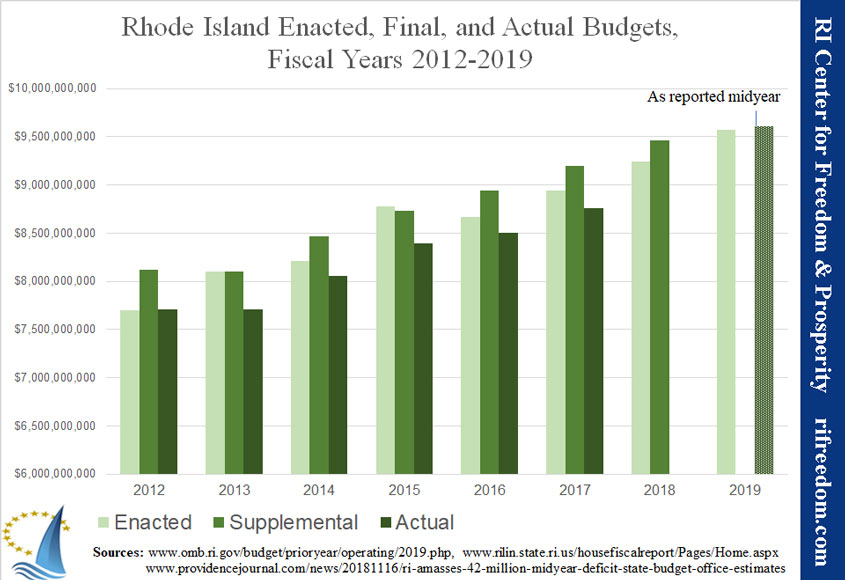

As we jump into the latest unsavory development in the state’s shady, deliberately ignorant roll-out of truck tolls, this preamble is the most important take-away: tolls on any vehicles in Rhode Island are completely unnecessary. The spending to repair Rhode Island’s bridges can be found within the annual budget – and without throwing 30% of the revenue away on gantry construction and toll fees.

RIDOT has announced today that they received federal approval for the balance of the gantries and that the contractor has been issued notice to proceed with construction, with the first new gantry expected to go live in May of 2019.

This flies in the face of Governor Gina Raimondo’s repeated statements that any more gantries would wait until the lawsuit and the legality of truck-only tolls is decided. Just one instance was on Dan Yorke State of Mind earlier this year (starting at Minute 06:00):

Yorke: You said, “If we lose the litigation, we don’t put the tolls up”.

Governor: “Correct”.

Governor: “We’re going to start with one in February. We assume there will be litigation which we will then have to defend and then we’ll see.”

Governor: “We gotta do one, we gotta see how it goes and then we’ll move to the next one.”

To not proceed with the construction of the balance of the gantries until their legality had been threshed out was a significant undertaking and also the prudent course on behalf of taxpayers and residents.

The implications for Rhode Island residents of her breaking her word and doing a highly irresponsible one eighty are significant. We have received repeated assurances that these gantries will be used only to toll trucks. But what happens if the court rules truck-only tolls illegal? The most innocuous – and actually not that innocuous – implication of her action in erecting gantries for a use that may be legally vacated is that she has very irresponsibly opened state taxpayers to a significant, unnecessary expense; i.e., putting us all on the hook for the cost of these gantries.

A far more ominous implication is that, by proceeding with the construction of all gantries before a court ruling, she is actively positioning the state for all-vehicle tolling. In a recent interview with WTNH, Governor Ned Lamont said that Governor Raimondo told him she is “highly confident” that the lawsuit will be found in the state’s favor – and “later this spring”, no less. (This attitude strikes me not only as baseless, extreme legal optimism but also quite disrespectful of the judge presiding over the case.).

The governor’s highly quizzical legal prognosticating to one side, it is impossible to predict the lawsuit’s outcome. A ruling against truck-only tolling doesn’t mean that tolls themselves have to go away, only their discriminatory assessment. By going back on her word on gantry construction, Governor Raimondo may be telescoping the time it takes to spread the – remember, completely unnecessary – toll cancer to all vehicles.

[Monique has been a contributor to the Ocean State Current for over ten years, has been a volunteer for StopTollsRI.com, a grassroots citizens group opposed to all tolls, for four years, and began working for the Rhode Island Trucking Association as a staff member in September of last year.]