State Pension Projections Versus Actual Results

As I reported in this morning’s liveblog, General Treasurer Gina Raimondo announced to the assembled municipal financial and management officials that the state’s latest five-year number for investment rate of return for its pension system was 2.28%. Of course, everybody’s hopeful that the past half-decade has been an anomaly, but a couple of slides from the presentation ought to be disconcerting to anybody who’s paying attention, given that announcement.

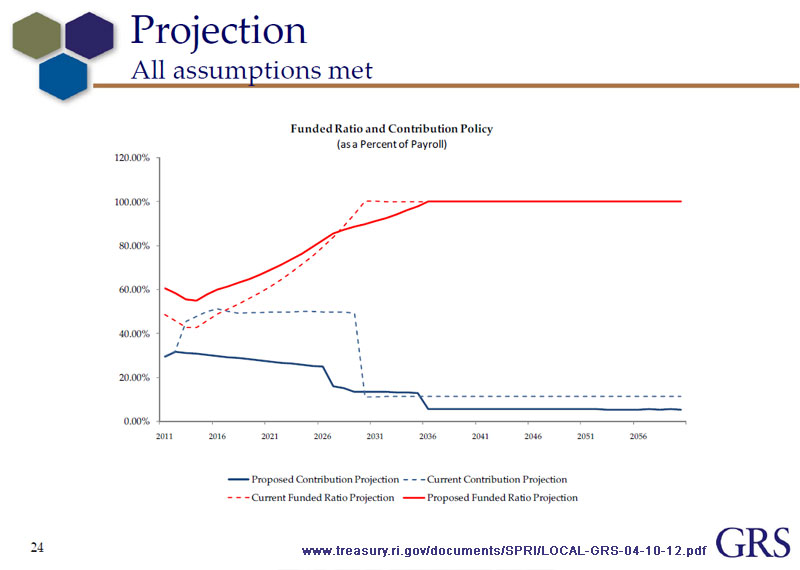

Actuary Joe Newton, of Gabriel Roeder Smith, gave a lengthy, informative presentation describing the state’s analysis and decision-making process while “making the case” (as Raimondo put it) that the changes being proposed for pension reform were both necessary and reasonable. Along the way, he showed this slide of pension payment and funding projections:

The dotted lines were the projections for the pension system before reform; the solid lines are the projections after it, assuming a 7.5% discount rate (or return on investment). The blue lines are the necessary contribution as a percentage of payroll. The red lines tell the real story of pension reform, as the percentage that the plan is funded. As the graph makes clear, the pension reform is supposed to leave the plan fully funded forever and ever around the year 2036.

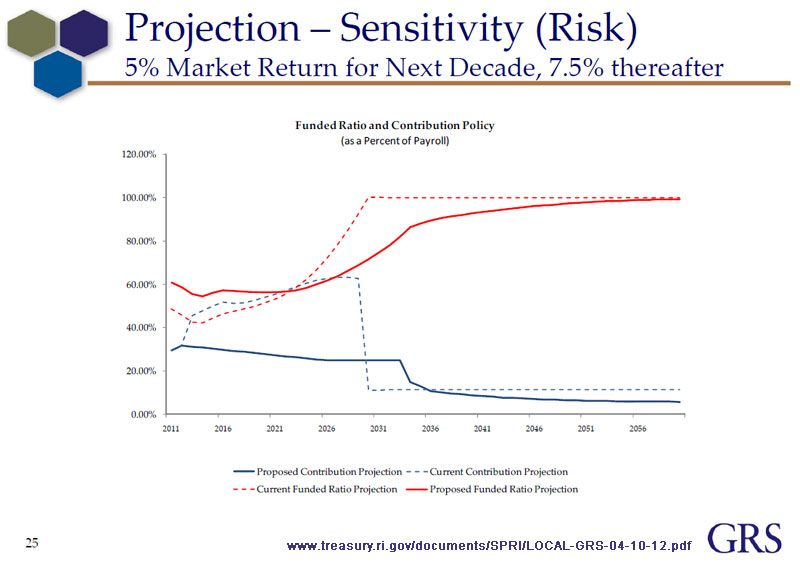

By way of contrast, Newton also presented a slide (although he didn’t dwell on it) showing what the graph would look like if the investments only return an average of 5% per year.

For one thing, the payments remain much higher for much longer (and it’s important to realize that the funding line is as a percentage of payroll, which can be expected to rise with raises, promotions, new hires, and general inflation. More importantly, the plan doesn’t become fully funded until around 2060.

How to make that possible as a matter of policy would become a debate for another day, but it would require re-reamortization. After all, the return on investment is truly a “discount” rate in that it reduces the amount that the employer has to pay for pensions. If the rate of return is lower, the employer must make up the difference… also making up the difference for returns that would have been compounded on top of prior returns. (If you make $100 profit, this year, you have that money for investment next year; if you don’t make it, you don’t have it.)

What the chart would look like for a continual 2.28% rate of return, Rhode Island is probably not prepared to consider, at this time.

ADDENDUM (5/11/12):

The General Treasurer’s office clarifies the slides here.