Rhode Island Cities and Towns, Where They Are and Where They’ve Been, Part 1

First the Disclaimers

It takes a great deal of work to drill down into all of the various sources of information about the circumstances that public policy must address and the trends by which they must be gauged. Even at the level of a “typical” Rhode Island town of twenty-something-thousand people, residents have bitter debates about what’s actually happening in their communities — who’s coming, who’s leaving, who’s working, and why it’s all happening. When the debate takes place in terms of anecdotes, the answer to all theories, even conflicting ones, will often be “yes and no.”

The necessary task, if the public debate is to be founded on some semblance of an objective basis, is to develop as accurate a sense of what is happening as possible.

Doing so is certainly not easy. As University of Rhode Island Economics Professor Len Lardaro has described on his blog, even a relatively data-driven question like “How many people are working?” is subject to adjustments and revisions that can change the story considerably.

In a certain way of looking at it, the fact that a collection of anecdotes can be distilled to numbers and put on a chart doesn’t mean its findings can’t be debated. It especially doesn’t mean that trends and conclusions are beyond debate. One thing that is beyond debate, though, is that the financial and political incentives to present data in a particular way are extremely strong and add layers of difficulty to an already insurmountable project.

So, we’re left with a mandate of democracy (become informed and assess situations rationally) and a hard fact of human reality (even the most fact-driven points will be arguable). It is with full understanding of its predicament that The Current offers its findings related to population and employment of Rhode Island’s cities and towns.

The data and graphics to follow, over three parts, are based on the best information known to be available at the time of their collection. Some general observations of interesting relationships are possible, but they are made from a necessarily distant view. Even the fifty most-informed people in a small town will dispute trends and causes, so we leave it to them to pursue.

Where We Are: Employment

For weeks, The Current has been posting data concerning population and employment statistics for individual cities and towns in Rhode Island (a full list will be provided in part 3 of this series). The data comes from the RI Department of Labor and Training’s data center, which collects information from various sources, including the U.S. Census Bureau and the U.S. Bureau of Labor Statistics (BLS).

The unemployment data, specifically, is drawn from the BLS’s Local Area Unemployment Statistics (LAUS) program, based on a monthly Current Population Survey. Throughout most of the country the BLS limits itself to examining metropolitan areas (the region immediately surrounding a city). In Rhode Island’s region, however, the bureau explores in more detail, for a New England City and Town Areas (NECTAS) data set that incorporates even the most tiny municipalities.

It is critical to keep in mind that these numbers are based on a model that the statisticians have created for each municipality. Even when the models are adjusted to account for new information (i.e., when they are benchmarked), the sources are surveys, often with very small numbers of participants. Ultimately, between Census counts, the month-to-month information for a small RI town of thousands of people can be influenced by the answers of mere dozens of people.

