If Not Now, When? If Not Nothing, 3%.

Completely eliminating Rhode Island’s sales tax would free businesses from the hassle and expense of collecting the tax on behalf of the state and would allow anybody with a notion of something to sell to do so without worrying about permits. It would also, one could surmise, make a splash of public awareness across the country, especially at a time when commentators are saying that the Internet may be seeing its last sales-tax-free Christmas season.

At Tuesday’s hearing of the legislative commission to study elimination of the sales tax, Revenue Analysis Director Paul Dion mentioned the proximity of a state that already has no sales tax to our north, New Hampshire, but he neglected to mention that one of the most heavily populated areas of the country is roughly the same distance in roughly the other direction.

Indeed, the day before the hearing,the U.S. Supreme Court decided to let stand New York’s law imposing a tax on Internet sales. Because Amazon has “affiliates” in the state, it is subject to the 4% tax imposed at the state level, which New York City increases locally to 8.875%. That’s a pretty big customer base within day-trip distance (or to target for tourism with an even stronger message during summer months).

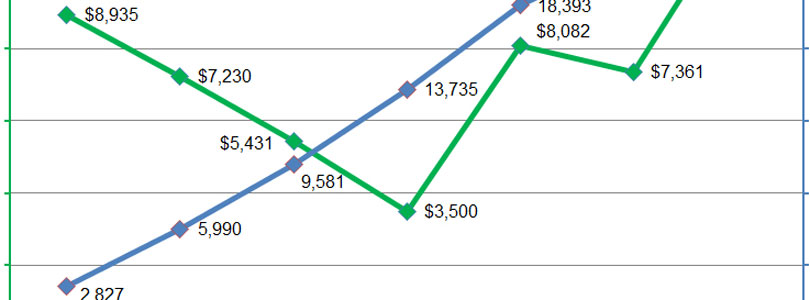

Of course, a dramatic change in tax policy, in order to pass, must make its way through offices whose occupants are terrified at what looks to them to be a $900 million cliff. To that end, the commission asked the RI Center for Freedom & Prosperity to apply its RI-STAMP modeling tool to a variety of sales tax reductions, with the following result (additional analysis here):

At a cost of $48 million in state revenue, once the dynamic effects of an improving economy come into play, with additional taxes and fees collected through other channels, a 3% sales tax rate would create 13,735 jobs. Essentially, the state would be investing $3,500 per job created.

However, the model projects revenue gains for the state’s cities and towns, to the extent that Rhode Island could see a $61 million increase in the revenue collected by all of its government entities as a group.

The biggest advantage of a reduction is that the state benefits from increased sales volume to the extent that it still collects a sales tax. According to the Center’s model, that balance flips at rates under 3%, because the tax collector isn’t picking up enough of each new sale. Above 3%, the incentive to invest and the draw for out-of-staters to shop here doesn’t create as much of an advantage versus the money that the state is not collecting.

It should be noted that much of the debate, at the hearing, had to do with whether the RI-STAMP model was too optimistic or whether the REMI model that the state uses favors government too much. Bigger questions exist about the possibility of modeling the future at all. There are things that it just isn’t possible to model, and in that context, the difference between eliminating the sales tax or just reducing it could be dramatic.

The proximity of New York City is a excellent example of a factor that the modeling may not adequately capture. A Manhattanite who can no longer avoid the sales tax via the Internet might drive a little distance up the coast for a day at the beach and a new TV at 0.0%. Three percent might not have a strong enough pull. It’s possible, in other words, that RI-STAMP understates the boost from eliminating the tax and overstates the boost from a reduction.

At some point, though, unknowns have to give way to what’s in front of us. Absent an overwhelming public outcry — which would give office holders reason to fear not eliminating the sales tax — government officials have to overcome their sense of risk at letting the sales tax slip entirely from their fingers. If that’s the deciding factor, it looks like 3% would be the way to go.