June 2017 Employment: If Everything’s Improving, Why Is Income Down?

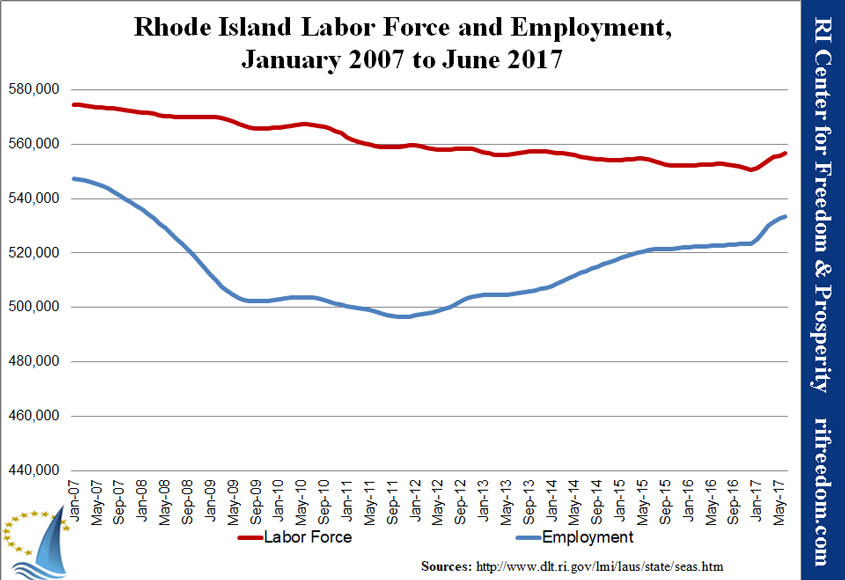

The increases in Rhode Island’s employment statistics cooled a little in June, although employment, labor force, and jobs based in Rhode Island all showed increases. Because the labor force increased more than employment, however, the state’s official unemployment rate ticked up a tenth of a percentage point, to 4.2%.

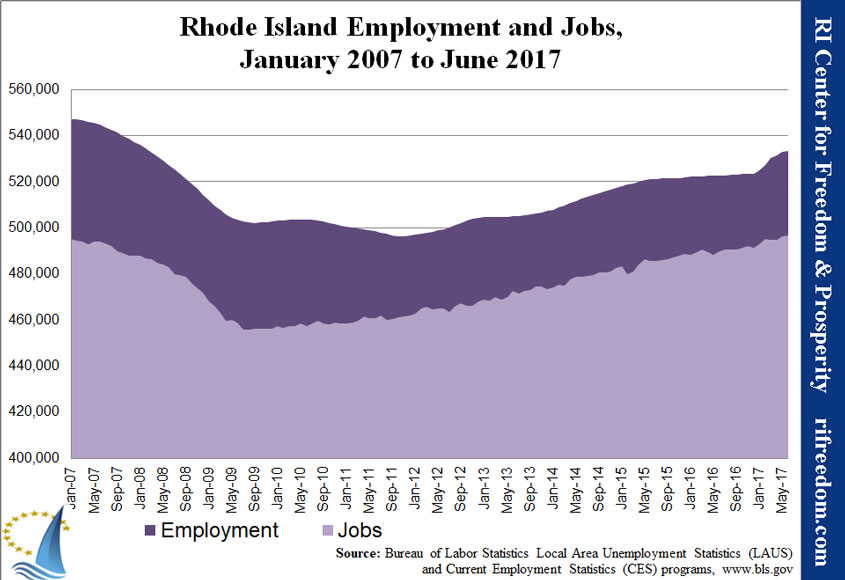

Of course, those numbers come with the caveat that Rhode Island’s annual experience has been a big improvement early in the year that the federal Bureau of Labor Statistics (BLS) largely revises away the following January. Even so, the number of Rhode Islanders who say that they are employed remains 13,989 below the state’s pre-recession peak, while the labor force remains 18,116 below its peak.

