or transient use” to be responsible for making sure that the rentals are in compliance with state and local laws and regulations. It would also require the platform operators to take a more active role in the collection and transfer of all relevant taxes.

This little change in law, affecting a narrow portion of a single industry in the state, carries some important questions of the sort that we don’t consider thoroughly enough. What is the nature of commerce? Who works for whom? Who has responsibility for whom?

From a free-market perspective that starts with the individual as the origin of all economic activity, the property owners are responsible for the product that they are offering, and the hosting platforms work for them. Because they are the constituents of state and local government, they have a say in that government and can arguably be said to have consented to granting it some authority to regulate their activities.

The progressive perspective that has long been insinuating itself into Rhode Island government and encroaching on Rhode Islanders’ rights is very different. That view doesn’t begin with individuals as autonomous sources of responsibility and power. The Rhode Islanders seeking to rent their property don’t truly have ownership of themselves. Rather state and local government has claims on their activities, and the hosting platforms own their rental businesses. It is therefore reasonable for the government to require platforms to make sure that their workers comply with its requirements.

From a free-market perspective, a government that imposes requirements on people might create incentive for them to hire a contractor to do tasks for them — for AirBnB to provide inspections for regulatory compliance, for example, with an extra fee. But from a progressive perspective, the government has a right to tell companies that intend to draw profits from its people what conditions they must impose, or else they cannot do business here.

In other words, progressives implicitly believe that the government is renting us out to the companies.

I’ve got an op-ed in the Valley Breeze today taking the opportunity of a new sales tax on software as a service products to illustrate the harmful thinking of our legislators:

In short, the state government is going to tax an innovation that empowers productive, motivated Rhode Island families who are making the most of technology that levels the economic playing field. Even if it’s “only” $4.8 million, why would the state government do that? …

So, when Speaker of the House Nicholas Mattiello, a Democrat from Cranston, tells reporters that “to not expect (the budget) to rise every year is not realistic,” he’s really saying it is unrealistic to expect state government only to grow at the same speed or more slowly than the household budgets of Rhode Island families. If that’s the expectation, then the governor and the General Assembly must find new ways to take more money from Rhode Islanders.

After all, the politicians have to find some way to pay for election-year raises for unionized state employees. If they’re going to increase the tax credits for producers who film movies here, they’re going to have to start taxing your Netflix account. If they’re going to promise a big chunk of the state’s income, sales, and corporate taxes to the PawSox for a new stadium, they’re going to have to increase those taxes even more to break even.

Appearing on Rhode Island Public Radio’s “Political Roundtable” show, recently, Rhode Island House Minority Leader Patricia Morgan, who is running for governor as a Republican, had an exchange with political analyst Scott MacKay:

MacKay: It sounds, in a way, like you don’t really care whether the PawSox go or not. Do you realize this is a part of Rhode Island culture and family entertainment that hundreds of thousands of people go to every year?

Morgan: I do understand, and I have taken my children, as well, to the PawSox stadium, but I still believe it’s a private company at this point. We can’t build a facility for every private company. I mean, why don’t we build bowling allies; a lot of families like to go bowling. Why don’t we build miniature golf entertainment areas? At some point, we really have to keep taxpayer monies for the things that actually are economic development, will actually build good jobs in Rhode Island.

Morgan should have concluded that thought by saying we have to keep taxpayer monies for things that are actually government responsibilities, but her point is otherwise right on. The problem, however, is that conservatives can’t win this sort of reductio ad absurdum argument with progressives, because the latter will happily say, “Go ahead.”

Perhaps progressives won’t generally have the personal affection for bowling or mini-golf that they have for baseball, but nobody should doubt that they’d be happy to use government resources for family entertainment if somebody were to credibly propose doing so. After all, family time is very important. Why shouldn’t government build facilities to foster it? Isn’t government supposed to do everything important for us?

Of course, the conservative reply might be that the lack of a private market for a bolling alley in a particular area is simply evidence that people aren’t interested in that activity in sufficient numbers to make it worthwhile. But however inexpensive the activity is, there might be some families that would jump at the chance if the price came down a little and who, without that opportunity, instead spend their time doing unhealthy things isolated from each other. And hundreds of thousands of Rhode Islanders have fond memories of bowling with their families.