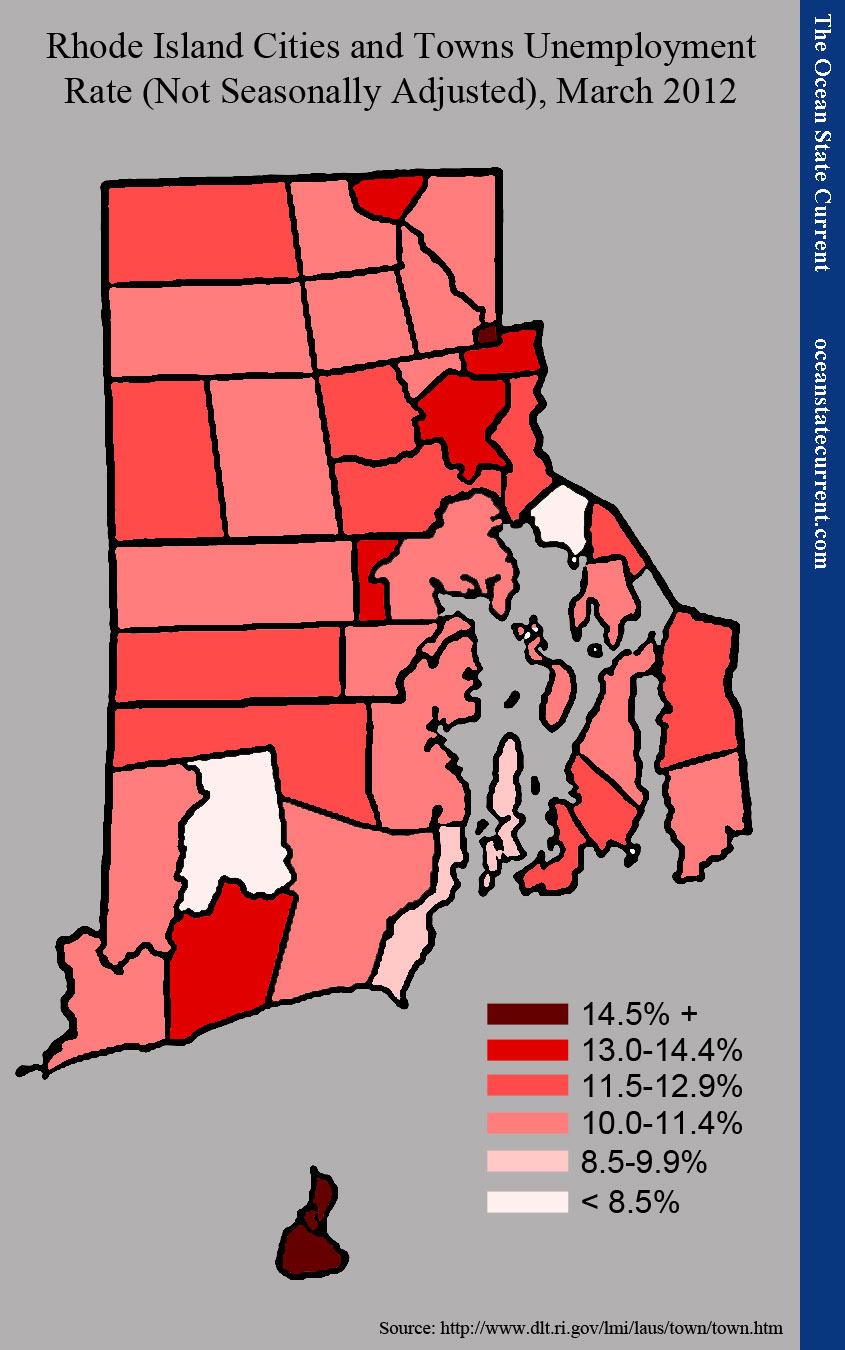

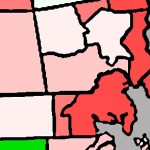

The following comparative map presents The Current’s findings for March 2012 unemployment rates (not seasonally adjusted). Unemployment is defined as the number of people in the city or town who are not currently working but are looking for work. It will not include, therefore, employed people who are looking for new jobs or people who say that they have stopped their searches, even though they aren’t working.

The darker the red, the higher the unemployment rate. During that month, the not-seasonally-adjusted rate for Rhode Island was 11.8%. (For a key of which cities and towns are which, see here.)

By this measure, the five municipalities in the worst shape are New Shoreham (29.5%), Central Falls (15.6%), Charlestown (13.9%), Providence (13.5%), and Woonsocket (13.4%). Because the data is not adjusted for seasonal fluctuation, seasonal economies like that of New Shoreham (Block Island) can be expected to have high unemployment rates this time of year. That said, the trends in all such cases show summers’ being less active while winters are increasingly brutal in recent years.

By contrast, the five municipalities in the best shape are Barrington (7.9%), Richmond (8.1%), Narragansett (8.5%), Jamestown (9.3%), and Warwick (10.1%). Take particular note of Warwick’s place on this list, because it will come into play in subsequent analysis.

One shortcoming of the unemployment rate, as a comparative guide, is that it is highly dependent on the underlying numbers. Even a big city in which very few people are working can have a low unemployment rate if very few residents want to work. That dynamic is referred to as “labor force participation.”

The next map shows the percentage of each city or town’s total population from the 2010 Census whom the BLS counted in the labor force for its 2010 average. Since the data comes from two sources, some conflicts exist (New Shoreham, for example, has more people working than counted in the population). But for comparative purposes, the data can be instructive.

The darker the color, the smaller the percentage counted in the labor force, so the more people there are who are not working and are not looking for work. The importance of this graphic is obvious: Central Falls and Providence have very low labor force participation, which keeps their unemployment rates low. Both cities would have nearly double their employment rates if participation were more in line with the “typical” municipality (which would be 56.4%).

Where We Are: Wealth and Population

In reviewing the labor force participation map, readers may observe that the most urban and poor municipalities make up the top tier for the number of residents who are neither working nor looking for work. What’s interesting is that the next tier includes some of the state’s wealthiest communities.

Intuitively, we can infer that the worst-off Rhode Islanders face disadvantages that might discourage them from economic activity (in education, as immigrants, in resources and transportation, and so on), while their lower overall income leaves less of an observable distance between the fruits of working and the safety-net resources that the public makes available.

Meanwhile, in the wealthiest communities, fewer people have to work, even during an economic downturn. (In general, the labor forces of RI cities and towns increased more quickly than their populations, and most of the difference cannot be attributed to the age of the population, meaning children coming of age.)