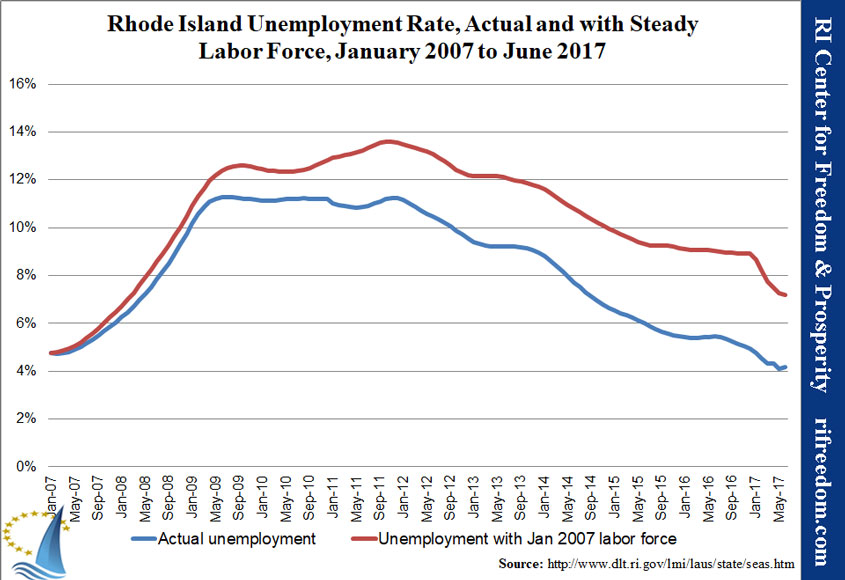

The fact that the employment deficit is smaller than the labor force deficit explains the state’s low unemployment rate, without painting a positive picture. The following chart shows that the state’s unemployment rate would still be 7.2% if so many Rhode Islanders hadn’t stopped looking for work.

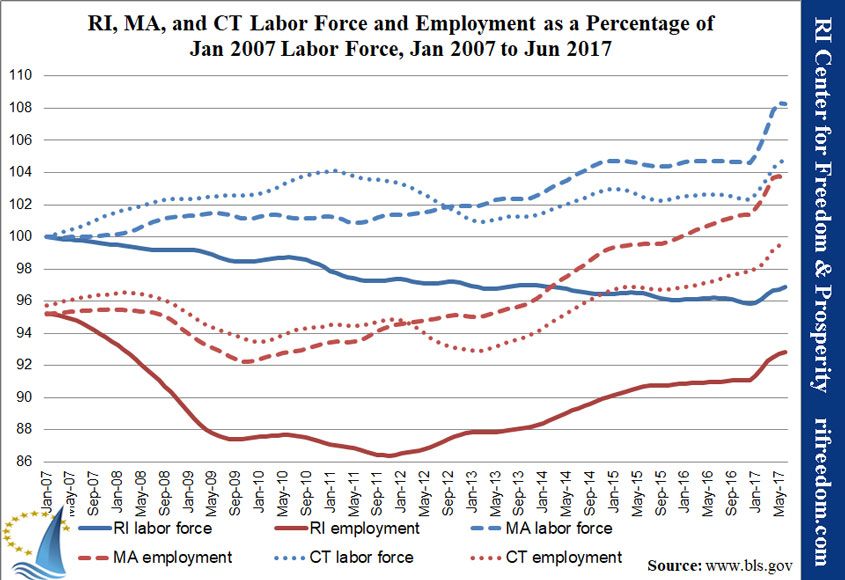

Bringing Rhode Island’s neighbors into the picture shows that the Ocean State hasn’t been alone in employment growth, suggesting that (to the extent the improvement isn’t just statistical noise) local policies don’t deserve much of the credit, if any. Indeed, the general picture is one of an increasing gap between Rhode Island and the two states that surround it.

