Union Lawsuits, Those Pesky Discount Rates, and the Economic Game

As has been widely reported, the various public-sector unions representing members affected by Rhode Island’s recent pension reform changes have sued to have the law invalidated as an unconstitutional breach of contract. The bulk of the law is slated to go into effect next week, and Superior Court Judge Sarah Taft-Carter has denied the unions’ request to halt implementation immediately.

Still, the lawsuit represents a real threat to the reform, which (although it’s been nationally lauded as groundbreaking) I continue to believe to be wholly inadequate already. Indeed, I’d go so far as to suggest that the pension reform represented a pretty good deal for active and retired members of the pension plan, insulating them from greater pain yet to come.

Of particular note are comments that National Education Association of Rhode Island Executive Director Robert Walsh made to WPRI (first link above). Echoing firefighter union leader Paul Valletta’s infamous claim that General Treasurer Gina Raimondo “cooked the books” to spark the pension reform push, Walsh called the movement “a manufactured crisis” based on a discount rate (or investment return assumption) that “went too far.” Raimondo led the state retirement board in a downward adjustment of the assumption from 8.25% to 7.5%.

For a better sense of what “too far” might mean, I emailed Walsh, on Friday, and he replied as follows:

The 7.5% is based on two factors – blended long-term real rate of return of 4.75% on top of inflation of 2.75% – I think that long term inflation reverts, as it historically has, to 3.0%, and that a 7.75% rate of return is over the long term is rational.

Whether it’s reasonable to say that an additional 0.25-percentage point drop crossed the line to “manufactured crisis” is a matter for debate. More important to the public discussion, however, is the question of whether any number within that range is reasonable — premised on either direct returns or inflation.

According to the latest actuarial report, as of last June, the average annual return for the state pension fund was 3.9% over five years, 5.3% over ten years, and 7.3% since 1995. The five-year rate has since dropped to 2.28% (as first announced at a pension reform workshop for municipalities). How, then, is an assumption of 7.5% too far?

For some perspective, consider what would be required to get back on track. In order for the pension fund to make up for its poor performance over the past decade, it will have to achieve an average return of 10.34% over the next decade in order to hit the same point that a consistent 7.5% return would have achieved over those twenty years. If we go with Walsh’s 7.75% assumption, the next decade would have to see consistent returns of 10.90%.

Tracing the S&P 500 since 1928, the annual average for the entire stock market — which ought to be much higher than a pension fund, which must cover itself with safer investments like bonds — has been 9.23%. If we apply a 35:65 mix of stocks and Treasury bonds, the next decade would have to look like the ’50s all over again to produce the returns the fund needs.

That’s a worthwhile talking point, but fairness requires me to admit that either the ’80s or ’90s would put the fund well beyond what the state pension fund’s assumptions require. Since investment is essentially gambling, though, the question is whether the next decade is at all likely to look like the past. Actually, the longer-term view is more important. Are decade-by-decade, upward-climbing booms and busts a norm that we should expect?

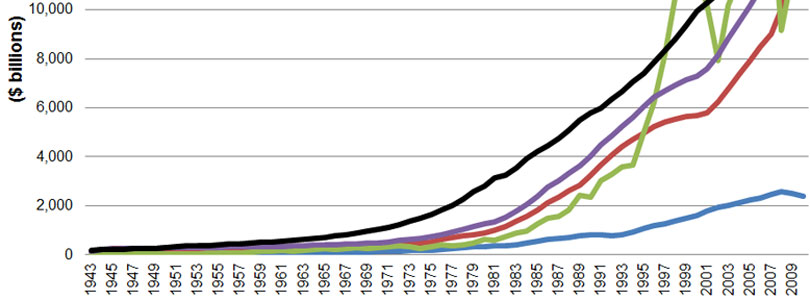

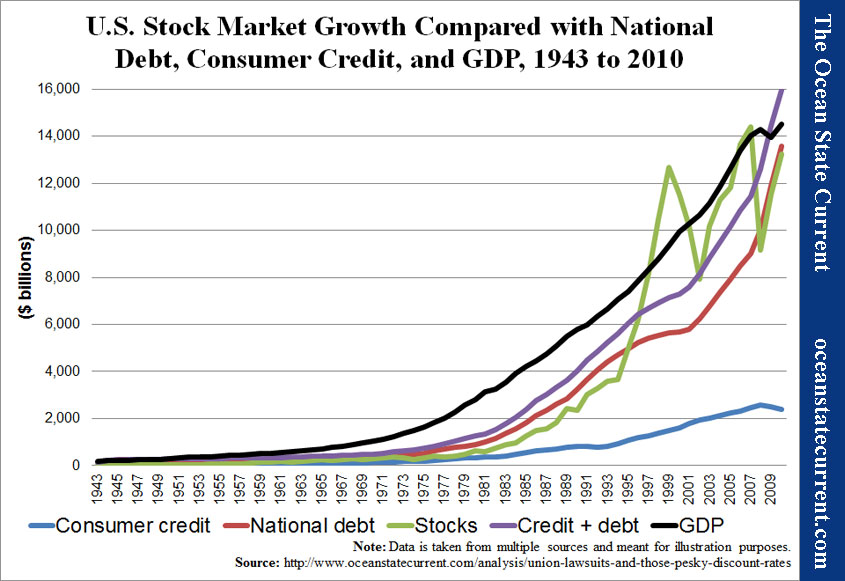

Looking for some graphical way to answer that question, I poked around the Internet for a more detailed sense of the history, and after collecting data from various sources, made a surprising discovery. Through the ’80s, the growth of the stock market is almost parallel with the growth in national debt. Consumer credit was on the rise, as well. Beginning in the mid-’90s, though, the stock market dislodged from government debt and began its wild oscillations. That’s also when the U.S. stock market shot past GDP in size for the first time ever.

Data for the following chart derives from multiples sources (linked in the previous paragraph), and I haven’t taken the time to make sure I’m 100% comfortable with their relationships (checking the alignment of dates, seasonality, and so on). However, for the purposes of illustrating a limited point, the results are very interesting.

One critical note, here, is that the spike in stock market value corresponds with President Bill Clinton’s initial changes expanding the accessibility of home loans. That’s critical because loans backed by real estate are not included in the consumer credit total shown in the chart.

Be that as it may, the narrow question of this post is whether the State of Rhode Island (or any state, municipality, or private investor, for that matter) should count on investment growth equivalent to past times of notable economic health over the next decade and beyond. As I’ve already said, investment is gambling, so tolerance for risk will vary from person to person. (One can’t blame pensioners for wanting the state constitution to keep their risk extremely low.)

In making a decision, though, the American history corresponding with the above chart has frightening implications. During the middle of the century, the U.S. experienced a post-war boom of pent-up demand corresponding with the utter destruction of much of the rest of the industrialized world’s infrastructure. Since that initial burst subsided, national debt has exploded, to the point that it is almost equivalent to the entire GDP.

This state of affairs does not look like something that we should expect to continue, and the wild cycles of the past couple of decades should especially not be counted on. 7.5%? 7.75%? The wiser move may be to stop promising benefits decades out into an unknown future altogether.

From a certain perspective, the stock market has essentially been a measure of inflation adjusting for revenue claimed from the future. Eventually, the future has to arrive.