Relentless Perpetuation of the “Equal Pay” Myth via Legislation

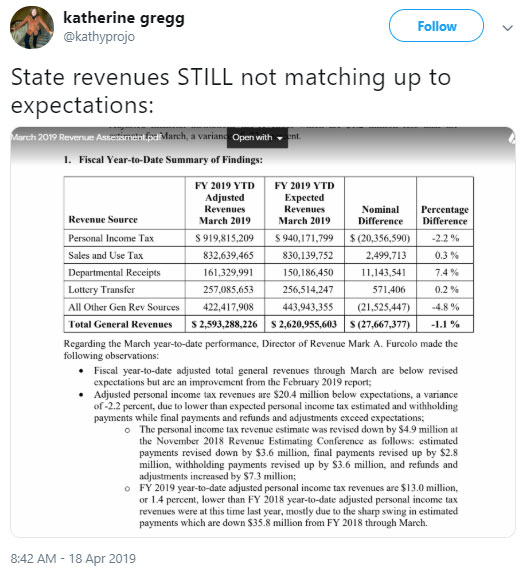

Helpful headlines notwithstanding, the Rhode Island Senate once again passed legislation to address the mythical “wage gap”:

A plan to close the gender wage gap in Rhode Island by adding new, sharper teeth to the state’s fair pay law and banning employers from asking job candidates their salary history sailed through the state Senate again Thursday.

“Rhode Island first passed an equal pay law in the 1950s, and I am sure it was revolutionary at the time, but we have not gone back and updated it unlike many other states,” said Sen. Gayle Goldin, lead sponsor of the pay equity legislation. “Passing this bill is not going to resolve the wage gap on its own, rather, this bill in combination with so many things we have worked on… is the way we will address the gender wage gap.”

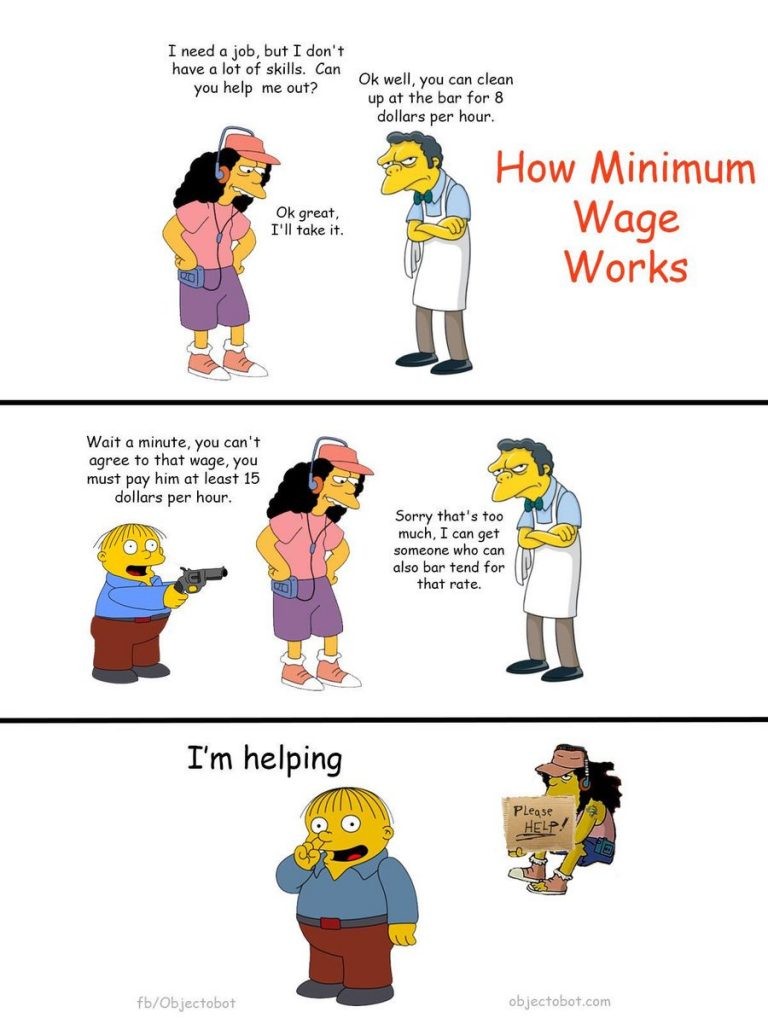

And so it goes. As long as progressives want to foster division and grievance, this legislation will keep appearing. Maybe some year the gears of political necessity will get it over the finish line. As that process plays on from year to year, opponents will tire of saying the same thing over and over again. That’s the advantage of the left-wing approach to public “debate”: When you refuse to acknowledge the other side’s arguments and just keep repeating the talking points, the other side moves to other topics, and the public just becomes used to the deception.

By way of a preventative measure, here’s my op-ed on the topic, from the Providence Journal last year around this time, which I published in more casual, expansive form in this space the month before:

Plainly put, this gives the government power to investigate just about any business and dictate changes to its pay policies, because the only pay differentials that wouldn’t have legal risks would be those between people of the same race, religion, sex, orientation, gender identity, disability, age, and nationality. That is, for any two employees who aren’t more or less demographically identical, the lower-paid one could initiate a complaint with the state with the same treatment as complaints that the employer withheld pay, and the burden is on the employer to explain it and to prove that no other business practice could erase it.

Think about how much of an encroachment on private activity and interactions that is, as well as the presumption that government is some sort of neutral judge that can accurately assess every business decision.

If this legislation ever passes, I expect it will have some degree of the same effect as the ill-advised paid leave legislation which progressives did manage to pass last yearl.