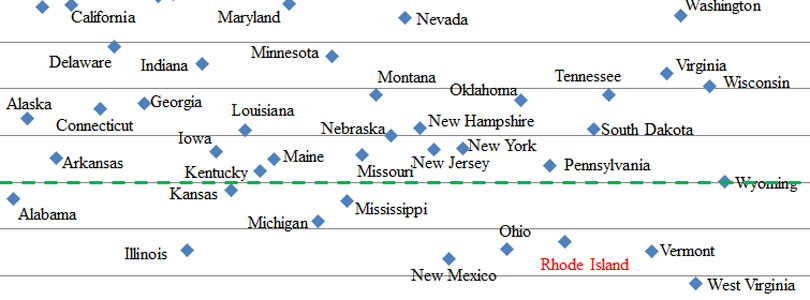

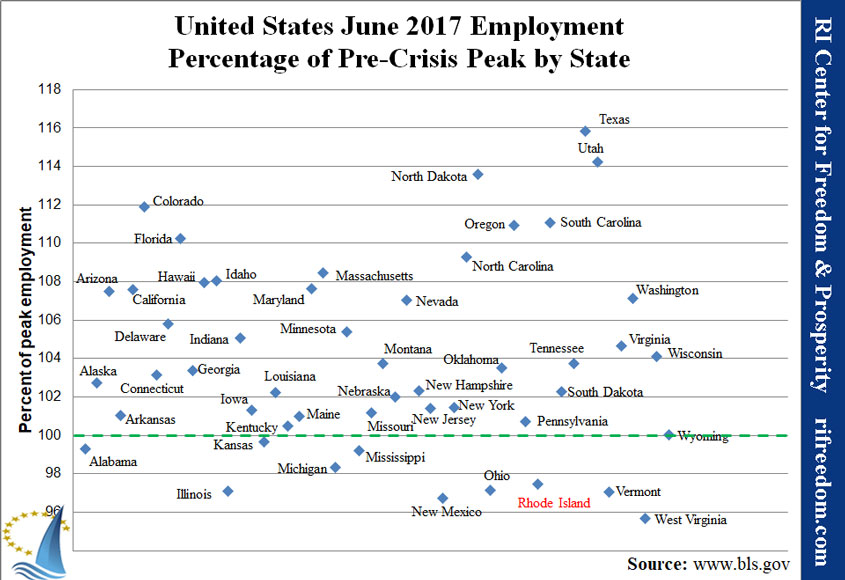

Nationally, Rhode Island is one of 10 states that has yet to recover all of the employment it had at its pre-recession peak, although sixth-worst may be the best relative standing the Ocean State has had since the market crash… and Vermont now has given Rhode Island a break as the worst in New England by this measure.

Perhaps the most significant of the dubiously positive news for Rhode Island is that the state has finally recovered all of the jobs based in the state from its pre-recession peak, which the Ocean State has bested by 600 jobs. Better yet, these numbers tend to be more stable, so this milestone might actually prove to have been real. Of course, the state took a long, long time to get back to this point, and the long slog suggests that overcoming the loss of the last decade was more the result of an inevitable trend of meager 1% annual growth than a recent boost from government policy. Indeed, the two completed fiscal years during Democrat Governor Gina Raimondo’s term have seen slower job growth than the two fiscal years before she entered office.

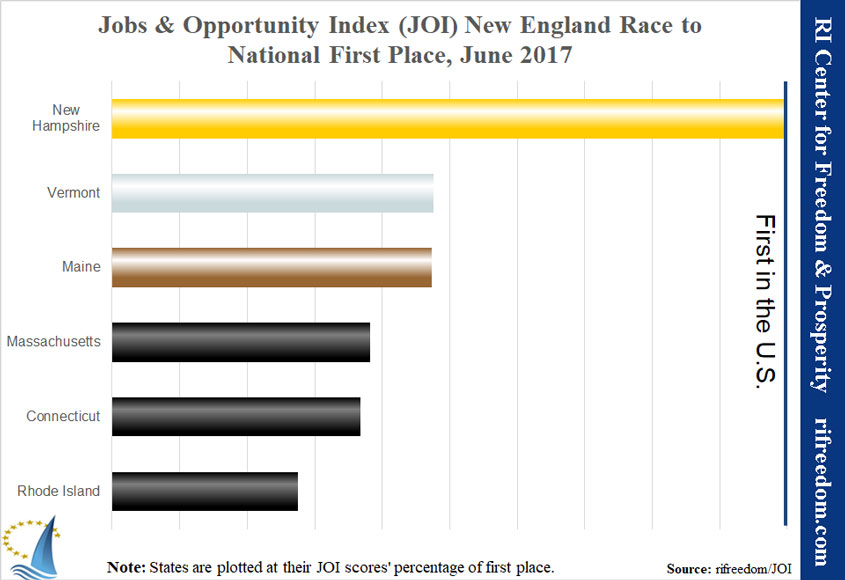

A deeper picture of Rhode Island’s economy can be viewed on the RI Center for Freedom & Prosperity’s Jobs & Opportunity Index (JOI). In summary, Rhode Island remains in its 48th-in-the-country rut, as any improvements are undone by slippage elsewhere. On the positive side of the ledger, employment and jobs are up and SNAP enrollment is down, while state and local taxes have decreased some. Canceling those improvements out, however, are increases in Medicaid enrollment, a decrease in personal income, and an increase in federal taxation.

The only significant change in the New England race is that Vermont edged past Maine by not slipping as much since April.