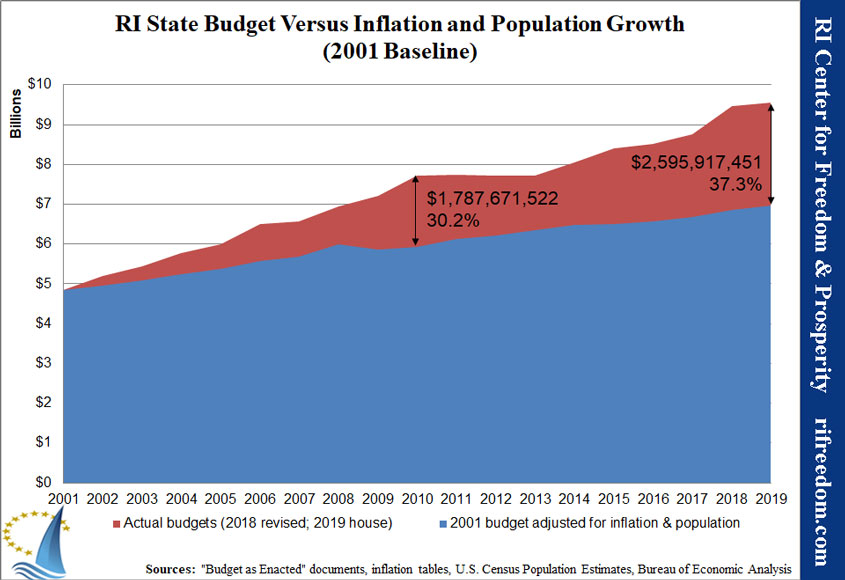

With the House budget released, the RI Center for Freedom & Prosperity has updated its annual chart showing how the state’s spending has actually grown during this century versus inflation and population. As you can see, it isn’t a pretty picture:

For some perspective, the state budget has grown at a compound annual rate of 3.9% per year. Inflation’s growth rate, by comparison, has been 2.0%, and the population’s has been 0.0%

Granted, for the ease of the comparison (and making it easy to repeat), we’ve just used the national inflation rate, here, and people periodically argue that some other metric would be preferable. Well, using data from the Bureau of Economic Analysis, personal income in Rhode Island has grown at a rate of 3.0% per year, and the state’s gross domestic product (GDP) has grown at 3.1% per year. (Both of those are current, unadjusted dollars.)

That means year after year, the state government eats up more and more of the Rhode Island economy and takes more of Rhode Islanders’ real income. Over the period shown in the chart, the state government has grown to the point that it’s taking another two percentage points of income and GDP out of the economy each year.

Even worse: This isn’t just a loss to the people right now. It actually affects broader economic growth, and likely plays a significant role in Rhode Island’s economic growth rate coming in below the national GDP rate of 3.8% over these two decades.

This is why Rhode Islanders often feel like they are serving the government, not the other way around. Few people would complain about the growth of government if the people of the state were becoming relatively wealthier, but that it’s the other way around.

Missouri has taken a step that Rhode Island should follow:

Previous state legislation in Missouri had required people who wanted to braid hair for profit to obtain a cosmetology license — which required the completion of 1,500 hours of training.

This requirement was time-consuming, expensive, and created an unnecessary obstacle that made using one’s knowledge and skills to earn a living more difficult. Furthermore, it mostly affected women of color, who primarily make up both the customers and the braiders.

The requirement was yet another example of the ways regulations hurt everyday Americans’ ability to provide for themselves and to pursue their own economic liberty.

We can discuss in a more rigorous way when licensing is needed. Is the use of chemicals a line? Should it be a matter of life and death or contagion? But surely, when one person consents to give money to another to braid her or his hair, the government doesn’t have to be in the middle of that transaction, especially to require a license for something that hair braiders don’t actually do.

The attorney general’s office has conspicuously delayed a records request until after it can affect legislation that might cost the attorney general’s office money.

