Honoring the Good-Policy Promise of Lowering the Sales Tax

Today, the RI Center for Freedom & Prosperity released a policy brief arguing that, with the 2020 budget, the state will have effectively reached the point of online sales tax collection that was supposed to trigger a reduction in the tax rate from 7% to 6.5%:

While the U.S. Supreme Court’s decision is not literally the same thing as “passage of any federal law,” it can be argued that the State of Rhode Island has effectively triggered this threshold of collecting sales taxes from remote sellers, including Internet vendors. It can further be argued that our state has actually exceeded this legal threshold.

[box type=”tick” style=”rounded”]Please consider a voluntary, tax-deductible subscription to keep the Current growing and free.[/box]

Yet, politically, not one lawmaker has made any noise about how Rhode Islanders may legally be getting ripped off by a broadened sales tax that doesn’t fulfill the legally required lowered rate that was promised.

The Center suggests that the General Assembly should honor its commitment to the people of Rhode Island, should abide by legislation that the legislature itself passed, and should complying with state law. The House of Representatives should include in its FY20 budget statutory language that would officially reduce the state sales tax to its statutorily required 6.5% rate.

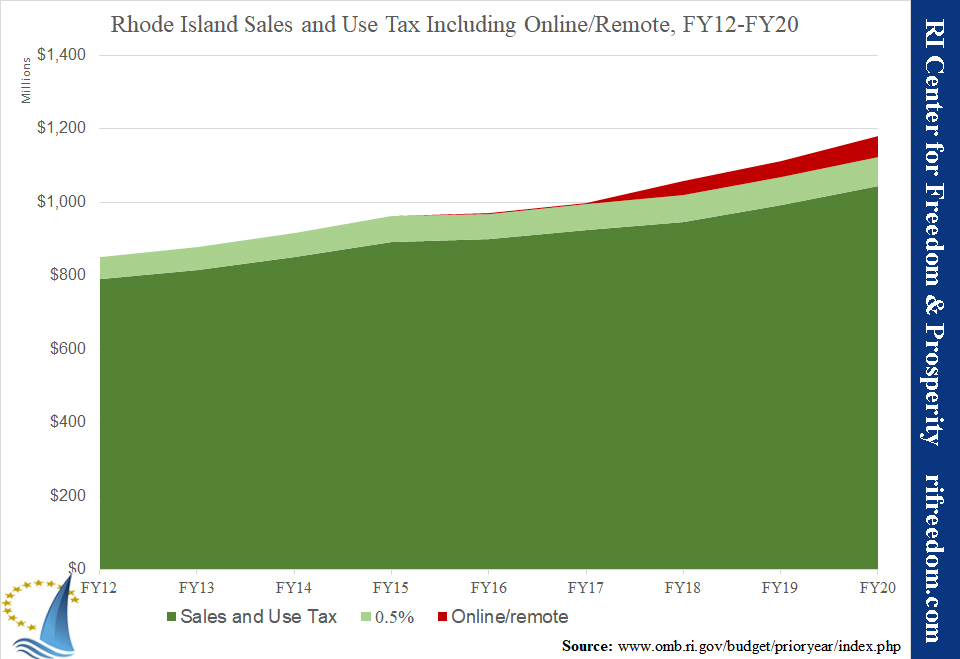

The included chart pretty well tells the story of the state’s expansion of the sales tax — at more than twice the rate of inflation, with nearly a 40% increase since fiscal year 2012: