04/10/12 – General Treasurer Guide to Comprehensive Pension Reform Part II

8:49 a.m.

I’m at the second workshop that the General Treasurer’s office is hosting for municipalities to help them with their pension problems.

Treasurer Gina Raimondo is opening the meeting. She mentioned that all but a few of the municipal experience studies were submitted by the April 1 deadline, and they’re working with them. She offered her office for consulting, up to and including “here’s our data, what do we do.”

8:58 a.m.

I’m having some technical difficulties, but Treasurer Raimondo is opening the meeting with a reminder of what RIRSA did.

She said the five-year rate of return is 2.28% (will be made official by a Retirement Board vote, tomorrow). Consequently, even well-funded plans in MERS will not receive COLAs.

9:00 a.m.

Raimondo: Point of pension is to retire with dignity? Does that mean retiring at the same salary?

Avoid temptation to build pension from bottom up… “what if we adjust this number.”

“If you take that approach, we’ll be back here in a few years doing this again.”

9:03 a.m.

Raimondo: Much consensus worldwide for retirement with dignity: 70-80% of final salary. “A good target replacement rate.”

9:05 a.m.

Raimondo: eye opening moment: “Wow, our system is actually designed to provide more in retirement than they earned working.”

9:06 a.m.

“The ability to prevail, legally, is very much related to the process that you follow.”

9:11 a.m.

Joe Newton, from Gabriel Roeder Smith, is presenting a strategy for reforming municipal pensions.

9:15 a.m.

Newton says municipalities should get the numbers nailed down so they can negotiate realistic tradeoffs: do you want to retire earlier, or do you want more money, and so on.

9:16 a.m.

Retiree medical programs are a good example of this dynamic: If the benefits are unsustainable, they’re already in a situation that they don’t exist.

9:20 a.m.

Raimondo: Figure out: “What can we afford?” Is it appropriate to allocate 100% of your property tax increase cap to pensions? Probably not.

9:24 a.m.

It figures… unexpected technical problems right in the middle of a liveblog. Guess it’s old-school Notes posted when things are back up and running.

9:29 a.m.

Newton is giving almost a pension reform 101 discussion… everything’s an individual decision to the employer; no cure-alls.

9:41 a.m.

Newton’s showing some old slides from the state pension reform. One of them shows that a 5% return on investment funds the plan by 2060 (as opposed to 2036 at 7.5%).

9:43 a.m.

Raimondo raises the specter of “is it fair?” “You can’t do comprehensive pension reform unless you impact everyone.” She listed: Retired, vested, and new hires. No mention at all about fairness to taxpayers (e.g., for amortization).

9:44 a.m.

An audience question on fairness: Can you distinguish what’s equitable versus what’s fair?

Newton: You’re probably correct that there may be a distinction. “Equitable does not mean equal. Different people can absorb different levels of change.”

9:46 a.m.

Question: Can the private plans just go into MERS?

Newton: That creates cost problems with the existing fund, closing them out. It would be better if it were possible to just move them in whole, which would transfer difficulty from financing to administration.

9:53 a.m.

Newton’s advising the audience to “err on the side of caution” when coming up with assumptions, as with pay increases. [You know, it really is a problem, it seems to me, that there’s a disconnect between the discussion of pensions and the discussion of budgets. Higher salaries, for example, have one effect on pensions and another on budgets. I suppose the actuaries can only worry about what’s in their scope.]

9:58 a.m.

Raimondo’s asking some questions of Newton. The last was: how do you go about dealing with a plan that’s currently closed but 20-30% funded.

Newton’s response, essentially, is to consult an actuary and make some decisions.

10:01 a.m.

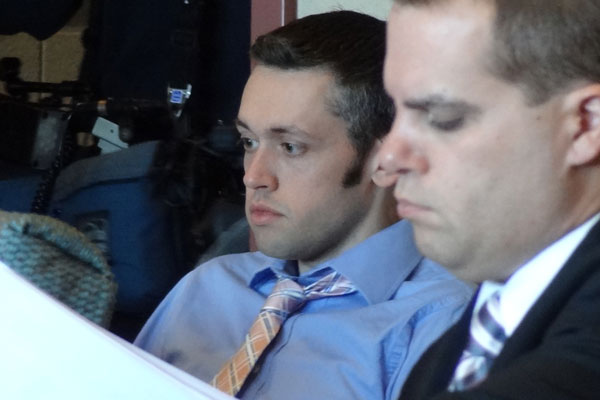

Most of the people in the room are financial managers for the towns. Some are elected officials. John Ward, Council Chairman from Woonsocket is here. Warwick Mayor Scott Avedisian was here, but he left.

I see the town administrator of Tiverton, Jim Goncalo. Rep. Peter Martin from Newport is here. The ever-tweeting Ted Nesi snuck in, too:

10:03 a.m.

Question: Some towns have a separately funded plan for COLAs; does that make a difference, legally?

Treasurer’s lawyer Mark Dingley answered that a judge might see that as important, but one can argue that such funding is included in the payment for plans that don’t have a separate fund.

10:06 a.m.

A question from Cumberland (that hasn’t been discussed with the union yet): Does anybody every use pension obligation bonds to win give-backs from the unions?

Newton is not a fan of pension obligation bonds, but if it’s offset with real savings in the long term, then it might be reasonable, “if that’s what you’re giving up to get something from the other side.”

10:08 a.m.

Dingley is now beginning his presentation.

“If you don’t follow this process, it’s very unlikely that the changes are going to hold up in court.”

10:09 a.m.

Laws that break contracts are against both the U.S. and RI Constitutions.

But…

“This area is developing now. There aren’t hard and fast rules.” Courts across the country are reviewing the laws.

There’s a general perception that every generation should pay for the services that it receives, but that hasn’t been the way it’s worked. [Thanks, Boomers.]

Subsequent generations may not be willing to pay for past services. “Particularly in RI, taxpayers say they’re stretched to the limit.”

On the other side, public employees planned their entire lives around benefits. So, courts are looking for fairness in these issues.

10:11 a.m.

Courts are going to ask: did you conduct an open and fair process and listen to all interested parties?

10:12 a.m.

He used the word “sympathetic,” as in “looking sympathetic to a judge.”

10:14 a.m.

There’s a distinction between “accrued benefit protection,” which is the amount that the employee has earned, and “contract right protection,” which guarantees benefits from day one. ERISA guarantees accrued benefits… but not for public plans.

10:16 a.m.

AK, HI, LA MI, NM, and TX have constitutional provisions for accured protection.

AZ, IL, NY, and CA have contract right protection.

Other states do it by statute. In New England, the protections are more a matter of court decisions and Common Law.

10:21 a.m.

Discussing RI Judge Taft-Carter’s finding that a Providence union has an “implied contract,” Dingley says it wasn’t a terrible setback, because RI courts don’t like to issue summary judgment, which is what Taft-Carter was determining.

Dingley’s confident that the state will prevail when the case goes to trial, because all of the appropriate steps were taken beforehand.

10:23 a.m.

Most municipalities clearly have a contract, because it’s not through ordinance.

10:24 a.m.

It’s also typically going to be the case that courts will find that any municipal change in pensions will constitute “a substantial impairment” of the benefits offered.

10:25 a.m.

Dan Beardsley asked: What if provisions in the contract are cost drivers that were not an agreement between the two parties? (I think he means to suggest arbitration.)

Dingley clarifies the reason laws can change is that two parties didn’t agree to it.

Beardsley is being explicit, now: What if a state statute requires mandatory arbitration that, 25 years ago, inserted COLAs into the plans? Will courts look at that differently than if the town agreed to it?

Dingley: He thinks the answer is, “Yes.” But he can’t cite any law.

Raimondo: “This is new territory.” Taft-Carter’s gauge was “reasonableness.” “That’s why we keep hammering home the process. It’s all about making the case that a change was reasonable and it was necessary.” Therefore, regular negotiations trying to address a binding arbitration award would help to make the “reasonable” case.

10:31 a.m.

Question about whether Taft-Carter gave any guidance about what would be “reasonable.”

Dingley: No, but there are questions about what evidence was considered, such as whether the city was warned in advance that it was at risk but kept engaging in negotiations.

10:33 a.m.

Dingley: For state pension reform, the treasurer analyzed a whole slew of options, trying to judge fairness. If municipalities take legislation from the governor and General Assembly and run with pension cuts, courts aren’t going to find the changes reasonable, the newly passed law notwithstanding.

10:35 a.m.

Courts are also going to look at alternatives beyond the contract, such as raising taxes, selling property, and so on.

10:36 a.m.

Raimondo: How important are legislative findings in the law, or in an ordinance.

Dingley: Huge, but they have to have a basis in fact.

10:37 a.m.

Dingley: “Legitimate public purpose” can’t just fill a budget hole. It has to be about making the plan and benefits viable.

10:38 a.m.

Question: How do you take this same methodology and make change based upon avoiding future problems, based on knowledge that offered benefits are going to create a problem.

Dingley: Risk is the critical factor that has to be shared and considered. Do the full analysis as if the plan were in trouble, and move forward based on the conclusion.

[I may have misunderstood some of the specifics, but it sounds like the discussion is pointing toward the conclusion that an ordinance could change contract language if the steps are taken to analyze, and if it can be shown that trends or risks will be unacceptable going forward.]

10:44 a.m.

Raimondo noted that Utah’s addressing that same issue at the state level, because the plan is well funded. She also stresses that the advice they’re giving is of a “do your best” sort, because the law is undefined. However, ordinances will receive exactly the same judicial consideration as state law.

Contracts create a bigger hurdle, though.

10:49 a.m.

Dingley says Taft-Carter’s ruling was unusual in the Medicare decision in Providence, because it shifted the burden of proof in conflict with an existing Supreme Court ruling.

10:51 a.m.

Dingley is continuing on with his presentation, saying that the state expects RIRSA to hold up in court because it’s “gone after the apple” multiple times in escalating fashion. 2005 affected only new & non-vested employees. 2009 and 2010 affected active employees, including vested. 2011 brought in retirees, too.

10:53 a.m.

Dingley: The state has also done all sorts of things, from changing healthcare benefits to reducing services to cutting municipal aid, to address its problems. The same has to be true for municipalities; if they’re finding surpluses, not raising taxes, increasing services, and so on, they’re not going to get away with modifying pensions.

10:55 a.m.

Similarly, when addressing the pensions, municipalities will have to review various possible changes, before picking one. That is, considering retirement age before stopping COLAs.

Dingley’s two most important words (in his view): “Legislation last.”

10:59 a.m.

Question from somebody who says he’s not an elected official: He was surprised to learn that state statutes prevent towns from reducing school funding. “Shouldn’t elected officials be going to legislators to change such laws?”

Raimondo: “You probably have a lot of friends in this room, right now.”

Now John Ward from Woonsocket: How different are the legal hurdles in attempting to modify retiree health benefits that aren’t available through contract negotiations, as far as imposing changes.

Dingley: Health benefits are qualified as welfare benefits, which are less protected. Has been vetted to some degree in RI courts. The process is the same, but the hurdles lower. In fact, courts might prefer to see healthcare changes (for example) before pension changes.

“You have to lay the groundwork. There’s no way to avoid the work.”

11:03 a.m.

Question from the audience: What about police who aren’t in Social Security or Medicare; how do you address that.

Dingley: There’s a much higher hurdle.

11:06 a.m.

Suzanne Greschner, director of Municipal Finance, is filling in for Rosemary Booth Gallogly for an update on the pension study commission created by RIRSA. (Thanks to Ted Nesi for providing the ID through Twitter.)

11:09 a.m.

She says the response rate of municipalities doing experience studies has been very great, and she thanks everybody. (Of course, that was mandated by law, so it would have been somewhat controversial had the result been otherwise.)

11:11 a.m.

Among municipal plans, there are a variety of methods of pension establishment… contract, ordinance, and some others for which the commission has to seek clarification.

11:13 a.m.

17 communities responded that they would like training on fiduciary considerations. Greschner is saying that the state didn’t want to make such training another mandate.

11:16 a.m.

Apparently, only four plans did not respond to the deadline for experience studies.

11:20 a.m.

Dingley’s asking whether municipalities actually adopted the new assumptions in the experience studies. Some back and forth with a representative of Cranston on whether the recommendations should be in the upcoming budgets. The answer appears to be no, but there has to be a plan. The commission is supposed to receive plans by November 1.

11:23 a.m.

One complication of whether to adopt experience studies is that some of them will change the funding percentage, making a plan in “critical status.” Those that are in critical status have to send out a notice to stakeholders.

The commission is drafting a letter for critical status. (Clarification that “critical status” is 60% or lower.)

11:25 a.m.

Dingley says the legislation should have required municipalities to “conduct and adopt” their experience studies. He’s encouraging all municipalities to act and determine their critical status very quickly.

Greschner says that nobody has the authority to grant waivers from the legislation’s deadlines.

11:27 a.m.

It sounds like the expert opinion is that the trigger for critical status with respect to sending out notifications is the actuary’s certification of the experience study, so that plans can be ready for November.

11:30 a.m.

Raimondo doesn’t “want to opine” about how carefully the General Assembly crafted this language, but her sense is that the best efforts of municipalities will be fine.

11:35 a.m.

Now clarification about what’s due on November 1. Greschner was hesitant to interpret the law. Dingley is saying it’s mainly some sort of plan for standards going forward, to make plans solvent.

11:38 a.m.

Raimondo brings it back to the beginning: Figure out what the plan should be, come up with a plan, and follow the process.

11:39 a.m.

Raimondo: “Now we’re entering the hard part.” The treasurer’s office wants municipalities to tell them what they need in order to be successful.

11:41 a.m.

And the meeting is officially done, four minutes early! (And now the mob of one-on-one questions.)