One can’t help but combine the news Monique highlighted here — that the administration of Democrat Governor Gina Raimondo missed a critical deadline for appealing a costly legal ruling — with today’s “Political Scene” in the Providence Journal:

As a champion fundraiser, economic-development cheerleader and devoted Yale Law School alum, Gov. Gina Raimondo has been out of state on official, or political, business at least 90 days since the Jan. 1, 2017, midpoint of her term as governor.

Her travels during this stretch took her to New York, Connecticut, Massachusetts, Arizona, Illinois, Pennsylvania, Colorado, Texas, Oregon, Michigan, California, North Carolina and Washington, D.C.

All of these trips were identified in a summary provided to Political Scene by the governor’s office as either “official” (27), “political” (19), or “mixed” (15). The trips categorized as “official” included her Harvard Class Reunion in April, which her staff described as a valuable networking event.

We can discuss the (unknowable) variable of how often prior governors were out of state and debate the importance of Raimondo’s trips to the people of Rhode Island, but the plain reality is that her administration has faced repeated problems executing its responsibilities, and at the same time, she has been traveling far and wide, burnishing her own brand and collecting unprecedented money for her political interests.

I commented recently on a fundraising email from the Raimondo campaign emphasizing the importance of donating money in order to support the policies of the Raimondo administration, so it’s possible the Raimondo camp believes its fundraising in order to buy the next election to be a long-term benefit to the people of Rhode Island. Those of us who must live with the consequences of government policies should probably give some thought to whether that interpretation matches their own assessment of a governor’s responsibility.

Both the Providence Journal‘s Kathy Gregg and WPRI’s Ted Nesi are reporting today that the State of Rhode Island, more specifically, the Executive branch’s Office of Health and Human Services (the Rhode Island Executive Branch being currently occupied, we should note, by Gina Raimondo), missed a critical court deadline to appeal a court ruling and thereby may have put state taxpayers on the hook for “$8 million annually for each year starting in 2016-17”. From Ted Nesi’s story about this disturbing and jaw-dropping situation:

As public opinion rejects one attempt to back a new baseball stadium after another, insiders are becoming more creative (and dangerous) in their tricks to hide the risk and the subsidy.

Just as central servers can lose their ability to “govern” the many computers they connect, a centralized government can’t handle all of the relationships between human beings.

The week before Tiverton’s financial town referendum (FTR), I reported that state estimates of revenue from the Twin River casino in Tiverton were based on a September 1 opening — a full month before earlier estimates and two months before the date that some preferred for local purposes. The budget that I submitted, Budget #2, which would have reduced the tax levy by 2.9% and finally brought our tax rate back into line with neighboring Portsmouth’s, used the September 1 estimate (although with revenue estimates still lower than the latest from the state).

Well, wouldn’t you know it, the week after the town government’s higher-tax budget won the referendum, with questions about casino revenue front and center, Twin River could no longer contain its enthusiasm and proclaimed:

Twin River beat the odds and will get gamblers to the tables a month earlier than expected.

John Taylor Jr., chairman of Twin River Management Group, said the casino will open on Sept. 1 instead of the previous forecast of an Oct. 1 opening.

In the past, the elector petitions have tended to win by 60% versus 40%, but this year Budget #2 lost roughly 45% to 55%. The Budget #1 advocates managed to erode or eliminate the typical margin relying heavily on exaggerated warnings about what would happen if the assumed casino revenue didn’t materialized. The victory, however, arguably came from the defection of people who typically vote for the lower-tax budgets but found use of the casino revenue to conflict with their conservative inclinations.

In fairness, on our side of the aisle, when we talk about government projects, we tend to assume that they can never come in on time. In this case, that assumption misses the key fact that the state government is relying on this revenue. Roads, bridges, and public works projects can take forever because the money is endless and the economic downsides primarily hit the private sector. The casino is part of a race to get ahead of the competition with other states.

Twin River’s optimism may still prove to be misplaced, but it looks unlikely, and frankly, my expectation is that the initial revenue estimate for the town is likely to prove to be about half what comes in. We’ll see.

The Rhode Island Department of Health proposal could expand a child immunization database into a universal health tracking tool.

I’ve got a post on Tiverton Fact Check that might be of some interest statewide. Most of it has to do with the increased expectations for revenue from the Twin Rivers location soon to open in town (which argues against the pessimism that some have about estimates in the 2.9%-tax-reduction budget that I submitted for a vote this week at the financial town referendum [FTR]). But the introduction of the topic of sports betting has broader implications:

Also this week, the United States Supreme Court “struck down a 1992 federal law… that effectively banned commercial sports betting in most states,” as a New York Times article put it. Expecting this outcome, Rhode Island Governor Gina Raimondo had already included a provision in her proposed budget for the upcoming fiscal year suggesting that referendum votes across the state and in Lincoln and Tiverton had already provided authority for the state to conduct sports betting. She estimated $23.5 million for the state from this source.

However, no language yet exists describing whether this betting would count as a VLT, table game, or something else. Therefore, although Rhode Island is apparently planning to allow only in-person betting, probably at the two Twin Rivers locations, how much the host communities would receive from these transactions is not yet known. State officials are coy on the matter, even on the way in which the $23.5 million estimate was calculated, but it is clear that negotiations are underway.

I haven’t been able to find any evidence of how the state thinks this money should be attributed or any calculation that led the governor to estimate her millions, even after communicating with multiple state departments.

Building off the successful “Justice Reinvestment” reforms that were enacted in by Rhode Island lawmakers in 2017, the state’s asset forfeiture laws should next come under scrutiny, as they can often lead to the unfettered government seizure of cars, cash, and other private property. While many policymakers might assume that such laws are directed at criminals, in reality, simply being accused of a crime or violating a regulation may be sufficient for the state to take your property.

So Rhode Island’s state government paid about a half-billion dollars for software to manage its various welfare programs, and now it’s having to “upgrade” to put bar codes on paper applications so it can properly track them:

“I have an idea,″ [Rep. Jason Knight, D-Barrington] said. “Put a box in each building and that’s where the scanned applications go…This is not difficult…Put a box in the corner.″

“Understood,″ Hawkins said, but “DHS [takes in] thousands of applications every month.” She said a technology upgrade “in the coming months″ will put a bar code on every document that is received by the department to ensure that every one “gets scanned to the right case and eliminate the errors.”

“We believe the technology system should solve this problem for us,” she said.

With a little work, perhaps Rhode Island can graduate to the latest technology of the 1970s.

Not to repeat what’s been written in this space before, but the problem, here, isn’t the technology so much as what the state is trying to use it for. Tracking all of the information necessary to determine, on an ongoing basis, the eligibility of everybody in the system for every welfare benefit requires a great deal of information.

It is within the competence of state government to set up agencies to process individual welfare programs. It is not within its competence to vacuum us all into its data base and get us on the dependency highway. And we should be relieved that that’s the case.

Let’s be clear that this guy should not be considered representative of either law enforcement or welfare recipients:

A Rhode Island deputy sheriff, who was praised as a hero in 2015 for saving the lives of two women, has been arrested for fraudulently collecting more than $12,000 worth of food stamps, according to the Rhode Island State Police.

Edward Cooper Jr., 49, of 78 Commodore St., Providence, obtained the food stamps while collecting a tax-free salary because of a job-related injury, the state police said.

It’s reasonable to suggest, though, that some people tend toward a mindset of taking what they can, or even of entitlement. It’s also reasonable to wonder whether government occupations and programs are an especial lure for such people.

The “I got mine” mindset isn’t a healthy one for the individual nor a just one for the community, so we should keep an eye out that we’re not creating incentives for it. Rhode Island clearly has such incentives.

This Associated Press article doesn’t have much by way of detail, but it’s enough to be a head scratcher:

The state Department of Transportation is looking to get out in front of the self-driving vehicle movement with a plan to provide automated service for an underserved section of Providence.

The department on Monday announced that it is accepting proposals from companies who can test and eventually deliver such a service to fill a transportation gap between downtown Providence and Olneyville via the Woonasquatucket River corridor.