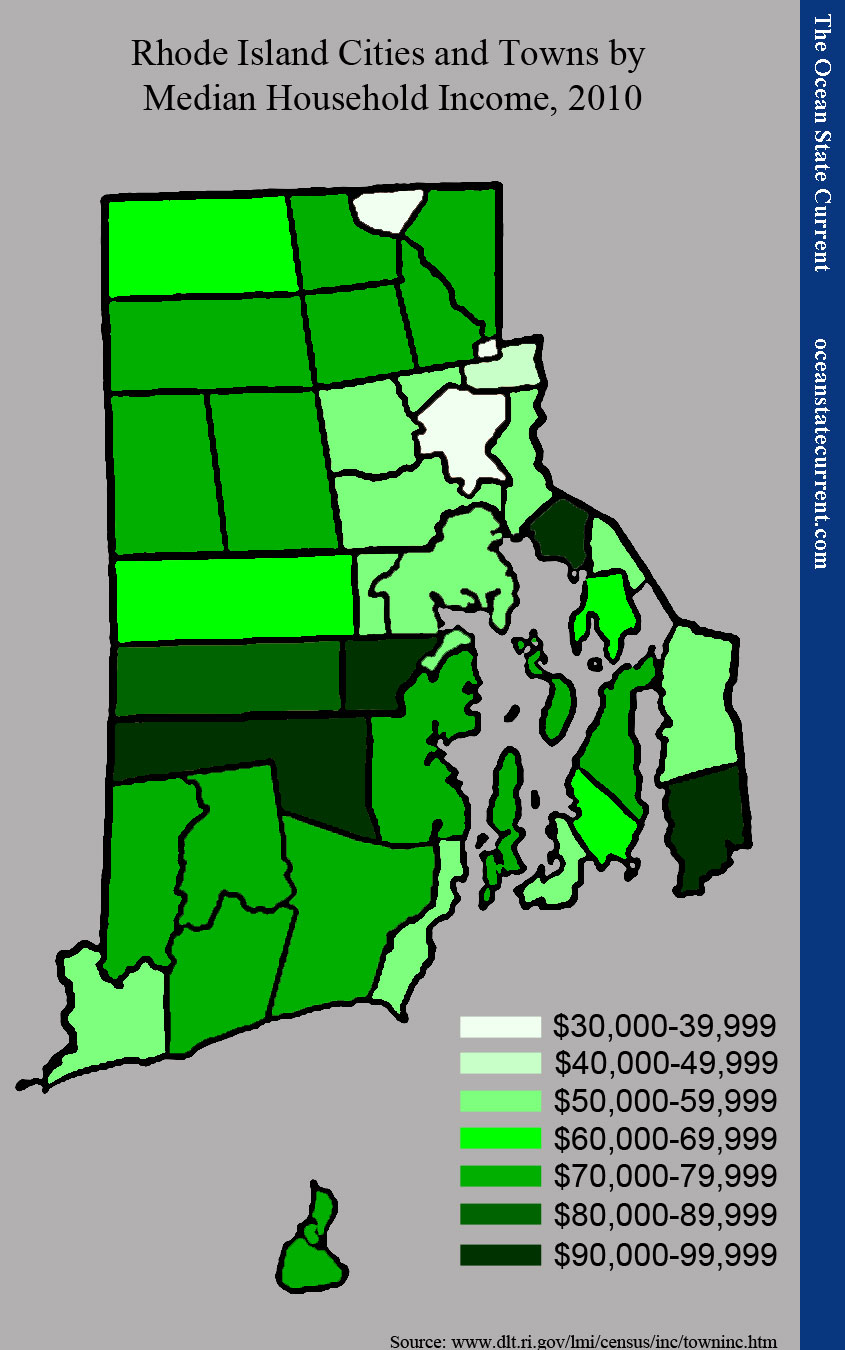

For comparison, the following map shows the median household income for each city and town in the 2010 Census. The darker the color, the more wealth in the town.

The five poorest communities, by this measure, are Central Falls ($34,389), Providence ($36,925), Woonsocket ($38,625), Pawtucket ($40,198), and North Providence ($50,013). The five wealthiest are Exeter ($98,438), Little Compton ($94,866), Barrington ($94,300), East Greenwich ($93,636), and West Greenwich ($81,419).

