Alarming – Budget Article 17 Could Set Up Stream of 38 Studios-Style Failures

Another problem article in the proposed House budget would, remarkably, put state taxpayers in positions of equity in certain, chosen companies. See the language below on page 9:

(b) Notwithstanding anything in this chapter to the contrary, the commerce corporation may make a loan or equity investment as an alternative incentive in lieu of the provision of tax credits so long as the applicant otherwise qualifies for tax credits under this chapter.

This is a bad idea and poses serious dangers to taxpayers if it passes, as Rep Patricia Morgan (R – Coventry, Warwick & West-Warwick) outlines in the following statement just issued.

Rep. Morgan Questions New Commerce Article Which Puts Taxpayers at Risk

STATE HOUSE — Representative Patricia Morgan (R-District 26 Coventry, Warwick, West Warwick) is calling attention to the new provisions in Article 17, which relate to commerce and economic development.

“The new language governing the Commerce Corporation’s program for economic development on the 195 land is troubling. The new law would fundamentally change the original intent of the program and lead the state into areas best left to financial experts. Financial money managers risk private money, the state risks taxpayer money,” stated Representative Morgan.

“Rhode Islanders have made it clear that they do not want tax dollars given to projects that should be left to the private marketplace. In the past, we have granted authority for the Commerce Corporation to issue tax credits which have the goal of growing tax revenue as the company thrives. However, the Commerce Corp. is now asking for the ability to make equity investments. This investment puts taxpayers in the position of being owners of the company.” explained Morgan.

“If the company thrives, the state not only receives the investment, but also a potential profit. However, if it fails, as in 38 Studios, state would lose the entirety of the taxpayer investment. Public money should never supplant private investment in the marketplace. It’s dangerous for taxpayers.”

Other provisions the Article17 also raise a red flag. “In existing statute the Commerce Corporation is authorized to give up to $15 million, capped at 30% of the total cost of the project, to a developer. The new Article allows a developer to split the project into two and accept $15 million for each portion for a total of $30 million. Additionally, the new language allows the Commerce secretary to waive the 30% cap once a year. That takes away taxpayer protections.”

“One major concern is a taxpayer funded subsidy for the Superman building project in Providence. In current law, economic development incentive programs for the 195 land reclamation project, include the Downtown Providence area with the Superman building. The budget article before the General Assembly increases the maximum aggregate tax credits for this program. The program has been increased to $150,000,000. With such a high program cap, the fear is that money will be diverted to fund redevelopment of the Superman building without taxpayer input.” explained Morgan.

“While these changes were presented to the Finance Committee, albeit well after midnight, they have not been thoroughly explained or vetted. The financial impact to Rhode Island must be thoroughly reviewed before any budgetary vote. I, as a House Representative, want to be fully confident this program will not lead taxpayers down another dead-end path of wasted taxpayer money.”

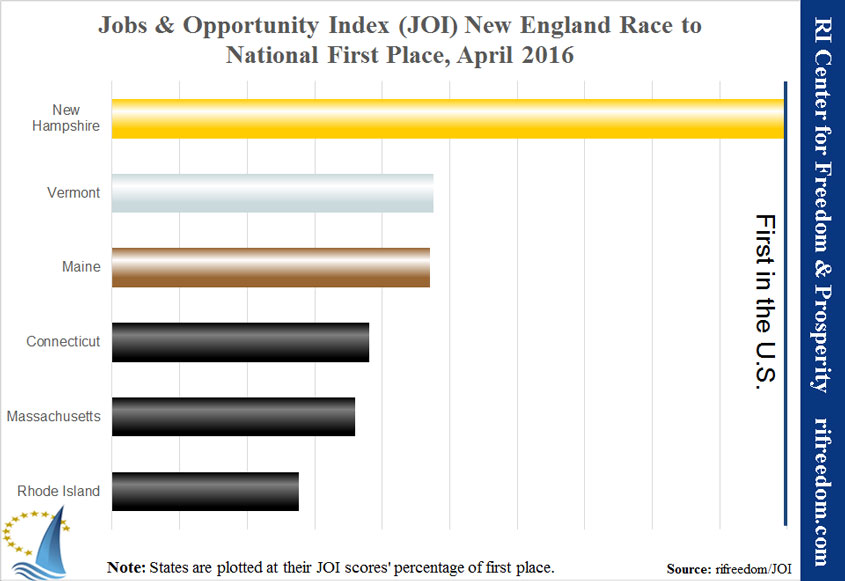

“Ultimately, our state’s leaders need to do more than find creative corporate subsidies. This welfare takes money away from hardworking Rhode Islanders and is funneled to companies of specific choosing. The State should not be in the venture capital business. Instead we need to do the hard work of reforming our economic climate; reducing property taxes, eliminating costly and non-value added regulations, changing a hostile legal system, restoring ethics, and reducing the cost of government instead of tacking on new taxes, fees and tolls each year.”

“Companies should come to Rhode Island because it’s a great place to grow, not because we pay them to come.”