Rhode Islanders should be a little nervous when our state government starts talking about getting out ahead of the private sector with technological innovations. A subsequent update to the article seems to go in an entirely different direction:

In an interview Monday, DOT director Peter Alviti Jr. said his agency doesn’t want to limit what private innovative concepts companies might propose, by mandating particular types of vehicles, the projects costs or even the route, which he said is not limited to just the Woonasquatucket River corridor.

Alviti said the DOT expects autonomous vehicles will begin appearing on Rhode Island roads with traditional cars within five years and the pilot is intended to create “tangible interactions” with the technology so the government can better understand how to plan for it. …

Although the pilot program could theoretically take the form of a bus, Alviti said the intent is not to create an autonomous mass transit system.

So, it appears the idea is to contract with some company to brainstorm just about any way self-driving vehicles might affect or be incorporated into public transit. That’s a bit more open ended of an objective than we ought to accept, and a cynic might wonder who is going to turn out to be the owner of the company that gets this open-ended brainstorming project.

Investor’s Business Daily found striking correlations between tax burden, presidential vote, population loss/gain, and government fiscal condition. In general, high-tax states tended to vote for the Democrat in the last election, tend to be losing domestic population to other states, and tend not to be in great fiscal condition. As IBD suggests:

One way to look at all this is to conclude that poorly managed states are trying to force taxpayers to cover for their mistakes. But, taxpayers won’t stand for it. Which strongly suggests that high-tax states need to set a new course, toward lower taxes and less spending, if they want to stop their population losses.

Of course, that’s a big “if.” As long as they can keep the scheme going, population is only incidental… never mind that our governments are supposedly instituted to represent the people who actually live in an area. That isn’t any longer true in a fundamental sense.

Everybody’s choosing corners in response to news that Speaker of the Rhode Island House Nicholas Mattiello, a Cranston Democrat, and his close allies have been tangled up in campaign finance peculiarities, with some subpoenas flying and Mattiello having to transfer $72,000 from one campaign account to another. Given the ground I’ve staked out on the broader issue, however, I’d suggest that italicized sentence in the following paragraph is probably the most important consideration:

Mattiello issued this statement late Tuesday night: “I am pleased this issue has been resolved. I regret that my campaign inadvertently made some mistakes. I accept the warning from the Board of Elections and will fully repay from my campaign account what is owed to the PAC account. To assure those mistakes are not repeated, right after the 2016 election I hired a CPA with expertise in campaign finance to handle all of the finances.”

If our election laws have become so complex as to require specialized accountants in order to run for a seat in a part-time legislature, we’re doing something wrong. We need more people running for office, not fewer.

Yes, money in politics is a problem, but the solution isn’t to force candidates to spend more money on campaign management. Rather, we need to reduce the value of elective office as an investment for special interests. That could mean something relatively easy, like term limits, but more fundamentally, we have to reduce the things that we task government with doing.

In preparation for my weekly spot with John DePetro, this afternoon, I revisited Katherine Gregg’s Providence Journal article about the 7.5% in raises (actually 7.7%, compounded) state employees under Council 94 are expected to receive as part of a deal with Democrat Governor Gina Raimondo. Raimondo, you may have heard, is facing a tough election this year.

These paragraphs jump out:

… the events at Council 94 union headquarters coincided with the announcement by the Raimondo administration that year-to-date revenue collections are running $46.5 million ahead of the estimates adopted at the state’s official Revenue Estimating Conference last November, on which Governor Raimondo’s $9.3 billion budget proposal was based.

A statement issued by the Department of Revenue said: “The major contributors to this surplus are personal income tax revenues, $43.6 million more than expected; estate and transfer tax revenues, $5.3 million above expectations; departmental receipts revenues, $4.5 million more than expected; and public utilities gross earnings tax revenues, $5.4 million ahead of estimates.” A few smaller sources of revenue fell short of projections, yielding the net surplus of $46.5 million.

Gregg notes that the new raises will be competing with the pleas of other special interest groups in their annual “more money” dance (which, admittedly, sometimes means more than a budgeted reduction).