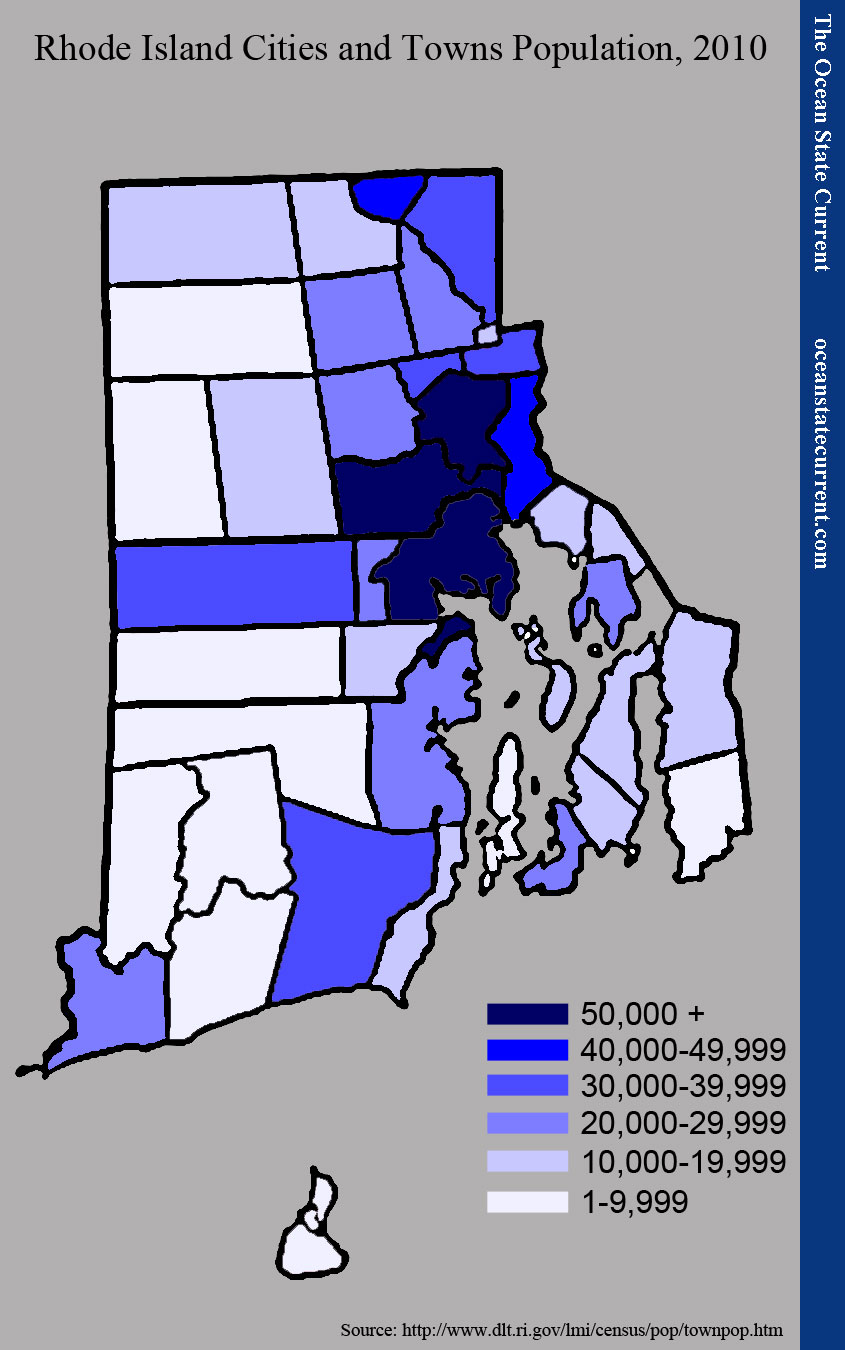

Obviously, the overlap of labor force participation and wealth is not exact. One factor that appears to play some role is the town’s population. For example, Little Compton is wealthier and more rural than Tiverton, but is in the same labor force participation category. Similar suggestions can be made of the southwestern part of the state, involving Exeter, West Greenwich, and their neighbors.

Readers should keep in mind something that isn’t calculated, here: population density. By population, Central Falls doesn’t rank very high on the state’s list, but as the map shows, it is very small, so more people are packed into a smaller space (although, at 19,376, it is a bit closer to its Providence County neighbors than may appear to be the case).

Initial Impression

Taking the above maps into consideration, one can begin to get a sense of the different character of the cities and towns of Rhode Island. The state packs a great deal of differentiation into a very small space: There’s urban ring and rural space; there are coastal communities and more “ordinary” inland communities; and crossing all of the lines, there are different demographic characters. Whether a town is between two cities creates a difference from other towns in an urban ring that bridge the space between urban and rural.

Of particular importance to our concerns, here, are economic progress. Part 2 will investigate trends, especially with regard to population, that should increase understanding of who is being affected by public policy in the state and how.