But have you noticed that an unexpected increase in revenue is never cited as an opportunity to lower tax rates? To the extent that it comes up, reduced taxes are typically handled in such a way as to make a special interest out of taxpayers, as with the specific elimination of the car tax.

In any event, time will tell whether Raimondo’s bid for the labor vote creates enough of a boost to save her job. Valley Breeze publisher Tom Ward is skeptical of her chances, generally:

My take on it: There is no amount of money that will save her candidacy. The unfixable UHIP that continues to cost taxpayers more millions, the now-late and already unpopular tolls that create a new budget shortage, the “scooping” of energy conservation monies – and now, grabbing 911 emergency funds for God knows what. She owns all of it! She will lose a two-way race soundly, and needs to keep independents like Joe Trillo in the race to save her.

We’ll see. The thing with full ballots is that a candidate can win with a small plurality, as Rhode Islanders keep learning… to our detriment.

As a UHIP skeptic from the very first time it was mentioned as a possibility, I continue to think that everybody is following the wrong storyline. However, increased scrutiny is starting to bring people around to the right questions… the correct angle. Consider:

As to why so many things went wrong, [Deloitte manager Deborah] Sills said: “Simply put, the system is very complex … the only eligibility system in the country that integrates more than 10 state and federal health and human services programs and a state based health insurance exchange … As the state’s comprehensive analysis last year made clear, Deloitte and the state needed ‘more time, more people and more training.'”

GoLocalProv has posted the entire 40-page, paper-and-pen application that goes along with the half-billion-dollar computer system, and what’s becoming clearer is that the state simply expected too much from software, hoping to avoid the hard work of reconceptualizing how benefits programs are done. In this light, the fundamental error of Democrat Governor Gina Raimondo was her failure to understand the nature of the Unified Health Infrastructure Project (UHIP). It was never really intended to be a cost-savings and efficiency tool, but rather a dependency portal, drawing people into government programs and maximizing the amount of “services” that the state could hire people to provide.

Look at the application. The complexity comes in because each program requires different information. That’s not a terrible problem if the applicant knows which one he or she wants, but the entire point of UHIP is to give people things they aren’t applying for, so the application asks for all of the possible information. Streamlining that would require regulatory and legislative changes, some of it at the federal level.

In order to effectuate those changes, advocates would have to make clearer the underlying objective, and that would run contrary to the plan. The dependency portal is meant to insinuate itself into reality under the banner of efficiency, which the public would actually support. Less popular would be a banner proclaiming, “We want to ensure that everybody gets every penny of taxpayer money possible, even without looking for it.” Even less popular would be, “We want to track everybody’s personal and financial information so that we can adjust their benefits automatically.”

Whether it’s removing market signals with a value-added tax or creating incentive to block new children through zoning, public policy shouldn’t remove its red flags and should seek to address original problems, not symptoms.

The court-appointed “special master” tasked with getting Rhode Island’s Unified Health Infrastructure Project (UHIP) working, Deming Sherman, tells Kate Nagle of GoLocalProv that the system is flawed:

“It (UHIP) was not a bad idea, but bad execution,” said Sherman about UHIP. The good idea of UHIP was to tie five distinct programs together, but the flaws have been that the vendor, Deloitte and the workforce did not work and were not trained, respectively. Just as the UHIP program was being implemented the state laid off key workers. Since then DHS has had a difficult time training and retain workers for the program.

Sherman said the UHIP system has two problems technology and the workforce that operates it.

The surface reaction one has to this is to be incensed that the state government has already spent roughly a half-billion dollars on the system. Nobody forced state government to undertake a project that it was not competent to oversee. In fact, the state barely conducted public discussion before jumping in. Bureaucrats under former Democrat Governor Lincoln Chafee simply went forward as if it was the obvious thing to do.

Similarly, nobody forced Democrat Governor Gina Raimondo to manage her personnel under the assumption that flipping the switch on UHIP would instantly bring a new day. She took a big, big gamble, attempting to make budgetary room for other things, like her crony capitalist approach to economic development, and the state’s vulnerable populations have suffered for it.

More deeply, though, we should challenge Sherman’s statement that the concept was sound. The goal of UHIP, which was pushed down from activists at the national level (with the encouragement of Democrat Congressman David Cicilline), is to draw people into dependency on government. The system has the 40-page application about which Sherman complains in part because the designers want it to collect scads of information about people, which would be constantly updated on the pretense of regularly checking eligibility.

If it weren’t for the human suffering and loss of opportunity that it’s causing, we should actually be happy that UHIP isn’t working, which is a sad statement on the condition of our democracy. Being saved from insidious ideas by managerial incompetence is not a silver lining that ought to inspire confidence or hope.

Progressives in Rhode Island, with potential gubernatorial candidate Matt Brown the latest among them, have been floating the idea of a state-run bank for a few years. Cato Institute Fellow Walter Olson expressed some thoughts on the question in a recent Wall Street Journal op-ed.

The concerns are manifold. For one thing, government-run banks “succeed, if they do, because of unfair advantages.” (And if they fail, look for them to receive more advantages at others’ expense.) Because they’re fundamentally political in nature, they also tend to allocate their resources with less concern for sound investments than private banks must.

Referring specifically to his state of concern, Olson writes:

A State Bank of New Jersey would be unlikely to content itself with the predictable and repetitive lending that goes on in an agriculture-and-extraction economy like North Dakota’s. It would inevitably turn into a Favor Bank for politicos hoping to lure subsidized jobs from the more vibrant cities of New York and Philadelphia. Once the initial buzz of idealism passed, it would become a tempting honey pot for the corrupt politicians for which New Jersey is famous.

Rhode Island has a similar fame, along with a newly minted reputation for institutional incompetence — along with a not-so-newly-minted history involving organized crime and a banking crisis. Frankly, Rhode Islanders should find it unsettling that anybody of influence could look at the socio-political landscape of the Ocean State — with Crimetown, 38 Studios, the UHIP debacle, Deepwater Wind, unfunded pensions, one-party rule, regular investigative reports showing public-sector malfeasance, and all the rest — and conclude that what we really need is another way to shuffle money around.

With the prospect of a state-run savings and loan operation, one suspects insiders are waiting in the wings to do business at the Ocean State Shavings and Cronies, but if the rest of us fall for it, the smart investment would be in local U-Haul operations.

Regular readers know I put a lot of emphasis on incentives as a way to understand events and a key consideration when crafting policies. The $250 million school bond proposed for the November ballot is a good example.

On the front end, the incentive is very strong for school districts and municipalities to let facilities deteriorate. First, the law is structured to give advantages to labor unions organized at the state and even federal level, creating incentive for them to manipulate the political structure. Then, elected officials have incentive to tilt budgets toward organized labor, drawing money to compensation. Next, having learned from that experience over time, taxpayers have incentive to squeeze money out of budgets so that even higher taxes aren’t paying again for things like maintenance that they thought were already included and that might be diverted again if available.

On top of it all, the near certitude of passing bonds for dire repairs creates disincentive for regular maintenance from the start. This mechanism creates incentives for financial interests and investors, and the bias toward big projects brings in the incentive that got me thinking of these things. As Dan McGowan reports for WPRI:

Fix Our Schools R.I., a 501(c)4 nonprofit formed last week, will spend the coming months “educating communities across the state about what this plan is and how it would affect them,” Haslehurst told Eyewitness News. …

The organization lists its address as 410 South Main St., the same building as the Laborer’s International Union of North America. Haslehurst said it will share space with the Occupational and Environmental Health Center of Rhode Island, a nonprofit that has an office inside the building.

A quick look at the health center’s IRS filing shows that it’s a labor union organization, with AFL-CIO poobah George Nee as the treasurer.

‘Round and ’round the incentives go, to the point that running things efficiently — in the way people run their households, planning ahead and all that — seems almost to be an impossible task. Be skeptical of anybody who tells you that this is a “once in a generation” investment that fixes a problem. After all, when the debt payments subside, the incentive will be to find more projects in need of debt or to build the payment amount into regular budgets.